During the reporting period, the new sales orders and shipment amounts of Tuo Jing Technology increased significantly compared to the same period last year, and the new orders in the second quarter also increased significantly compared to the first quarter. As of the end of the reporting period, the company has sufficient sales orders on hand. The cumulative number of wafers produced by the company's thin film deposition equipment on the client production line has exceeded 0.194 billion.

On August 27th, Tuo Jing Technology disclosed its semi-annual report for 2024 according to the Science and Technology Innovation Board Daily.

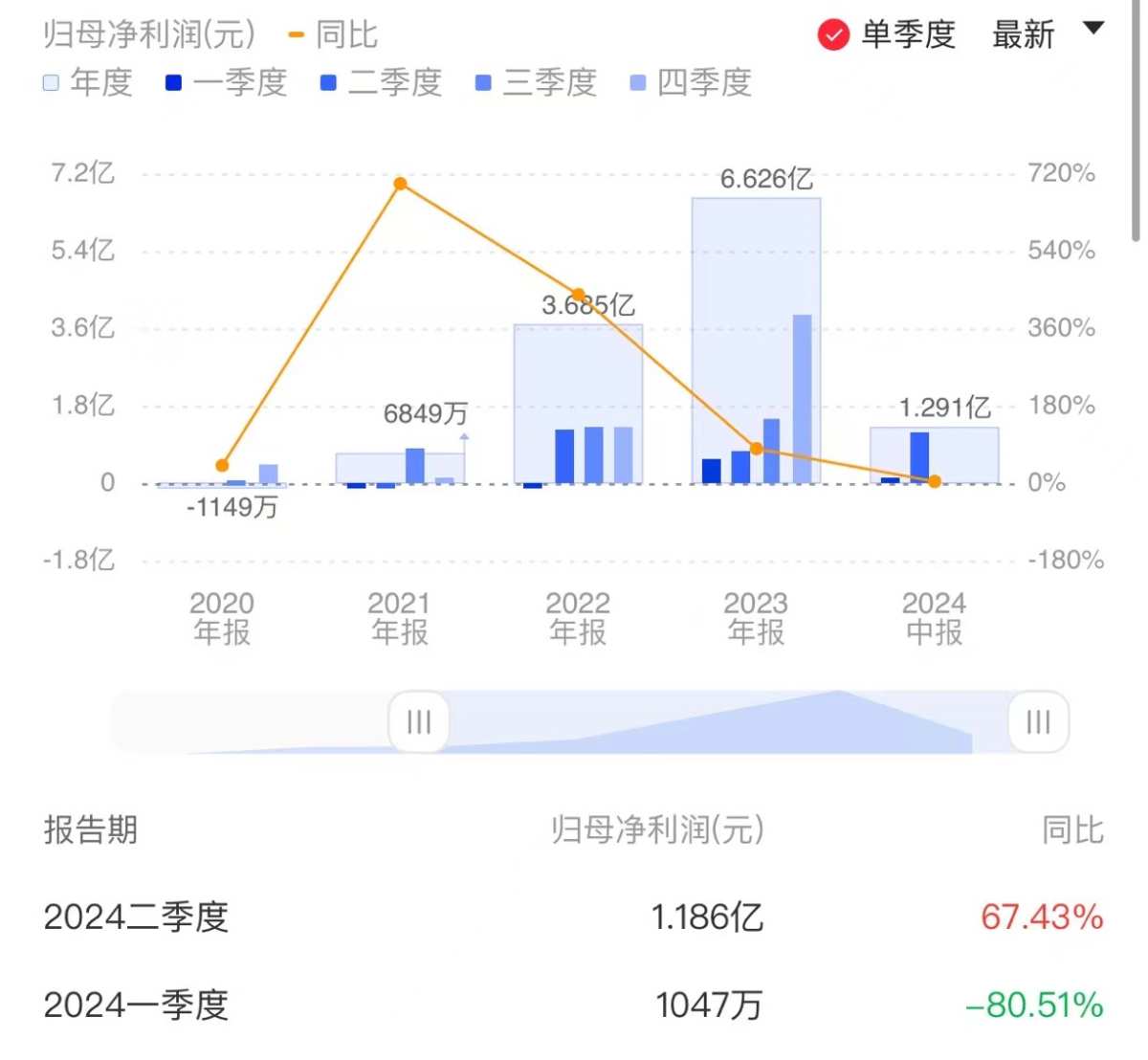

In the first half of this year, the company achieved operating income of 1.267 billion yuan, a year-on-year increase of 26.22%; net income attributable to the parent company was 0.129 billion yuan, a year-on-year increase of 3.64%; non-GAAP net income was 19.9575 million yuan, a year-on-year decrease of 69.38%. During the reporting period, the company's government subsidy income included in the non-recurring profit and loss was 0.107 billion yuan, a year-on-year increase of 47.9086 million yuan.

Regarding government subsidy income, Tuo Jing Technology also admitted in the financial report that government subsidies are mainly support for research and development investment. If the company cannot continue to obtain government subsidies in the future, or if government subsidies are significantly reduced, the company will need to invest more self-raised funds in research and development, thereby affecting the company's cash flow.

In terms of quarterly performance, the company achieved operating income of 0.795 billion yuan in the second quarter, a year-on-year increase of 32.22% and a quarter-on-quarter increase of 68.53%; net income attributable to the parent company was 0.119 billion yuan, a year-on-year increase of 67.43%.

Regarding the performance, Tuo Jing Technology stated that during the reporting period, new products and new processes such as ultra-high aspect ratio trench filling CVD equipment, PE-ALD SiN process equipment, HDPCVD FSG, HDPCVD STI process equipment, etc. have been validated and implemented by downstream users to achieve industrial application, and the company's revenue has steadily increased.

As for the slower growth rate of net profit compared to the year-on-year growth rate of revenue in the first half of the year, Tuo Jing Technology attributes it to the increase in research and development expenses, sales expenses, and sales personnel compensation. Specifically, the company's research and development expenses in the first half of the year reached 0.314 billion yuan, a year-on-year increase of 49.61%; sales expenses reached 0.1598 billion yuan, a year-on-year increase of 39.24%.

