Abstract: the article is edited from "Chuancai Securities-property Management Industry report: the Blue Ocean Plate that swings up along the cycle".

The property management industry is one of the best performing sectors in the Hong Kong stock market this year. So far, the sector as a whole has risen 88% this year and has substantially outperformed the Hang Seng Index. So from the current point of view, is the property management plate still worth our investment?

一Industry section: continuous expansion of market space and further improvement of concentration

1. After the cycle of the real estate development chain, the scale will be accelerated soon.

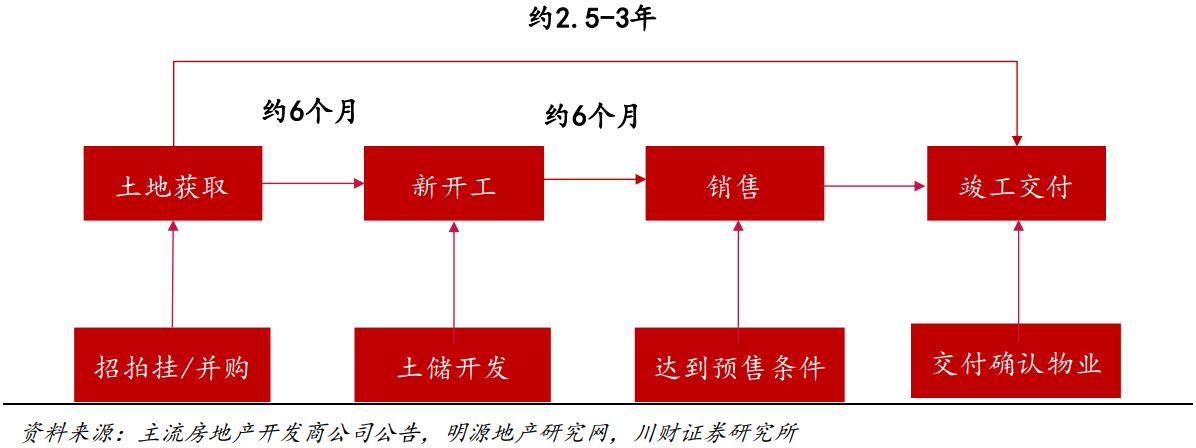

The scale of property management lags behind sales and new construction.。As the post-cycle node of the real estate development chain, the property management industry lags behind the new construction and sales of commercial housing, which is conservatively estimated to take 2.5-3 years.

The scale of property management lags behind sales and new construction.。As the post-cycle node of the real estate development chain, the property management industry lags behind the new construction and sales of commercial housing, which is conservatively estimated to take 2.5-3 years.

Real estate development cycle

China's commercial housing sales continued to grow positively from 2015 to 2018, with a compound growth rate of 10.1% in the past three years.

Sales area of commercial housing and its year-on-year comparison

The non-residential industry still needs to be valued.。At present, the traditional residential property is the main component of the property management industry, the competition pattern in the industry is becoming increasingly clear, and the advantage of the head enterprise is gradually expanding. On the other hand, the non-residential industry has more development potential.

Composition of completed area of commercial housing

Completion of non-residential buildings

It will take time for the property management industry to "rise in both volume and price".The continuous improvement of people's income in our country will put forward higher and more requirements for the quality and types of property services, which will become one of the potential driving forces for the improvement of unit prices.

Per capita disposable income of urban residents and year-on-year

At the same time, since last year, the property management industry guidance price has been initially liberalized. The improvement of the degree of marketization of property charges has become the second potential driving force for the increase of unit prices.

Comparison of charging standards for new and old properties in some cities

two。 Industry integration is accelerated and concentration continues to improve.

The improvement of the concentration of developers has led to a tilt in the scale of property management to the head of the industry.The concentration in the field of real estate development has increased significantly, while the head real estate enterprises generally have property services, such as Country Garden Holdings and Country Garden Services Holdings, Vanke An and Vanke property and so on. In the future, this kind of property companies will fully enjoy the scale-up dividend brought by the high increase in commercial housing sales.

Real estate developers' sales concentration continues to rise.

Landing in the capital market to consolidate the head advantage, receiving mergers and acquisitions to promote the integration of industry resources.At present, the leading enterprises in the property management industry actively enter the capital market, promote scale expansion and consolidate head advantages with the help of capital advantages.

Sorting out the listing of property companies since 2014

The planned use of the funds raised by the listing of property companies

3. Deeply ploughing the core metropolitan area and strengthening the penetration rate of single city

Adapt to the trend of regional rise, deep ploughing the core metropolitan area.The layout choice of property companies has gradually transitioned from project-oriented to urban deep ploughing, preferring cities with development advantages and population advantages.

The layout of the top 100 properties under management (2018)

It is necessary to strengthen the permeability of single city and selective subsidence in order to realize the layout of metropolitan area.At present, the top 20 cities with the management scale of the top 100 property enterprises are all first-and second-tier cities in the core metropolitan area. Considering the current regional economic development, the third and fourth-line satellite cities around the core cities will fully enjoy the dividends brought by regional coordinated development.

Property top 100 layout city TOP20

4. Steady growth of basic services and icing on the cake for value-added services

Property companies "tailor-made" value-added services has become a trend.For the expansion of value-added services, head property companies tend to combine their own advantages to achieve targeted choice of value-added services. For example, Country Garden Services Holdings provides the following value-added services:

Country Garden Services Holdings value-added service

The performance of value-added services thickens.No matter in terms of income composition or net profit, the profitability of value-added services is much higher than that of basic property services.

