Xiao Jin, who earns 10,000 yuan a month, is a conservative investor. In her investment dictionary, apart from depositing the bank, it is depositing Yu'e Bao.

Xiao Bao, who shares an apartment, does financial work in the company. Xiao Bao told Xiao Jin, "our company is going to issue a bond with an annual yield of 7.05%, so don't put your money in the bank." Our country is developing so fast that it would be good to buy a three-year treasury bond. "

Xiao Jin is full of questions. "What is a bond? Is it reliable?Thinking about the long-awaited Swarovski in the shopping cart, Xiao Jin was determined to regain his enthusiasm for learning financial management when he was a student.

But for her, the numbers of bonds are too complex and boring-duration, basis points, discount rate, convexity. I don't know where to start.

But for her, the numbers of bonds are too complex and boring-duration, basis points, discount rate, convexity. I don't know where to start.

Buying investment products is like buying health medicines. Few people will have an in-depth understanding of the science behind the drugs. Just look at the prescription instructions and know what diseases the medicine can cure and how to take it.

In fact, people who read investment product brochures carefully show that they have enough patience and concentration that they have already exceeded 90% of people.

So, let's just useAn article tells you the "description" of the bond.And pick out the two issues you are most concerned about:

What do you think of earnings and return time? What do you think of risks and sequelae?

Bond productsInstruction manual

First of all, a bond is essentially a document contract with interest that a government agency or company sells to investors in order to borrow money. From the moment you buy a bond and sign a contract, they will give you a contract that promises to repay the amount on an agreed date.

The prescription is in the medicine jar. Where can I find the bond statement? The answer is simple:Bond contractThat is,Bond prospectus. The instructions are clear about how much bonds can earn and what to do if they default. Since the financial crisis, investors have paid more attention to the prospectus, because it is directly related to how much money we can get back when the company goes bankrupt and liquidated. So be sure to read it carefully before you buy it, and don't take a chance.

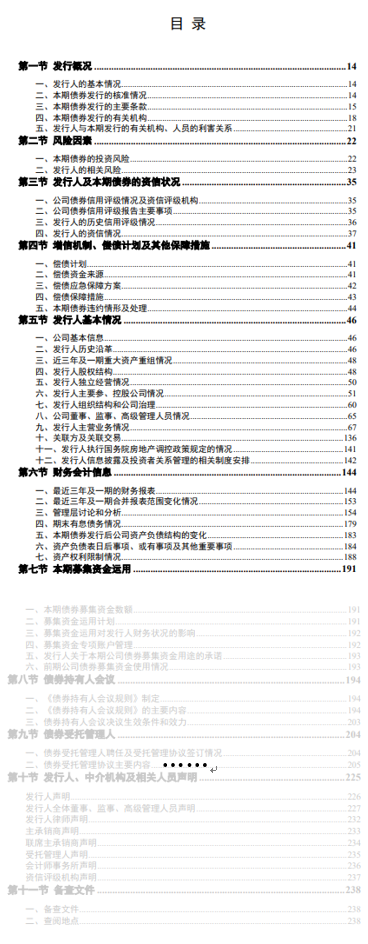

But when you open the prospectus, the list you see looks like this:

Don't panic, said we only need to look at three points: efficacy, taking time and sequelae.

1. Efficacy: what is the benefit?

Like bank deposits, the yield depends on the interest rate, and the interest rate on the bond is called "Coupon rateThe principal that can be recovered even when it is due is called "Face valueFor example, it is written on our country's 5-year treasury bonds:

It means that with a face value of 100 yuan and a coupon rate of 3%, the income this year will be 3 yuan. Generally speaking, bonds issued at parity have a face value of 100 yuan.

2. Take time: when can I see the return?

Because you and the issuer have an agreement, in "Expiry dateThe principal and interest will be recovered at the same time.

If you buy a 5-year period today, you will be happy to wait for the harvest after the 5-year period. In these five years, today or half a year of each year can wait for an interest payment, so your income may be distributed like this:

「Current rate of return": a rate of return of 10 yuan per year for the first four years

「Yield on maturity": when the five-year period comes, we can get an interest rate of 1010 yuan after calculating all the factors such as interest, resale difference between investors, inflation and so on.