With sufficient orders on hand, it is expected that the annual shipments will exceed 1,000 reaction chambers.

In terms of orders, during the reporting period, Tuo Jing Technology's newly signed sales orders and shipment amounts have both significantly increased year-on-year, and the new signed orders in the second quarter have also increased significantly compared to the first quarter. As of the end of the reporting period, the company has sufficient orders on hand.

Regarding shipments, it is reported that in the first half of this year, the company's shipment amount reached 3.249 billion yuan, a year-on-year increase of 146.50%. As of the end of the reporting period, the company's remaining inventory of goods reached 3.162 billion yuan, a 63.50% increase compared to the end of 2023.

In addition, the company's equipment shipments have significantly increased. In the first half of the year, the company shipped more than 430 reaction chambers. As of the end of the reporting period, the company has accumulated more than 1,940 reaction chambers shipped, entering more than 70 production lines. It is expected that the company will ship more than 1,000 reaction chambers throughout 2024, setting a new record.

In terms of product segmentation, in the PECVD series products, as of the end of the reporting period, more than 25 PECVD Bianca process equipment reaction chambers have received orders, and some reaction chambers have been shipped to clients. More than 180 new type reaction chambers (pX and Supra-D) have received customer orders, and more than 130 reaction chambers have been shipped for client validation.

As for the ALD series products, the first PE-ALD SiN process equipment (PF-300T Astra) has passed customer validation, and Thermal-ALD equipment continues to receive orders and ship for client validation.

In addition, the cumulative shipment volume of the company's HDPCVD reaction chambers has reached 70. The first ultra-high aspect ratio trench filling CVD series products have passed customer validation, achieved industrial application, and received repeat orders and orders from different customers. As of the date of this report, the cumulative shipment of relevant reaction chambers has exceeded 15.

In terms of equipment performance, it is reported that during the reporting period, the company's equipment had an average machine uptime of over 90% on customer production lines, reaching the level of similar international equipment. The company's thin film deposition equipment's mass production application scale in wafer manufacturing production lines continues to expand. As of the end of the reporting period, the cumulative number of wafers produced by the company's thin film deposition equipment on customer production lines has exceeded 0.194 billion.