Source: China Fund Daily

Author: Mo Fei

Just now, Shenzhen property market brushed the screen again! After adjusting the standard of "luxury tax", Shenzhen's property market regulation and control policy has come up with a new move.

At noon on December 12, Nanfang Daily reported that the Shenzhen Housing and Construction Bureau confirmed that Shenzhen had cancelled the "rent-only-not-for-sale" policy of business apartments introduced last year. Some market analysts pointed out that the policy change and the "luxury tax" standard adjustment intention is similar, that is, to stabilize Shenzhen's economic growth.

This means that the Shenzhen property market, which has risen continuously, may continue to be a "warm winter". Many people even revealed that after the adjustment of the "luxury property tax" standard, the Shenzhen property market is unusually hot, with frequent CD-ROMs in the new market, and it is not rare for second-hand housing to jump by 300000 overnight. There is even news that real estate owners and intermediaries in Shenzhen have joined hands to control the rise in prices, and the price of a single set has risen by more than 3 million, of which tricks are frequent.

In the context of the overall regulation and control of the real estate industry, the Shenzhen property market has gone out of a wave of rising prices against the trend, and many price increase models have been renovated frequently. This also makes many netizens sigh: Shenzhen property market is too magical.

Business apartment "rent only but not for sale" cancelled

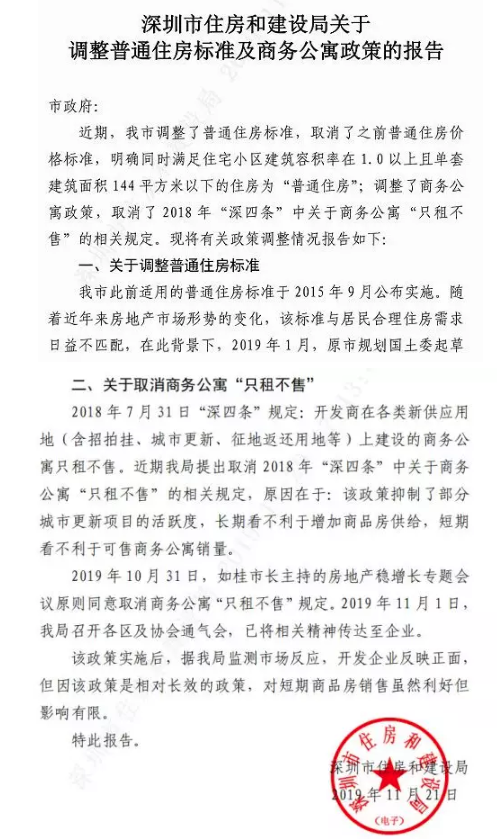

Yesterday evening, a suspected internal document of the Housing and Construction Bureau on the policy adjustment of commercial apartments was released, which showed that the core clause was to abolish the 2018 "Deep four" rules on "rent only, not for sale" of business apartments.

On the morning of December 12, the Southern Network reporter confirmed the above news to the Shenzhen Municipal Housing and Construction Bureau. A person from the Shenzhen Housing and Construction Bureau said that Shenzhen has lifted the "rent only, not sale" restriction on business apartments introduced last year. This is after the adjustment of the "luxury tax" standard, Shenzhen again out of the property market regulation and control policy.

According to the Shenzhen Municipal Housing and Construction Bureau, the reason for abolishing the relevant regulation of "rent but not sale" of commercial apartments is that the policy suppresses the activity of renewal projects in some cities and helps to increase the supply of commercial housing in the long run. in the short term, it is not conducive to the sale of commercial apartments. It is understood that the abolition of business apartments "rent only but not for sale" has been implemented since November.

According to data monitored by Zhongyuan Real Estate in Shenzhen, the supply area of commercial apartments in Shenzhen was 1.3351 million square meters in 2018, down 0.4% from 2017, and this is the first time that the growth rate of commercial apartment supply has slowed since 2014. As of November 2019, the total supply area of business apartments in Shenzhen reached 1.3918 million square meters, exceeding the supply level for the whole of last year.

Data show that the regulation and control policy on the purchase of commercial apartments was clearly defined in the Shenzhen property market regulation and control policy issued on July 31, 2018, which is regarded by the market as a "strengthened version" of the most stringent purchase and price restriction policy on October 4, 2016.

At this time, the 731 policy began to be loosened, which is also understood by the market as a new favorable policy in the Shenzhen property market, which will be a great benefit to the commercial housing market in Shenzhen, including apartments and housing.

Great adjustment of the standard of luxury housing lineThe change of property market policy attracts attention.

In fact, this is not the first time Shenzhen has adjusted its property market policy. On November 11, a number of media confirmed that there was a major change in the levying standard of Shenzhen's "luxury property tax".

