Source: ideological steel seal

Author: people and gods work together

1. Failure is easier to build consensus than success

Socrates said, "an unexamined life is not worth living. "

When I apply this creed to investment, it becomes: an undefeated company is not worth investing in for a long time.

I like Ping an. Unlike the big white horse you imagine, this company fell into the quagmire several times before 2010 because its operation was too radical.

I like Maotai, which is still paying for the production reduction mistakes made in 2015 out of excessive pessimism about high-end consumption, which led to an imbalance between supply and demand a few years later.

I like Sunchuang. After making fatal mistakes several times, Sun Hongbin still keeps his style today, but he no longer falls down because of his mistakes.

For a large enterprise失Failure (preferably a fiasco)It's easier to build a consensus than success, which is what Charlie Munger said, "if I knew where I was going to die, I wouldn't go there for the rest of my life."

If there are N kinds of possibility of failure in investing in a company, then the company that has experienced setbacks in investment is the possibility of failure in NMUI 1.

Of course, chicken soup is always chicken soup, and the cruelty of reality is that most losers can no longer stand up, so if you want to know whether a company can "Phoenix Nirvana", you need to study it after it has fallen down for a period of time. See if it's possible to reverse the dilemma.

Last week, the first article in the "profit model" series briefly introduced the four profit models I summarized that are suitable for retail investors.

This article will interpret the first profit model-dilemma reversal in detail.

2. Trap or pie

Not only A shares, but any market, 70% are mediocre companies, stock trends fluctuate randomly, and most investors are unable to make money from these companies.

20% of companies are "bad companies" with a downward trend, usually in bad industries with a declining demeanor, or poorly managed companies in mediocre industries, or major shareholders who just want to leave through financial fraud.

There are two kinds of stocks that suffer the biggest losses from retail investors.Overpriced "mediocre companies"; second, seemingly cheap "bad companies", which are often asked for. "ReverseThe illusion is the standard "low price trap".

Only 10% of the companies meet the criteria of "good industry and good company". However, these 10% of companies do not always have upward performance, and most of them will encounter difficulties at some point:

The first is that when the prosperity of the industry or downstream customers goes down, a good company will also become a "dead son".

The second is product transformation. "Hard landing」中Push too hardThe financial data will be very ugly.

The third is the occurrence of business errors, product quality events, equity disputes, the loss of major customers, illegal operation was punished, and other accidents.

Is it true that good companies can get out of temporary difficulties? Of course not.

It doesn't matter if you walk and wrestle, and you are not afraid of a car when you walk, but you are afraid that when you walk to avoid a car, you will suddenly fall, which is really "killing yourself".

In a highly competitive industry, like a lot of high-speed cars on the road, any fall may make you unable to stand up again. So 10% of good companies encounter times of crisis, of which 1% will not be able to reverse their troubles.

therefore,The first step in reversing this profit model is to use the "presumption of guilt" to scrutinize them closely and screen out the traps that seem to be opportunities.

3. Three kinds of low price traps

Stocks in line with the "dilemma reversal" are easy to see on the K chart: after the company suffered a decline in performance, the stock price fell by more than 50% after more than a year, but this proposition must not be reversed. Because 90% of the stocks in line with this morphological feature are not dilemma reversals, it is necessary to distinguish three typical "low price traps":

First, distinguish it from ordinary companies in cyclical industries.

The rise or fall of the performance of ordinary companies in cyclical industries depends entirely on the profitability of the industry, and many stocks that halve have risen several times a year before. These are often due to the general trend of the industry, that is, pigs that encounter tuyere. And the operation and management ability of the enterprise itself is not so outstanding.

On the other hand, the "dilemma reversal" companies have achieved excellent performance for a long time because of their outstanding management ability or solid moat.

