Despite an already strong run, Energy Services of America Corporation (NASDAQ:ESOA) shares have been powering on, with a gain of 29% in the last thirty days. The annual gain comes to 165% following the latest surge, making investors sit up and take notice.

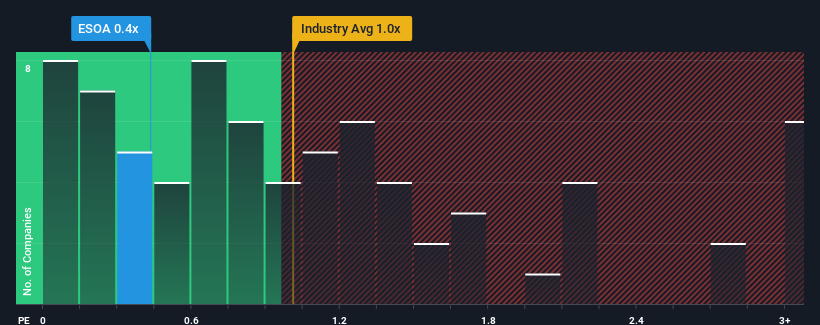

Although its price has surged higher, considering around half the companies operating in the United States' Energy Services industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Energy Services of America as an solid investment opportunity with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Energy Services of America Has Been Performing

With revenue growth that's superior to most other companies of late, Energy Services of America has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Energy Services of America will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Energy Services of America's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Energy Services of America's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 32% gain to the company's top line. The latest three year period has also seen an excellent 176% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth is heading into negative territory, declining 0.4% over the next year. That's not great when the rest of the industry is expected to grow by 9.2%.

With this in consideration, we find it intriguing that Energy Services of America's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Despite Energy Services of America's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Energy Services of America's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Energy Services of America's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Energy Services of America has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.