Currently, Futu Securities has launched Hong Kong stock index futures trading and supports 10 mainstream stock index futures. Today, let's first take a look at small-scale Hang Seng Index futures.

The Hong Kong Futures Exchange has launched a mini Hang Seng Index futures contract since October 9, 2000 to meet the needs of those interested in the Hong Kong stock market.

This small, uniquely designed Hang Seng Index futures contract is based on the index related to the index of the Futures Exchange Hang Seng Index futures contract, that is, the Hang Seng Index, as the basis for trading. The multiplier for small Hang Seng Index futures contracts is HK$10.00 per point, or one-fifth of the Hang Seng Index futures contract. Like Hang Seng Index futures contracts, small Hang Seng Index futures contracts are also settled in cash.

For retail investors who don't want to take too much risk and need fine-tuning hedging, small Hang Seng Index futures contracts will be the best hedging tool for them to invest and manage risk.

Advantages:

Tailor-made for retail investors

On the one hand, small Hang Seng Index futures contracts uphold the benefits of Hang Seng Index futures contracts, and on the other hand, they are designed for people who don't want to take too much risk. Its finer contract value allows experienced and novice investors to participate in the performance of index components on a finer scale.

Low investment costs

Since the value of small Hang Seng Index futures contracts is only one-fifth of the Hang Seng Index futures contracts, their margin requirements and commission charges are also relatively low.

Deposit offset

The deposits for small Hang Seng Index futures contracts and Hang Seng Index futures contracts can be 100% offset against each other, making the investment portfolio more flexible.

Electronic trading platform

Like other products on the exchange, small Hang Seng Index futures contracts will be traded using the HKATS electronic trading system. All orders will be traded in order of price and time priority. Information such as the purchase, sale price and transaction price of the order will be transmitted instantly to provide the market with the best price and market transparency.

Settlement company performance guarantee

Mini-Hang Seng Index futures contracts are registered, settled and performance guarantees are provided by Hong Kong Futures Clearing Limited (the clearing company), which is wholly owned by the Futures Exchange. Since the clearing house is the counterparty to all open positions, there will be no counterparty risk between the clearing house participants. This guarantee does not extend to clearing house participants financial liability to their customers. Therefore, investors should be careful and careful in choosing a broker to trade.

Trading period:

Trading hours are 9:15 a.m. to 12:00 p.m., 1:00 p.m. to 4:30 p.m., and 5:15 p.m. to 3:00 a.m. (The closing time for the month of the expired contract is 4:00 p.m. on the last trading day)

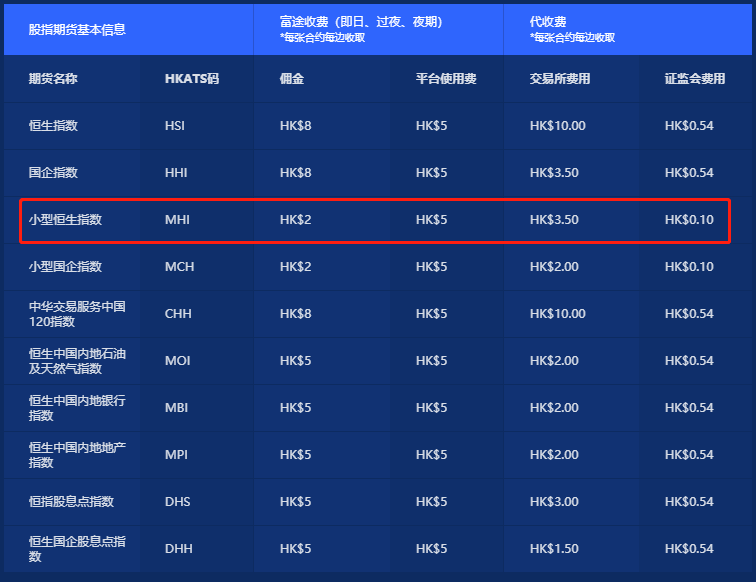

Transaction fees and commissions:

Currently, trading small-scale Hang Seng Index futures on Futu is very low. Each side of each contract only charges HK$2 commission, HK$5 platform usage fee, HK$3.5 exchange fee, and HK$0.10 SEC fee, for a total of HK$10.6. Detailed charges can be found at:Futu Hong Kong Stock Index Futures Fees.

Note: The exchange may adjust fees from time to time, as described inExchange websitequerying

What are the similarities and differences between Hang Seng Index Futures and Mini-Hang Seng Index Futures?

Differences:

Since the design of small Hang Seng Index futures is set according to the needs of some retail investors, their differences are mainly reflected in contract multipliers. The contract multiplier for mini-Hang Seng Index futures is HK$10 per index point, while Hang Seng Index futures are HK$50 per index point. Therefore, when the Hang Seng Index futures price is at 17,500 points, the value of a small Hang Seng Index futures contract is HK$175,000.00.

Similarities:

Other than the difference in contract multipliers, everything else about the two is basically the same. For example, contract months for large and small Hang Seng Index futures are the current month, next month, and the next two quarterly months (March, June, September, and December), the lowest price fluctuation is one index point, and the contract price is calculated in full index points based on the price of small (or large) Hang Seng Index futures contracts registered with the settlement company. Other than that, the trading time, trading method, final settlement date, last trading day, and settlement method are all the same.

Edit/Iris