Source: macro Changchun

Authors: Hua Changchun, Tian Yuduo

This meeting left interest rates unchanged as expected, but delivered three clues to the future policy path. At the same time, combined with the five recent trends on US monetary policy, it is considered that it is still necessary to cut interest rates in 2020.

Maintain interest rates as expected, while passing on clues to three policy paths:

1) the statement removes the expression of uncertainty about the economic outlook, butStill emphasize the pressure of global development and low inflation, and emphasize that once the situation changes, the threshold for interest rate reduction will be raised, but the window is still open.;

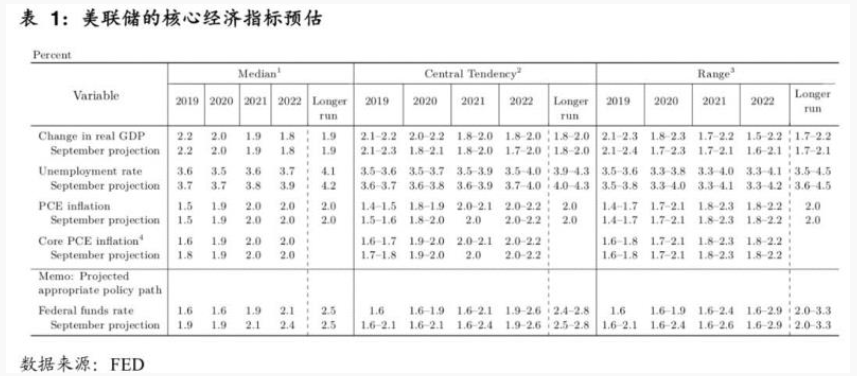

2) the economic growth in 2020 is slightly slower than that in 19 years, but still close to 2%.Unemployment and core inflation expectations are further revised down to meet the inflation target in 2021;

3)将To deal with the liquidity at the end of the year by providing repurchase for the New year, there is no further expansion arrangement.;

With regard to the future path of US monetary policy, there are five major trends to consider:

1)2020 ticketing Commission "Pigeon":The right to vote will be rotated, two hawks will withdraw, and the new voting committee will be more "dove" than in 1919.

2) the US repo market continues to tighten: the role of existing repo and short-term Treasury bond purchases seems to be inadequate-in addition to year-end tax payment and treasury bond issuance, the Fed's previous expansion process resulted in reserve assets in the structure of highly liquid assets of large banks being squeezed by treasury bonds. The tight liquidity situation is the manifestation of the lag effect of table expansion.

3)The momentum of the US economy weakens in 2020, and the weakness of the manufacturing chain is obvious.;

4) the tension of domestic politics in the United States, the competition between the two parties restricts fiscal policy.

5) the uncertainty of the American international environment, the uncertainty of Sino-US economic and trade relations, political events and the weak recovery of the global economy.

To sum up, we thinkThe Federal Reserve still has to cut interest rates in 2020.。

1. Three clues provided by the meeting

1.1. The statement removes "uncertainty" but still emphasizes global growth and inflationary pressures

This time, the interest rate remained unchanged, which was supported by all the voting committee members and was in line with market expectations. In the statement, the statement removed the expression of uncertain outlook (uncertainties about this outlook remain), but still stressed the pressure of global economic growth and low inflation (global developments and muted inflation pressures). Powell also made a special response to this at the news conference, saying that the previous uncertainty also came from these two aspects. Therefore, on the whole, the content of the statement does not change substantially.

The Fed provides a threshold for action, but remains open to new policy changes. Powell said at a news conference that once future developments lead to the need to reassess policy and economic outlook, the Fed will act, policy is not on the current path (developments emerge that cause a material reassessment of our outlook, we would respond accordingly. Policy is not on a preset course). To support this view, Powell reviewed the situation in 2019 before the announcement, when a slow rate hike a year ago was considered appropriate at the time, but eventually cut 75BP.

Therefore, in the face of low inflation and the short-term interest rate hike window has not yet opened, the Fed's action direction is still to cut interest rates, and it is still possible to cut interest rates in 2020.

