The Clean Energy Fuels Corp. (NASDAQ:CLNE) share price has done very well over the last month, posting an excellent gain of 28%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

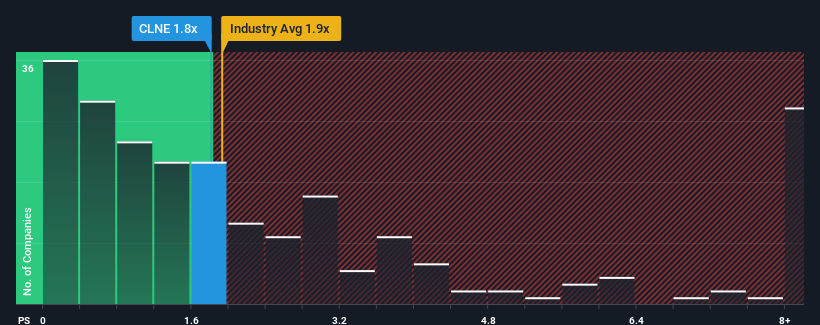

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Clean Energy Fuels' P/S ratio of 1.8x, since the median price-to-sales (or "P/S") ratio for the Oil and Gas industry in the United States is also close to 1.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Clean Energy Fuels Performed Recently?

Clean Energy Fuels has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Clean Energy Fuels will help you uncover what's on the horizon.How Is Clean Energy Fuels' Revenue Growth Trending?

In order to justify its P/S ratio, Clean Energy Fuels would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, Clean Energy Fuels would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. Still, the latest three year period has seen an excellent 81% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 17% each year as estimated by the seven analysts watching the company. That's shaping up to be materially higher than the 1.0% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Clean Energy Fuels' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Clean Energy Fuels' P/S?

Clean Energy Fuels' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Clean Energy Fuels currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Clean Energy Fuels that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.