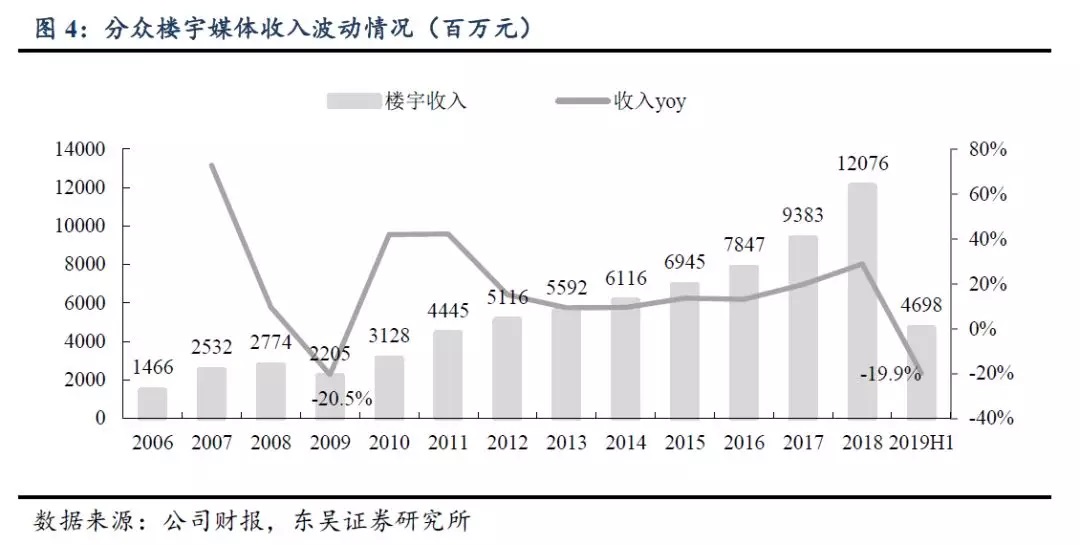

Take focus Media as an example, generally speaking, it is very difficult to judge the management ability of a company, and field research is needed. I was still in the advertising circle and had some contact with them during the period when focus Media was racing the enclosure. So I think this is a very good management team.

Many people will think that this is a company that relies on resources for a living, while ignoring his management ability. in fact, focus was only one of several elevator media in the early days. Focus and focus respectively laid the net in Shanghai and Beijing, got venture capital almost at the same time, expanded rapidly at the same time, and later had fierce competition with frame media.

Here is an experience to judge the excellence of a company's management ability: in a fast-growing industry, the barriers are not particularly high, and two companies start to compete at about the same time, as long as one of them is a little more efficient. Accumulate to form a huge advantage, and finally win.

More efficient management, coupled with the timing of listing and the luck of asset mergers and acquisitions, has created such an outdoor media giant, which has enjoyed monopoly profits for many years, but is not slow to respond to the challenges of new competitors such as trendy.

Second, the reversal of the plight is the "son in distress", not the "bankrupt nouveau riche".

Although listed companies are the best companies selected from various places, we have to admit that the so-called "excellent" only means that enterprises have seized a certain market opportunity in the past just to meet the listing requirements. As soon as the industry trend goes, it immediately shows the nature of its "naked swimmer" and becomes a mediocre company.

This process is often accompanied by a huge decline, coupled with the concept of the theme of the past, has become a typical "low price trap".

The reversal of the predicament is usually the "son in distress" in which the good company encounters the predicament of the industry.There are three empirical indicators to distinguish between a "son in distress" and a "bankrupt nouveau riche":

First, look at the industry.In the consumer industry, there are many "bankrupt nouveau riche"; in sunset industries, there are many "bankrupt nouveau riche"; if technology stocks and pharmaceutical stocks that rely on a certain technology family become rich, if technology is eliminated, it is also the fate of "bankrupt nouveau riche." most of the high-end manufacturing companies that are in trouble because of the recession in the downstream industry are "troubled sons".

Second, look at the position in the industry.Long Dalong Erduo "son in distress", other followers or industry leaders who lack barriers are more likely to become "nouveau riche bankrupt".

The third is the competition pattern of the industry.In an industry dominated by dominant or differentiated competition, there are many "sons in distress", competitive industries, and "bankrupt nouveau riche".

Take focus Media as an example, elevator media has very unique advantages.

I introduced it very specifically in my previous article:

Focus belongs to the elevator media is also a dominant, and elevator mediaUpstream is the property company, which is also an industry with a very low concentration.It is very troublesome to negotiate from family to family, and focus, which has already talked about most of the resources, can be said to be in an extremely favorable negotiating position.

Another feature of advertisers' advertising is that they have to doScene combination. Why does the new economy choose focus? When I go to work or go home, I see the lucky advertisement in the elevator and place an order later. This is a typical consumption scene.

