Unfortunately for some shareholders, the Sify Technologies Limited (NASDAQ:SIFY) share price has dived 27% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 85% share price decline.

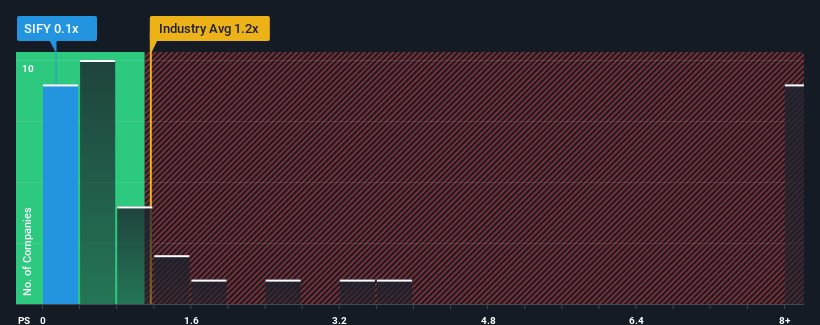

After such a large drop in price, Sify Technologies may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Telecom industry in the United States have P/S ratios greater than 1.2x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Sify Technologies Has Been Performing

Sify Technologies certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sify Technologies.Is There Any Revenue Growth Forecasted For Sify Technologies?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Sify Technologies' to be considered reasonable.

Retrospectively, the last year delivered a decent 6.7% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 43% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 47% over the next year. That's shaping up to be materially lower than the 153% growth forecast for the broader industry.

In light of this, it's understandable that Sify Technologies' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Sify Technologies' P/S Mean For Investors?

Sify Technologies' recently weak share price has pulled its P/S back below other Telecom companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Sify Technologies' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 3 warning signs we've spotted with Sify Technologies (including 2 which shouldn't be ignored).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.