The staff of Shenzhen Taxation Bureau confirmed that from November 11, 2019, the standard of ordinary housing will no longer have a price stipulation, and houses with a volume ratio of more than 1.0 and a single building area of less than 144 square metres are ordinary housing. This means that second-hand houses for two years may be exempt from VAT.

In 2015, the standard for ordinary housing in Shenzhen was introduced, stipulating that houses with a total price of more than 4.9 million in Nanshan, 4.7 million in Futian and 3.9 million in Luohu are luxury houses and need to pay tax in accordance with the standards of luxury houses. However, with the rise of housing prices in Shenzhen, the luxury line is no longer in line with the status quo. This is also the reason why Shenzhen has introduced the adjustment policy of the luxury line.

Analysts believe that the adjustment of luxury line standards will have an impact on Shenzhen in three major aspects, mainly:

1. To reduce the purchase cost of ordinary people, especially the rigid demand, the adjustment of luxury house tax is in line with this aspect.

Because at present, the total price of many small households exceeds the luxury house tax standard, so that many dozens of square meters of small homes are luxury houses, thus bearing a large luxury house tax, which is obviously not conducive to meet the rigid demand for housing demand.

2. On the one hand, it will lighten the burden of buying a house and have a greater incentive to enter the market. On the other hand, the seller will also feel that this benefit should be shared by himself, which may have an impact on house prices.

3, the whole second-hand housing transaction has played a more favorable transaction, taxes and fees have been reduced, and the threshold for buying houses has also been lowered at the same time.

Warm winter market appears in Shenzhen real estate marketIs there a "untie" signal in first-tier cities?

Some analysts believe that the cancellation of the policy of "only renting but not selling" business apartments is consistent with the previous adjustment of the luxury housing line to stimulate second-hand housing transactions, that is, the need for Shenzhen's economic "steady growth". According to data, Shenzhen's GDP growth rate reached an all-time low of 5.12% in the third quarter of 2019.

It is worth noting that near the end of the year, Shenzhen property market appeared a wave of rising against the trend of the "warm winter market." The Weifang Index of first-tier cities released by the Chinese Academy of Social Sciences shows that house prices in Guangzhou, Beijing and Shanghai have been relatively depressed in the past year, rebounding weakly in the first quarter of 2019, and then began to fall after the rebound. Only Shenzhen continues to maintain its first-half rally in the second half of 2019.

According to the Weft Housing Index of first-tier cities, house prices fell 3.37% in Guangzhou, 3.99% in Beijing, 0.81% in Shanghai and 5.58% in Shenzhen as of October.

However, for the impact of the abolition of the "rent-only-not-for-sale" policy of business apartments, there is also a view that it cannot be simply regarded as a signal of "deregulation" from the property market.

Wang Feng, director of the Shenzhen Real Estate Research Center, believes that the impact of this policy on the Shenzhen property market is negligible. In fact, it is the government's adjustment of the planning and construction policy and a supply-side adjustment of the real estate supply structure. It should not be misinterpreted as the relaxation of the regulation and control of the Shenzhen property market. "in the past, it was stipulated that only rent but not sale was due to the high hype of business apartments. There have been few new commercial apartment projects since July 31 last year, and it takes about a three-year cycle even if they enter the market. Therefore, this policy has little impact on the current property market. "

From January to November this year, the Shenzhen property market has been running smoothly. Shenzhen has been firmly implementing the national macro-control policy, and will strictly implement the regulation and control requirements of housing speculation in the future. The public should avoid being misled by some media hype and have wrong expectations about the property market. "Wang Feng said.

Ma Guangyuan, an economist, said that the current situation of the Shenzhen property market is quite similar to that when it was launched in 2015, and some people think that the bull market is expected to come again. However, Ma Guangyuan said that house prices will not see another "surge" as in 2015, after all, prices are still high. Shenzhen has received unprecedented policy support, which can not all be interpreted as good for the property market, and it will take a long time to digest and cash in.

The controlling price of the owner's intermediary jumped overnight.The half-month opening price has risen by more than 3 million.

It is worth noting that due to some changes in the property market policy in Shenzhen, the popularity of real estate transactions has not cooled down. Different from the current situation of new and second-hand housing transactions in other cities, property market transactions in Shenzhen are extremely hot.

According to Databao statistics, the recent Shenzhen new housing market "daily CD" appears frequently. On October 30th, Shenye Zhongcheng opened, 2794 batches of customers grabbed 192 apartments, with an average record price of 131000 / flat, with a removal rate of 100%. On November 5, Hecheng Land Building launched 61 residential units at an average price of about 92600 per cent, which sold out on the opening day.

On November 14, the Baozhong Yunxi brocade court opened with an average price of 109000 / ping and Quhua 80%. On the evening of November 24, the Longhua Jinmao House raided the market with an average price of 102000 / ping, and arrived in group 183. finally, 161sets were sold, with the first batch resolution rate of 88%. On November 29th, the China Merchants lead Seal opened with an average price of 108000 / ping, and all of them were sold out in only 4.5 hours.