1.2. Inflation expectations are revised down to achieve the 2% inflation target in 2021, and the bitmap moves down.

According to the Fed's economic forecast, the economic outlook for December remained unchanged compared with September, but for economic growth in 2020, Powell said at a news conference that the economic growth rate had slowed but was still close to 2%.

Both unemployment and core inflation expectations have fallen. The unemployment rate fell to 3.5% in 2020 from 3.7% before, and the long-term unemployment rate was reduced from 4.2% to 4.1%. Core inflation was revised down from 1.8% to 1.6% in 2019, maintaining inflation expectations for the next three years. But both the PCE price index and the core PCE price index will not reach the 2 per cent inflation target until 2022.

With regard to the level and target of inflation, there was much discussion at the press conference. Powell stressed the importance of achieving the inflation target. Long-term failure to meet the target will lead to a downward revision of inflation expectations, further depressing inflation and restricting monetary policy space. Inflation of 2% in 2021 is both the Fed's expectation and a policy commitment that cannot be below the inflation target for a long time.

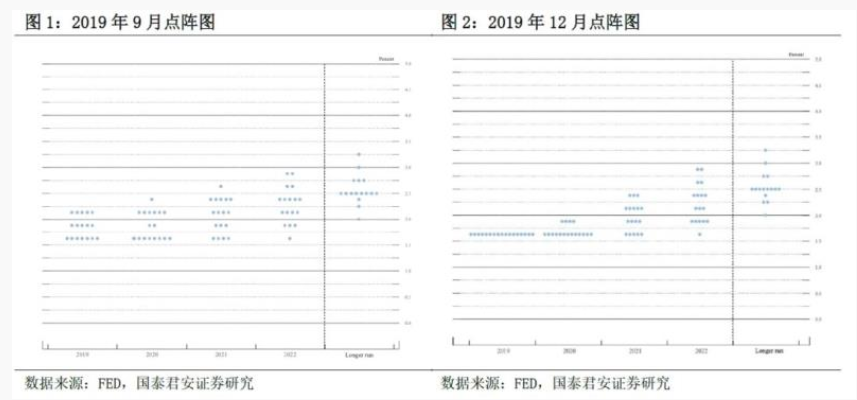

The bitmap has moved down from September as a whole, with the federal funds rate expected to be 1.6% at the end of 2020, 1.9% in September, and the long-term interest rate at 2.5%. Judging from the bitmap, it will remain unchanged in 2020. However, Powell stressed at a news conference that paying too much attention to the bitmap will be difficult to see the whole picture.

1.3. Liquidity problem-actively deal with the liquidity problem at the end of the year, no commitment to further expansion

In response to the tension in the repo market, Powell said that he would deal with the liquidity shock at the end of the year by providing repurchase arrangements for the New year, leaving the previous arrangements for the purchase of short-term government bonds and open market repurchase operations unchanged.

two。 The "dove" of the Federal Reserve voting committee

After the last meeting of the year, voting rights will be rotated under Fed rules. Among the four members of the voting committee to be rotated this time, Esther L. George and Eric S. Rosengren have been hawkish, opposing the last three interest rate cuts, arguing that interest rates should be kept unchanged.

The four members who won the right to vote this time are Minneapolis Fed Chairman Neel Kashkari, Cleveland Fed Chairman Mestre (Loretta Mester), Philadelphia Fed Chairman Patrick Harker and Dallas Fed Chairman Robert Kaplan. Mestre is opposed to the three interest rate cuts. Huck is in favor of the first rate cut, but the latter two are relatively weak as hawks.

Kaplan supports interest rate cuts in 2019, but stressed in October that further cuts are unlikely unless the situation worsens. Mr Kashkari wants to cut interest rates by more than his colleagues in 2019 and the fed should promise not to raise rates until inflation stabilizes at 2 per cent.

Therefore, after the overall assessment, compared with the staunch hawks of the original voting committee, the new members of the voting committee as a whole will be "doves".