A big budget must be invested outdoors.In addition to focus, outdoor media is extremely dispersed, and a marketing campaign gives you a budget of hundreds of millions of dollars to do outdoors in first-and second-tier cities. If you choose a big outdoor brand, you have to coordinate hundreds of resource bits of a dozen media, and mistakes in your work are inevitable; if you choose focus, you can easily spend hundreds of millions of dollars on advertising, and the effect is not bad.

The "competition pattern" is particularly important, and even for a small number of stocks that are in line with the reversal of difficulties, the success rate of reversal is not high.

There is an old saying called "being fooled by fate". If the development of some good companies stagnates because of some external factors, it may trigger a chain reaction. If there happens to be a very strong competitor that leads to the loss of good talent and big clients, this is that a small fall may also cause high paraplegia.

No matter how good a company is, you can't rule out the possibility above.The best way is to fall deep enough, and that's the third point.

Third, the "dilemma reversal" must fall beyond the margin of safety.

What does it take to fall beyond the margin of safety?

First,Only good companies have reasonable valuations. Bad companies and companies you don't understand don't have reasonable valuations, so there is no margin of safety.You think, if you buy a stock for 50 yuan and then buy it for 10 yuan, if you finally delist, everyone's loss will be the same.

Second, we can't just look at the decline.Because the decline is related to previous gains, during the 2015 stock market crash, it was only halfway up the mountain after a few highs fell to the limit.

Finally, you can't look at the price-to-earnings ratio.Because the premise of PE valuation is stable earnings. When this kind of company just reversed, it is particularly easy to be regarded as junk stock speculation and scoffed by value investors.

In my previous article, I used two methods for focus to measure the margin of safety.One is a valuation acceptable to the market assuming that the economy recovers in the future.Since we think that it is a distress reversal company, then it must be able to exceed the previous performance again, which means that the stock price must exceed the previous high, which is the investment goal of the dilemma reversal, and then reverse it with a certain discount rate.

A valuation that is assumed to be the lowest this year and acceptable to the market.This method is usually used in a bull market.

However, for "dilemma reversal" companies, the margin of safety is usually not safe enough, soThe difficulty of the operation is not the price, but the position control and the timing of intervention.

4. Important operational suggestions

In theory, many good companies in crisis are like returning to the state of start-ups, and the reversal of difficulties is more like venture capital, but the extent to which VCs understand and intervene in the initial companies, as well as the protection of investment terms, is much higher than that of secondary market investors.

Therefore, the predicament reversal company is characterized by low certainty, according to the principle of "certainty determines position", it should be light position.

How much should it be? My experience goes like this:

First of all, determine the maximum position according to your investment habits, for example, the maximum position of the most deterministic stock is no more than 10%, that is, 10%.Get involved in a "dilemma reversal", with a maximum position of no more than 5% until you are completely out of the woods.

I will buy about 35% of the position according to the company's texture and safety margin, which is equivalent to making a small bet.

Second, the dilemma reversal is a probability game.Individual investors "bet" two or three at the same time, which is a more reasonable combination.

Third, because the variables of this kind of companies are too large, they occupy a small position.It's not worth spending too much time studying.At most, take a look at the annual report and in-depth research report, not to mention the market.

Last but not least, for companies with reversals, stock prices sometimes peak before performance and sometimes bottom out after performance, so we can't reverse business conditions based on stock prices.MustSet an indicator and a deadline to determine whether he is really reversed.

For example, focus, because there is no problem with its own business, the most important indicator is whether the downstream industries that often invest in brand advertising, such as the new economy, cars, and so on, recover.

Once this target is achieved, regardless of whether its share price verifies it or not, it will no longer be a "dilemma reversal" company, but based on fundamentals to judge whether to take profits or enter the "growth plus position" and "value hub" model.

Another problem of participating in the opportunity of "dilemma reversal" is that the reversal signal does not appear for a long time, so another focus of the operation is to grasp the "intervention time".

5. the timing of the opportunity to reverse the predicament

When a company is operating well, many problems are covered up. Once there is a loophole, all the problems will break out. If you want to solve it, it is possible to reverse it five or six years later.

Focus, for example, has been strong in the second half of the year, and there has been some improvement in operating data, but has it really come out of the predicament? I don't know, its last business cycle was driven by the "new economy", but now it is the most difficult time for venture capitalists. Which industry will fill the hole left by the "new economy"? Consumer goods? Is it a local life service? It is still not clear that if the next financial report disappoints the "gambler", it is not impossible to return to the vicinity of 5 yuan.