Share of income from basic services and value-added services in the top 100 properties

Share of net profit of basic services and value-added services in the top 100 properties

Second, the company: the strong is always strong, multi-dimensional promotion of casting high threshold

1. Dimension 1: the head of property management has changed from scale expansion to high-quality growth.

By undertaking the new resources given by related developers and expanding the projects from top to bottom, the property management head company has successfully achieved the improvement of scale. In recent years, the head of the industry has changed from scale-oriented to quality growth, which makes the revenue and net profit much higher than the average of the top 100.

Revenue of the top 100 properties in 2018

2018 net profit level of the top 100 properties

two。 Dimension 2: brand effect

As a service-oriented enterprise after real estate development, property management has a certain accessory, which has a certain impact on the price of residential projects and the rent of leasing projects. With the gradual transformation of the incremental market to the stock market, brand effect will become one of the new core competitiveness after the scale.

Top 10 Brand value of Chinese property Management Enterprises in 2018

3. Dimension 3: technological innovation, reducing cost and improving efficiency

With the improvement of the scale of the industry, the increase of labor costs directly leads to the increase of operating costs of property companies. Therefore, how to achieve scale expansion and further strengthen cost control has become the main problem for property companies to enhance their competitiveness.

2018 composition of operating costs of the top 100 properties

The leading enterprises in the industry have tried to improve efficiency and reduce cost by means of scientific and technological innovation. For example, Country Garden Services Holdings has carried out strategic cooperation with Tencent, Haikang, BABA, Huawei and other enterprises to achieve community intelligence, reduce costs and improve efficiency, while improving customer satisfaction.

4. Dimension 4: taking people as the core and common development

In order to ensure the smooth expansion of business, leading enterprises continue to introduce talents, and the professional ability and comprehensive quality of employees have been greatly improved, thus driving the sustained growth of per capita output.

Per capita output of the top 100 properties

Third, the subject matter: help shake up in the right cycle, and bully the frost in the opposite cycle.

1. Country Garden Services Holdings

Country Garden Holdings's top-down resource transfer ensures the sustained growth of the company's size.The company currently manages 1055 projects. Considering that the sales volume of Country Garden Holdings, the leader of the developer, ranked first in the industry from 2017 to 2018, with the delivery of the project one after another, the future scale of Country Garden Services Holdings steadily increased with certainty.

While consolidating basic property services, we will actively expand community value-added services.The company takes the basic property services as the cornerstone, actively develops high gross profit value-added services, and the profit level has been in the forefront of the industry.

2019H1 income composition

Gross profit margin level of each business

Continue to work in the field of smart IoT and intelligent community, and be the pioneer of science and technology creation in the industry.The company has cooperated with Haikangwei, Aliyun and Tencent to continuously promote the deep integration of artificial intelligence and property services based on the rich intelligent application scenarios in the community, while improving the satisfaction of the owners. to achieve cost reduction and efficiency enhancement of the overall service.

two。 Greentown service

Actively expand, the management format is more balanced.In addition to undertaking projects from Greentown China, the company has actively expanded third-party resources in recent years, including industrial parks, office buildings, commercial complexes, urban renewal and other non-residential formats.

The park business and consulting business have developed steadily, and value-added services have added early education.The value-added service of Greentown service is mainly composed of consulting service and park service. At present, the company continues to build Greentown service early education brand.

3. China Shipping property

With the background of central enterprises, the development of municipal property is outstanding.The company belongs to the China overseas Group under the China Construction Group. In terms of business layout, the company relies on the background of central enterprises, in addition to residential properties, commercial properties, the active layout of municipal properties, including Xiongan Citizen Service Center, Shenzhen Museum of Contemporary Art and Urban Planning Museum and so on.

New business type actively explore value-added services, based on the Internet of things, the "Xinghai Internet of things", "you interconnection" to form the company's new core competitiveness.

"Xinghai Union of things" full value chain service

"you interconnected biosphere"

4. Yongsheng living service

Inherit the group project internally and expand the third-party resources externally to achieve "internal and external repair".The company was founded in 2002 and began to provide property management services for the projects developed by Xuhui Group in Beijing in 2003. At present, both in terms of management and revenue, the company shows its excellent ability in third-party expansion.

On the construction surface of the pipe

Income composition

Out of the residential format, commercial property management brand gradually become.At present, the company has corresponding brands for residential industry, commercial office property management services and agency customers, and value-added services have also developed. In the future, the company will expand synchronously in the two dimensions of multi-format and value-added services, and the overall value can be enhanced.

5. Elegant life

The combination of strong and strong forces to achieve rapid growth in scale.Considering the combination of the two major shareholders of Agile Group and Greenland Holdings, it can ensure the endogenous growth of the company in the management scale. At the same time, the company's third-party expansion capacity is in the forefront of the industry, and the company's management scale is expected to continue to increase in the future.

Source composition of the company's area under management (2019H1)

Diversify the layout of business and enrich the sources of income.While operating property service companies, the company is actively exploring diversified development paths. at present, it has formed an organizational structure dominated by property service companies and actively developing public services, community commerce and asset management.

Risk Tips:The completion of commercial housing is not up to expectations; labor costs continue to rise; the risks brought by the failure of diversified business development.

Edit / Jeffy

物管规模滞后于销售、新开工。物管行业作为房地产开发链条的后周期节点,滞后于商品房新开工及销售情况,保守估计需2.5-3年。

物管规模滞后于销售、新开工。物管行业作为房地产开发链条的后周期节点,滞后于商品房新开工及销售情况,保守估计需2.5-3年。