3. The "tightening" of the repo market in the United States

Interest rates in the US repo market have risen since September and market financing has tightened, forcing the Fed to increase its buybacks and start buying short-term Treasuries.

John Williams, president of the New York Fed, explained the nervousness in the repo market in a speech, saying it was mainly due to tax payments at the end of the year and the issuance of a large number of US Treasuries. But in its recent quarterly review, BIS offered a structural explanation for the continuing tension in the US repo market.

After the 2008 financial crisis, the asset structure of banks changed, the holdings of treasury bonds increased while cash reserves decreased; in addition, the overall repo market is dominated by large banks, and the net financing of the top four banks in the United States reached $300 billion at the end of June. But with the Fed's previous process of shrinking its balance sheet, leading to a lack of stable buyers for large bank debt positions, banks need to adjust the structure of their liquid assets.

As a result, the tension in the US repo market is also a reflection of the lagging effect of the Fed's long-term asset purchases.

Although the Fed has promised to maintain its overnight repurchase operation until January 2020 and to buy short-term Treasuries until the second quarter of next year, judging from the recent fact that the New York Fed has been increasing the size of its buybacks, the liquidity crunch has not eased. In its repurchase operations on Dec. 2 and 9, the New York Fed raised its quota from $15 billion to $25 billion, but was still about twice as subscribed. In addition, the Fed's stress tests on banks at the end of the year further increased their capital needs to meet regulatory needs.

The tension in the liquidity market is the powder keg of the US financial market and economy.

First, it will lead to instability in the entire financial market, because hedge funds and insurance companies all need to adjust funds through this market; second, it will hinder the implementation of the Fed's monetary policy. liquidity constraints will hinder the decline of short-end interest rates and then transmit the long end. Third, looking back on the 2008 financial crisis, there was also a tense situation in the repo market, and investors were worried about the default of bills to redeem money funds, but the market liquidity was tight, which led to the hindrance of corporate financing and a chain reaction.

Therefore, in the face of tighter liquidity, the Fed must maintain a high degree of vigilance, and once existing policies fail to fundamentally ease the continuing tension, it will be possible to trigger another interest rate cut and start long-end bond purchases.

4. The "weakening" of the American economy

After a long period of expansion, the decline of the US economy is basically the consensus of the market. But the recent rebound in U. S. non-farm payrolls data and the University of Michigan consumer confidence index have disturbed market expectations.

However, there are three points to pay attention to: first, the deviation between non-agricultural data and ADP data, ADP as an automatic collection of data that is relatively more reliable, and the history of non-farm employment exceeding ADP employment shows signs of negative correlation with manufacturing PMI; second, ISM manufacturing PMI continues to weaken, and there are signs of transmission from manufacturing to non-manufacturing. Third, the decline in manufacturing capacity utilization and capital expenditure in the United States is a negative drag on the economy.

5. The "tension" of the domestic environment

2020 is an election year, and the election is accompanied by President Trump's impeachment. The political competition between the two parties has entered a day-to-day stage. Under the bipartisan control of the House of Representatives and the Senate, it is expected that Trump's impeachment will eventually fail to reach the 2/3 voting threshold in the Senate. The same Trump fiscal stimulus package is also harder to pass during the election. Us fiscal policy is expected to be constrained during the general election.

6. The "turbulence" of the international environment

With regard to the Sino-US economic and trade dispute, there has been no final certainty about the first phase of the agreement that the market is looking forward to. This has brought great uncertainty to the Chinese and American economies as well as the global economy.

In addition, although the risk of Brexit has declined due to concerns about the Conservative Party's recent lead in the polls, unrest in many parts of the world, such as the resurgence of the "yellow vest" movement in France, have brought new uncertainty to the fragile global economy.

On the one hand, the turmoil in the world will directly affect the global trade chain and the capital expenditure of enterprises, on the other hand, it will also transmit and amplify risks through the financial market, which will bring challenges to the central bank's policy goal of maintaining the financial market.

To sum up, in the face of five major domestic and international trends, the Fed is still expected to start cutting interest rates in 2020.

Edit / Phoebe