So, even if the reversal is a high probability event, time is a big problem, and if it takes four or five years to reach the previous high point, if you intervene too early, the return on investment will not be worth it.

In addition, the performance during the operating recovery period is unstable, and the stock price is more easily affected by the bull-bear atmosphere of the market.

The reason why focus has a very safe price margin in the middle of the year is precisely because of the super bear market in 2018, because a large number of companies with high certainty have also fallen miserably, and the main funds will certainly choose these white horses first. Time has been given another half a year, until the second half of the year, when almost all the varieties of certainty have been fried very high, it is only this kind of "son in distress".

If it is a bull market, focus will not only give no opportunity in price, but also fleeting in time.

So the stock that the predicament reverses looks like the opportunity is big, actually very difficult to operate, and have great risk, need you to have certain information comprehensive ability, need considerable investment skill and mentality, as well as the knockout system of portfolio selection.

PlusThe position is light, the winning rate is not high, and the final profit is also very average.

Why is it so difficult that I still list it as one of the four important "profit models"?

6. The reversal of difficulties is the starting point for the study of a company.

I have previously studied the position styles of some of the best public fund managers in China, and found that at least 1x3 people like to take advantage of the reversal of difficulties, especially among private equity managers.

Star fund managers like this style, because A shares are very volatile, and many good stocks will be abandoned because of temporary missteps.

A more important reason.The development of a company is a continuous process, and the reversal of predicament is the starting point for the study of a company, whether it is growth stocks or value stocks.

Even if you fail to grasp the opportunity of reversing the predicament, as long as you do enough research, you will be more sure of the next opportunity of "growth increase" and "value center".

On the other hand, only companies that have experienced a reversal of difficulties are good companies worth investing in.

7. Heaven will fall on us.

Speaking of Ping An Insurance, everyone must think that this is a big white horse for stability, and some people even say that it is the only company that can be held for a long time regardless of the fundamentals. However, 10 years ago, Ping An Insurance was a "bear child" of A shares. He listed more than 30 billion yuan in 2007, and six months later, he suddenly announced an additional issue of 160 billion. The standard junk company approach not only fell to the limit, but also dragged down the entire market.

At least in the insurance industry, most people were optimistic about China Life Insurance Company Limited at that time. Because Ping An Insurance in the initial period of time, is really not a worry-free company, the early operation is very radical, so compared with their peers, there are many operational crises:

From 1995 to 1999, the policy spread loss of high interest rate

In 2002, there was a storm of investment and surrender.

From 2004 to 2005, the structure was adjusted and the premium grew negatively.

In 2008, huge losses on overseas investment

In particular, in 2008, Ping an Investment Fortis Group suffered huge losses, with a floating loss of 22.6 billion yuan at its worst, and the share price fell by 85%.

Only by looking at stock prices and financial reports, Ping an is another Petrochina Company Limited. Only by deeply understanding Ping an's business logic can we see the possibility of a "dilemma reversal".

Some time ago, I read a research report by Shao Ziqin of Ping an Securities (now the chief of Citic non-Bank) in 2008, with a paragraph in the middle:

"each test is different, and the same thing is that it does not bring destruction, but industry change.The interest margin loss makes the company strengthen the actuarial function of insurance; the investment storm makes the company begin to pay attention to customer segmentation and strengthen risk management and control; structural adjustment promotes the birth of universal insurance, optimizes the product structure, and increases the per capita production capacity of agents; the ups and downs of the capital market make the company reflect on the bottom line of risk bearing and begin to cultivate investment culture. "

Since then, Ping An Insurance's performance has risen steadily, but still experienced a six-year bottom from 2010 to 2015 to absorb excessive valuations.

Therefore, investors who buy Ping An Insurance after 2015 should be very lucky, just like a former prodigal son, who knows more about the balance between enterprising and steady.

The drop in new premiums for Ping an in November this year made many people panic. in fact, looking at the long history of Ping an, it is not even a small spray.

Mencius said: if heaven is going to give great responsibility to the people, they must first work hard, strain their muscles and bones, and lack their bodies....

This is the case in life, and the same is true in stocks, which is the true meaning of investing in troubled companies-undefeated companies are not worth investing in for a long time.

Edit / Jeffy