But don't be in a hurry to take it out on interest day, because the truth may be like this:

Some people are very excited: isn't it happy to make a profit and sell it? Some people see it but are bewildered: how can this be counted as a profit?

The key here is that when you can get the money back, you will talk about it in detail in the article "duration". But no matter what method you use, the core point is to remember:The rate of return on maturity can only be achieved when you insist on maturity!

In addition, five years may seem long, but they are considered short-term bonds in the general classification. The specific classification is as follows: the maturity date is regarded as short-term in 1-5 years, medium-term in 5-12 years, and long-term in more than 12 years.

3. Sequelae: what if the company pays it back ahead of time?

It is difficult to fall in love for a long time, and if the investment period is long, some companies will break the contract. Like some. "Prepayable bondsIt will be made clear that if the company wants to repay in advance, they will redeem it at a higher price on or after a specific date, and then issue new bonds at lower interest rates.

This is hard for investors: cash received in advance has to be reinvested, but market interest rates are falling. Investors during the dotcom bubble in 2000 and the subprime crisis in 2008 had a painful experience.

Therefore, we must look at an indicator: "The lowest yield". It is the rate of return that the company promises to redeem in advance for whatever reason. In many cases, the lowest rate of return is the actual return we receive. This figure is equivalent to being optimistic about the break-up fee before marriage, bravely saying the bottom line and protecting yourself is the most important.

Of course, breach of contract does not happen very often. You may have recently seen the news of bond defaults of large companies such as Peking University founder Group and Hongtu Sanpower Group, but the last time a central enterprise defaulted was 20 years ago. Gao Teng International also pointed out

Now that the possibility of default on Chinese bonds is moderate, the risks have been exaggerated.

Even if the company you believe in defaults, don't despair about the bond market.Bond funds can be used to diversify investment and reduce the impact of a single bond thunderstorm on overall returns.

Therefore, we should also gently remind everyone that it is easy to follow love blindly, and it is not advisable to blindly believe in big companies and established companies. If you have concerns about your own safety, you are advised to choose a bond fund, so that the money invested in others has a fund manager to help you manage it. For example, the Gao Teng Company, which once held founder Group, reduced its holdings and sold as early as when it discovered the risk. To help you stop your losses in time.

As an intimate partner of butter, Futu Fund Bao provides you with a number of bond fund products, including Gao Teng Asian income Bond Fund and Castrol China income Fund.

Conclusion

In fact, there is a professional basis for reading the bond prospectus in the above way, because these factors are called investment by the academic circles. "Health factors (hygienes)」。

However, no matter how you make money or which product you invest in, don't forgetThe most important factors affecting earnings(none of them) is to accurately predict the fundamental factors that affect capital markets and interest rates, such as economic growth, inflation and the movement of the Federal Reserve.

That's why we only pick out a small number of health care factors to share with you: these latter factors are the decisive force in measuring the overall return on the portfolio.

In the next article, we will begin to focus on the cultivation of financial intelligence and teach you how to read.The trend of Federal Reserve。

To understand the investment of bond funds, let's pay attention to the business school, which is full of practical information.

Edit / xiaohanma

Disclaimer: this document is not and should not be regarded as the basis for soliciting, soliciting, inviting, recommending the sale of any investment products or investment decisions, nor should it be interpreted as professional advice. Investment involves risks, and investors should carefully read the fund information and related documents (including its risk factors). Investors are advised to note that the prices of fund products can rise or fall, and may change substantially within a short period of time. Investors may not be able to get back the amount they have invested in the fund. The past performance of the fund does not predict future performance. If there are similar forward-looking statements in this document, such contents or statements shall not be regarded as guarantees of any future performance, and it should be noted that the actual situation or development may differ materially from such statements.

可是对她来说,债券的数字太复杂太乏味——什么久期、基点、折现率、凸度……根本不知从何看起。

可是对她来说,债券的数字太复杂太乏味——什么久期、基点、折现率、凸度……根本不知从何看起。