Start capturing the market?

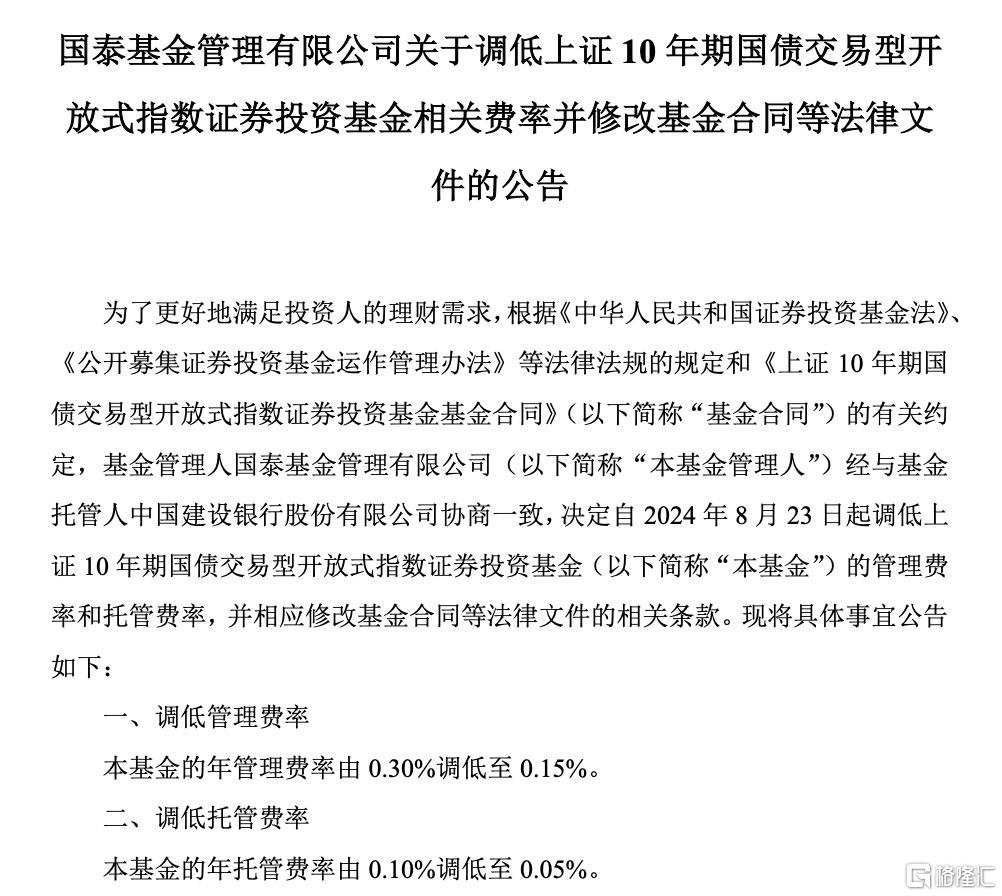

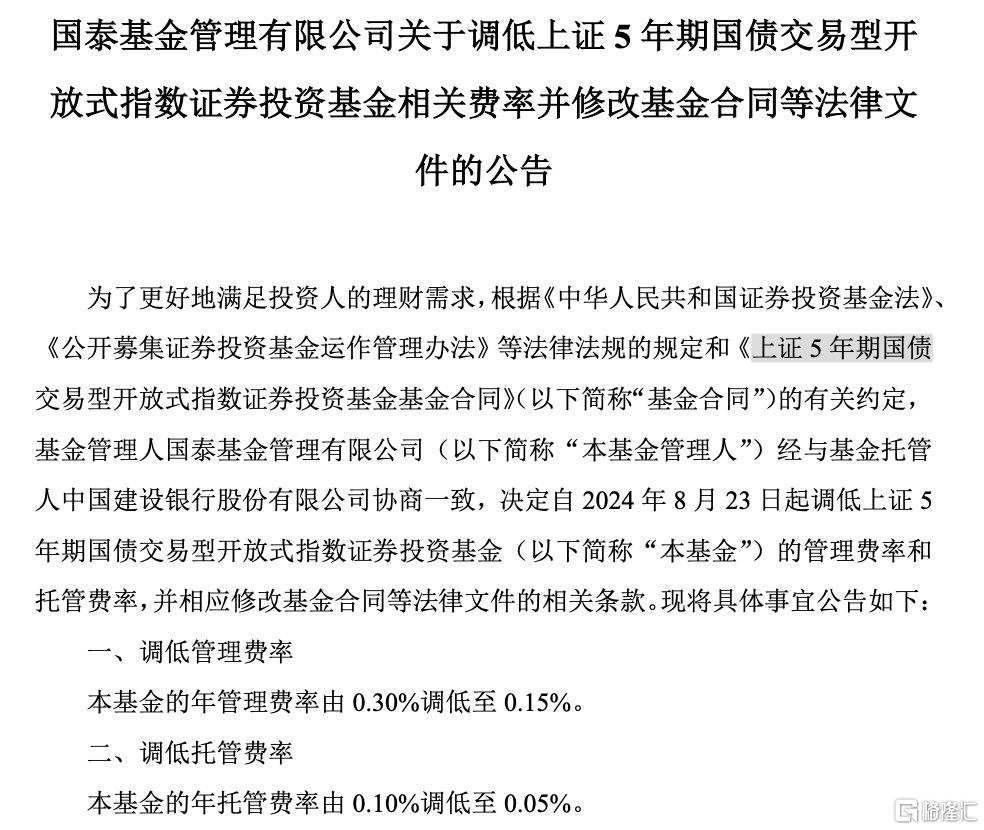

On August 23, Guotai Fund announced that in order to better meet the investment needs of investors, it will reduce the management fees and custody fees of Guotai SSE 10-year China Treasury Note ETF and Guotai SSE 5-year China Treasury Note ETF from August 23. The annual management fee rate is reduced from 0.30% to 0.15%, and the annual custody fee rate is reduced from 0.10% to 0.05%.

Guotai Fund's two Treasury Bond ETFs were among the highest in the same category before the fee reduction, with an annual management fee rate of 0.3% and an annual custody fee rate of 0.1%. After the fee reduction, the annual management fee rate and annual custody fee rate of Guotai SSE 10-year China Treasury Note ETF and Guotai SSE 5-year China Treasury Note ETF are 0.15% and 0.05% respectively, which are the lowest rates in the market.

Currently, the highest fee for the entire bond ETF is still the Haifutong SSE Chengtou Bond ETF, with an annual fee rate of 0.3% and an annual custody fee of 0.1%.

Currently, the highest fee for the entire bond ETF is still the Haifutong SSE Chengtou Bond ETF, with an annual fee rate of 0.3% and an annual custody fee of 0.1%.

Since the beginning of this year, due to the booming government bond market, several bond ETFs with a scale of over 10 billion yuan have been born in the A-share market.

As of August 23, there are a total of 20 bond ETFs in the domestic market, with a combined fund size of 132.498 billion yuan. Among them, there are 5 bond ETFs with a fund size of over 10 billion yuan, namely HFT CSI Short-term Financing ETF, GF China Securities and Government Bonds ETF, Bosera CSI Convertible Bond and Exchangeable Bond ETF, HFT CSI Chengtou ETF, and Ping An ChinaBond Medium-High Grade Corporate Bonds Spread Factor ETF, with the latest fund sizes of 29.572 billion yuan, 28.957 billion yuan, 16.235 billion yuan, 11.728 billion yuan, and 115.71 billion yuan respectively.

From the perspective of net fund inflows this year, the most favored bond ETFs by investors are GF China Securities and Government Bonds ETF, Bosera CSI Convertible Bond and Exchangeable Bond ETF, and HFT CSI Chengtou ETF. As of August 22, the net fund inflows for these ETFs are 21.028 billion yuan, 10.923 billion yuan, and 86.56 billion yuan respectively.