On November 30, four major properties opened together, and 80%, or even all seconds, were removed on the first day.

More than a lot of people revealed that the recent Shenzhen second-hand housing trading market also appeared owners and intermediaries together to control the market, violently raise prices, a night jump of 300000, 500000, not a few. Some owners are even more greedy and raise the price directly to the ceiling.

According to netizens on Wechat moments, the transaction price of three apartments in a high-end district in Nanshan was still 10 million at the beginning of this year, climbing to 11 million in August, about 12 million in mid-November, and 11.5 million in the last set, which has been on a steady upward channel.

But by the end of November, the listing price of all households in the district suddenly became 15 million, with a maximum of 18 million, which rose violently by 300 to 5 million in less than half a month. Many people in the market believe that this is a typical behavior of owners and intermediaries holding together to drive up prices.

Inspired by the rising prices of these residential buildings, many owners of hot markets have also begun to join hands. It is reported that the organizers go to the property to get the phone number and contact information, contact the same household owners to build a group directly, and even hold a minority rally to discuss the housing price pull-up strategy. There are a lot of tricks in order to drive up prices.

Analysts believe that although the behavior of controlling market prices is in a small number, the distortion of housing prices really occurs. If resources such as hot sales and school districts are in short supply and sellers are strong, they will have the strength to set prices. Scarce properties of housing if the collective pull up, it will soon form a new price anchor, so that buyers collectively achieve the goal of owners to pull prices.

Yan Yuejin, research director of the think-tank Center of the Yiju Research Institute, said that after the Shenzhen market rebounded, housing enterprises and landlords took advantage of the opportunity to raise prices, especially after the price speculation of second-hand housing, the prices of first-hand housing also began to rise. For the follow-up market risk, it is still necessary to guide the implementation of the tax policy, the key is to achieve the stability of housing prices.

The Shenzhen Housing and Construction Bureau also said that Shenzhen still strictly implements the policies of purchase, loan, sale and price restrictions since 2016, and the work of "stabilizing land prices, stabilizing housing prices and stabilizing expectations" is still in progress in an orderly manner. In addition, the work of the long-term mechanism for real estate development is also accelerating. In the future, Shenzhen will deepen the reform of the housing system, vigorously develop the housing rental market, and comprehensively use land, finance, taxation, legislation, and other means to continuously improve real estate regulation and control measures, continue to curb speculation, and promote the stable and healthy development of the real estate market.

Report of the Academy of Social Sciences:The property market will usher in an inflection point in 2025.

Although the Shenzhen property market is hot, from the perspective of the national real estate market, the property market as a whole has entered a stage of gradual cooling.

In October, second-hand housing prices fell in 35 of the 70 large and medium-sized cities, accounting for half of the total, according to the National Bureau of Statistics. That means the number of cities where house prices fell in October hit a 55-month high.

The China Housing Development report released by the Chinese Academy of Social Sciences predicts that the next two years will be a critical period for the regulation and control of the property market, the window of opportunity for the regulation of the property market will be closed around 2025, and the great potential and expectation of housing development will change around 2025.

The Chinese Academy of Social Sciences gives four reasons why the inflection point will be in 2025:

First, China is currently in a rapid development range of 30% of the urbanization rate and 70% of the urbanization rate, and there is still some demand potential in the future. Although the urbanization rate in some parts of the country has exceeded 80%, reaching the level of developed countries, on the whole, the urbanization rate of China's resident population is 59.58% and that of registered residents is 43.37% at the end of 2018. There is still plenty of room for growth in the future. For the property market, there will be a lot of rigid demand in the next few years.

Second, China's economy is resilient. Analysts said that objectively, this year's market policy, capital and other aspects of the environment is very unfriendly, but commercial housing sales data still have some points to point out.

Data show that from January to October, commercial housing sales area of 1.33251 billion square meters, the growth rate for the first time this year from negative to positive, an increase of 0.1% over the same period last year, of which residential sales area increased by 1.5%. In addition, from January to October, national investment in real estate development totaled 10.9603 trillion yuan, an increase of 10.3 percent over the same period last year. Of this total, residential investment increased by 14.6%. Therefore, subjectively, the property market has turned cool, but according to the data, it is a major trend to stabilize or even pick up in the future.

Third, the interest mechanism of real estate speculation still exists. For example, for Beijing, the inflection point of the property market has basically been determined, but there are still cities that do not "admit defeat", and even owners collectively control the market, wantonly driving up housing prices.

Fourth, regulation of the property market is unlikely to be relaxed. Analysts believe that although the growth rate of real estate development investment, new construction and other data has declined, but the total amount is still high, the possibility of substantial loosening is very small.

Edit / Phoebe