On August 16, 2024, Hang Seng Index Company announced the results of its regular semi-annual index adjustment (the review and evaluation period ended on June 30, 2024, and was announced within 8 weeks after the evaluation date).

On August 16, 2024, Hang Seng Index Company announced the results of its regular semi-annual index adjustment (the review and evaluation period ended on June 30, 2024, and was announced within 8 weeks after the evaluation date). The scope of this adjustment covers Hong Kong's main flagship indices such as the Hang Seng, China Enterprises Index, and Hang Seng Tech Index. In addition, the Hang Seng Composite Index, which directly determines the scope of investment for the Hong Kong stock connect, also has a significant adjustment.

Index adjustment and impact: Gogovan-W (01519) and New Oriental-S (09901) are included in the Hang Seng China Enterprises Index, and ASMPT (00522) is included in the Hang Seng Tech Index; Hang Seng Index components remain unchanged.

Changes in constituent stocks: Gogovan-W and New Oriental-S are included in the Hang Seng China Enterprises Index; ASMPT is included in the Hang Seng Tech Index.

Changes in constituent stocks: Gogovan-W and New Oriental-S are included in the Hang Seng China Enterprises Index; ASMPT is included in the Hang Seng Tech Index.

1) Hang Seng Index: No new inclusions or deletions, and the number of constituent stocks remains unchanged at 82.

2) Hang Seng China Enterprises Index: Gogovan-W and New Oriental-S are included with weights of 0.65% and 0.52% respectively; the number of constituent stocks remains unchanged at 50.

3) Hang Seng Tech Index: ASMPT is included with a weight of 1.62%; the number of constituent stocks remains unchanged at 30.

Passive fund flow estimation: Focus on the positive impact on Gogovan-W, New Oriental-S, ASMPT, and other stocks. According to Bloomberg, the size of ETF funds tracking the Hang Seng Index is approximately US$25.89 billion, and the size of ETF funds tracking the Hang Seng China Enterprises Index and Hang Seng Tech Index is approximately US$4.87 billion and US$14.71 billion respectively. Combined with the above changes in constituent stocks and weights, we estimate the potential passive fund flows. Further combining with the daily average trading volume of individual stocks in the past three months, we can estimate the impact of the changes in passive funds. 1) Hang Seng Index: Although there is no adjustment in constituent stocks this time, the weights of some underlying stocks have been reset. New World Development (with a weight increase of 0.01ppt) and Haidilao (with a weight increase of 0.03ppt) will require the longest time for passive fund inflows, and are expected to bring in US$2.59 million and US$7.77 million, respectively, with inflow times of about 0.4 days and 0.3 days. In terms of fund outflow, Sino Biopharm's weight will decrease slightly by 0.02ppt, which is expected to result in a passive fund outflow of approximately US$5.18 million, with an outflow time of about 0.3 days. 2) Hang Seng China Enterprises Index: Gogovan-W and New Oriental-S, both newly added this time, will require the longest time for passive fund inflows, and are expected to bring in US$31.63 million and US$25.3 million, respectively, with inflow times of about 2.2 days and 0.8 days. 3) Hang Seng Tech Index: ASMPT, which is newly added this time, will require the longest time for passive fund inflows, and is expected to bring in approximately US$238 million, with an inflow time of about 9.3 days.

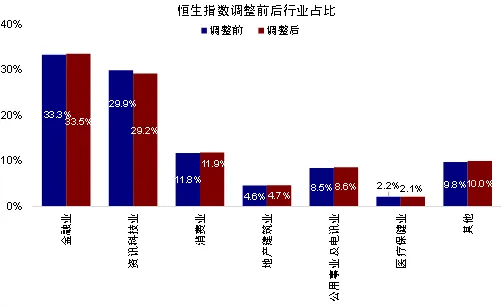

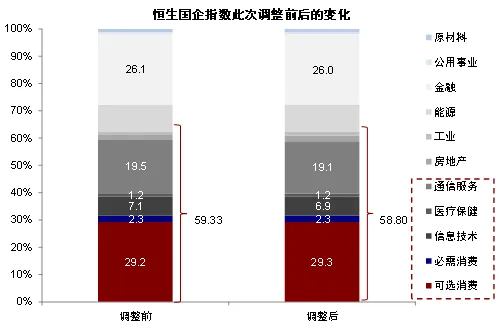

Industry composition: An increase in the proportion of finance and consumer sectors and a decline in the information technology sector. After this adjustment, the proportion of Hang Seng's new economy market capitalization will decrease from the current 47.0% to 46.5%. Specifically, the proportion of the finance and consumer sectors increased, rising from the current 33.3% and 11.8% to 33.5% and 11.9%, respectively; the proportion of the information technology sector decreased from the current 29.9% to 29.2%. In addition, communication services and information technology in the Hang Seng China Enterprises Index have declined significantly, while industry and energy sectors have performed well.

