The Hillenbrand, Inc. (NYSE:HI) share price has fared very poorly over the last month, falling by a substantial 27%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 29% in that time.

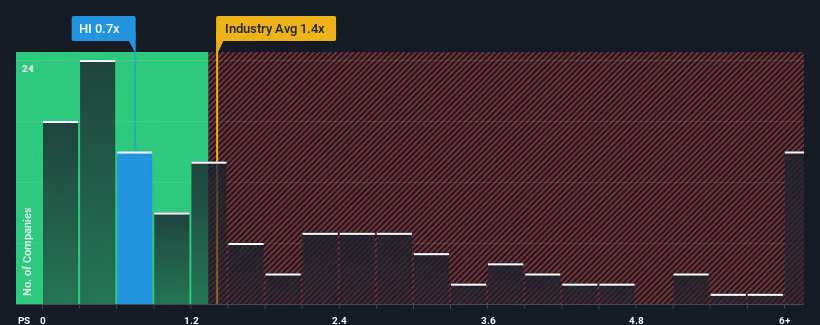

After such a large drop in price, Hillenbrand's price-to-sales (or "P/S") ratio of 0.7x might make it look like a buy right now compared to the Machinery industry in the United States, where around half of the companies have P/S ratios above 1.4x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Hillenbrand Has Been Performing

Recent times have been advantageous for Hillenbrand as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hillenbrand will help you uncover what's on the horizon.How Is Hillenbrand's Revenue Growth Trending?

In order to justify its P/S ratio, Hillenbrand would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Hillenbrand would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. Revenue has also lifted 11% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 0.2% over the next year. Meanwhile, the broader industry is forecast to expand by 1.0%, which paints a poor picture.

In light of this, it's understandable that Hillenbrand's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Hillenbrand's P/S Mean For Investors?

The southerly movements of Hillenbrand's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Hillenbrand's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It is also worth noting that we have found 2 warning signs for Hillenbrand that you need to take into consideration.

If these risks are making you reconsider your opinion on Hillenbrand, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.