In terms of ultra-long-term government bond ETFs, Pengyang Fund 30-year Treasury Bond ETF, Guotai Fund 10-year China Treasury Note ETF, and Guotai Fund Treasury Bond ETF have recorded net fund inflows of 3.261 billion yuan, 0.414 billion yuan, and 3.28 billion yuan respectively. This shows that the market has recognized the two government bond ETFs under Guotai Fund. The price reduction of these two ETFs by the fund companies has to some extent benefited the clients.

Regarding the future allocation value of government bonds, Zheng Shaoliang, the fund manager of CMBZZ Mid and Short-term Debt Bond Fund, stated in the semi-annual report that the macroeconomic fundamentals are still in the process of wave-like recovery. The new round of relaxations in the real estate policy is expected to help ease the decline in real estate sales and investment. However, whether the trend can be sustained still depends on the policy effects and the sustainability of the recovery. Until other marginal incremental factors emerge, the internal driving force for economic growth is still relatively weak, and the market still has expectations for the central bank's reserve requirement ratio cuts and interest rate cuts. On the supply side, the central government's leveraged efforts are still relatively moderate, and the supply impact on interest rate instruments is limited. The net financing of city investment is still contracting, and the non-bank "asset shortage" on the demand side has not eased. In this background, it is expected that there is not much risk of upward trend in interest rates and credit spreads. Currently, the bearish factors mainly come from the monetary authority's attention to the reasonable range of long-term yields, which limits the downward space for long-term interest rates and increases volatility. Overall, we tend to believe that the domestic fundamentals are more critical in the face of monetary policy impact, and the logic of central bank interest rate cuts during the year is still valid.

In terms of risks, the central bank may use operations of injecting short-term funds and selling long-term government bonds to steepen the yield curve, maintaining low rates in the short term and causing a mild upward shift in long-term rates. If this situation occurs, interest rate and credit short- to medium-term instruments with maturities of 5 years or less are safer, and opportunities for trades with steepening curve should continue to be monitored.

目前整个债券ETF就剩海富通上证城投债ETF的费率最高,仍处年费率0.3%、年托管费0.1%的水平。

目前整个债券ETF就剩海富通上证城投债ETF的费率最高,仍处年费率0.3%、年托管费0.1%的水平。