Hong Kong stock connect constituent stocks adjustment: 33 stocks meet the inclusion criteria, and 27 may be removed; whether Alibaba can be included in remains subject to dual primary listing conversion.

This coincides with the half-year index review of the Hang Seng Composite Index (twice a year, with the end of June and December as the cutoff dates), which will become the main basis for the investment scope of the Hong Kong stock connect. Based on the adjustment and the inclusion requirements of the Hong Kong stock connect, we analyze the possible adjustments to the constituent stocks.

Please refer to the source text for this section, as there are bullet points and formatting that need to be preserved in the translation.

Please refer to the source text for this section, as there are bullet points and formatting that need to be preserved in the translation.

This coincides with the half-year index review of the Hang Seng Composite Index (twice a year, with the end of June and December as the cutoff dates), which will become the main basis for the investment scope of the Hong Kong stock connect. Based on the adjustment and the inclusion requirements of the Hong Kong stock connect, we analyze the possible adjustments to the constituent stocks. Please refer to the source text for this section, as there are bullet points and formatting that need to be preserved in the translation.

33 stocks may meet the inclusion criteria for the Hong Kong Stock Connect, including Hang Lung Group, K. Wah Int'l, COFCO Packaging, Q Design and Management, Mongol Mining, Zhi Xing Auto Service, Kinetic Development, Hao Tian Int'l Construction Investment, DALIPAL Holdings, HEC CJ Pharm, DL Holdings GP, Tianli Int Hldg, Stella Holdings, ZONQING Ltd, DALIPAL Hldg, Senmiao Int'l, Quantumphy Hldg, Dah Sing Banking, Sinopec SEG, Dekang Agriculture and Animal Husbandry, Auto-street, Mezzion Pharma, Suncity Group, Yisou Tech, Teahouse 88, Myfintec, Wanwucloud, JNBY, CSSC Shipping, Lao Pu Gold, Sunshine Insurance, S.F. Express and NetEase Cloud Music.

27 stocks may be removed from the Hong Kong Stock Connect, including Cosmopolitan International, Xiabu Xiabu, Shoucheng Holdings, Nonfemet Intl, Zhuguang Hold, Powerlong Real Estate, Silvery Dragon Prestressed Materials, Frontage Holdings, Alli International Ed Le, Chinasouthcity Hldg, China Kepei Education Grp, EC Healthcare, Mindray Biomedical-B, Shengnuo Biotechnology-B, Measat Global, Yadong Group, Ningmeng Pictures, Dingdang Health and others, which may be removed from the Hong Kong Stock Connect due to being excluded from the Hang Seng Composite Index.

In addition, regarding the recent market focus on whether Alibaba can enter the Hong Kong Stock Connect, the company management stated during a conference call last week that the company will hold a shareholders' meeting on August 22 to discuss and submit relevant proposals to the shareholders for considering Hong Kong as the company's primary listing venue. If approved by the shareholders' meeting, the company is expected to complete the dual primary listing conversion in New York and Hong Kong by the end of August. According to our previous discussions, considering that the company has already met other requirements for inclusion in the Hong Kong Stock Connect, assuming the company successfully completes the dual primary listing conversion by the end of August 2024, there is still a chance to catch up with the Hong Kong Stock Connect inspection day on September 5 and be included in the current round of adjustments near September 9. However, we remind that there is a risk of not being included if problems arise that prevent the dual primary listing conversion.

Adjustment schedule: Effective on September 9.

The above index adjustment results will take effect on September 9 (Monday). During this period, some active fund managers may still take certain arbitrage operations based on the announced adjustment results, but passive funds will choose to adjust their positions on the trading day (September 6) before the effective date in order to minimize tracking errors. We expect that the trading volume of relevant stocks may be significantly higher than usual, especially in the closing session.

Chart 1: After this adjustment, the information technology industry in the Hang Seng Index declined due to the reset of weights, but the weights of finance and consumption industries slightly increased.

Source of information: Bloomberg, Wind, CICC Research Department

Chart 2: After the adjustment, the proportion of the industrial and energy sectors in the Hang Seng State-owned Enterprises Index increased, while the proportion of communication services and information technology declined.

Source: Jingtou Caijing, edited by Chen Xiaoyi from Zhitong Finance.