To the annoyance of some shareholders, Ginkgo Bioworks Holdings, Inc. (NYSE:DNA) shares are down a considerable 31% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 88% share price decline.

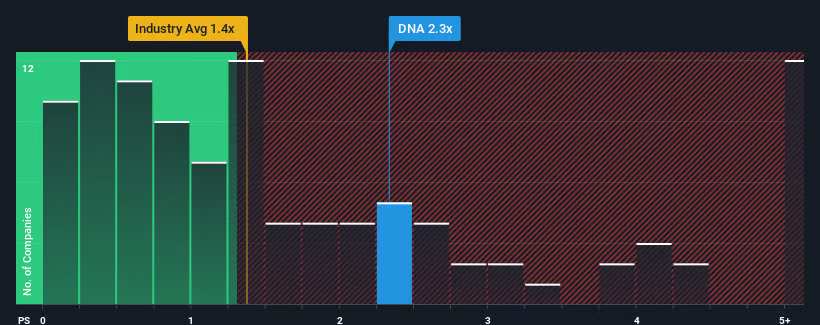

Even after such a large drop in price, you could still be forgiven for thinking Ginkgo Bioworks Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.3x, considering almost half the companies in the United States' Chemicals industry have P/S ratios below 1.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Ginkgo Bioworks Holdings' Recent Performance Look Like?

Recent times haven't been great for Ginkgo Bioworks Holdings as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Ginkgo Bioworks Holdings will help you uncover what's on the horizon.How Is Ginkgo Bioworks Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Ginkgo Bioworks Holdings would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 43%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 39% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 7.3% during the coming year according to the six analysts following the company. With the industry only predicted to deliver 3.6%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Ginkgo Bioworks Holdings' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Ginkgo Bioworks Holdings' P/S

There's still some elevation in Ginkgo Bioworks Holdings' P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Ginkgo Bioworks Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Ginkgo Bioworks Holdings (of which 1 is potentially serious!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.