If you try to predict where the stock market will go tomorrow or next year, you have already lost half of it.

-Buffett

At the end of the year, no matter whether it is the KPI assessment or the reason for the performance at the end of the year, the major investment banks are always happy to send you forecasts for the coming year, although it turns out that most of them are hit in the face.

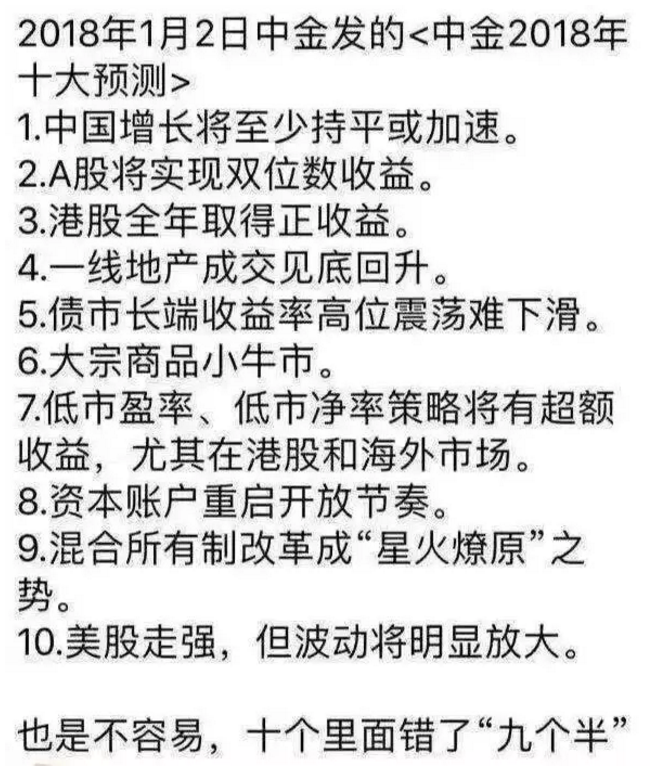

The classic case of CICC hitting the face is still fresh in my mind a year later.

There are still 20 days to go before the end of 2019, and as long as there are no big surprises, the overall pattern of the market this year has basically been settled.

At the same time, a considerable number of big banks have made forecasts for 2020.

Let's happily review (hit the face) 2019 and look forward to 2020.

2019, how did you perform?

Overall, growth stocks had the best performance by the end of November, with returns of 30.3 per cent, followed by global REITS (24.7 per cent) and developed country stocks (24.6 per cent), followed by commodities with a yield of just 2.5 per cent.

Source: Morgan Stanley

In terms of stock marketThe US stock index represented by the S & P 500 is still the best gainer.. After a slump in the second half of 2018, us stocks rebounded quickly in 2019, up 27.6 per cent by the end of November, followed by European (except UK) stocks, which also rose 25.9 per cent.

After 18 years of panic selling in the trade war, the Shanghai Composite Index began to repair its valuation in the first quarter of this year, then fell back quickly and is now stable at around 2,900 points. The MSCI emerging Markets Index is up about 10.6% this year.The worst thing for the year is the Hong Kong stock market.The hang Seng index basically gave up its gains of nearly 15 per cent at the start of the year and is now up only 3.16 per cent from its low at the start of the year.

Source: Morgan Stanley

On the commodities side, WTI crude also peaked at 40 per cent after a collapse in the second half of 2018. It is currently stable around $55, with an increase of more than 20% for the whole of 2019. After soaring in the second half of 2018, gold has continued to climb since June, rising 14% from about $1300 an ounce to $1466. But other commodities have not performed well.

In terms of national debtItalian, British and Spanish bonds have the highest yields, at 11 per cent, 8.8 per cent and 8.6 per cent, respectively, with an average global yield of 5 per cent.

Source: Morgan Stanley

Fixed incomeEmerging market bonds, US high-yield bonds and IG global bonds all yield more than 10 per cent, with emerging market bonds yielding the highest yield of 12.3 per cent.

Source: Morgan Stanley

After watching the market performance this year, let's enter the happy face-beating link. By comparison, how reliable is the forecast of the major investment banks for this year at the end of 18 years?

Review of 2019 predictions: a year of facial pain

Goldman Sachs Group bought the villa against the sea.

For 2019, Goldman Sachs Group is the most bullish on emerging markets and bearish on European markets.But European markets are second only to the United States this year, while emerging markets are second from the bottom.

(source: Goldman Sachs Group)

It is optimistic that the prediction of bulk products is more accurate.On the currency side, it is bullish on the euro and yen and bearish on the dollar.The euro has been weak this year due to repeated problems such as Brexit, even falling to almost parity with the dollar at one point, while the dollar remained strong, up 1.5% by the end of November. Supported by risk aversion, the yen has remained at a high level.

The most outrageous prediction is that Goldman Sachs Group expects the Federal Reserve to continue to raise interest rates in 2019.But in fact, since July 31, Fed has opened the valve to cut interest rates, cutting interest rates three times this year.

(source: Goldman Sachs Group)

So whenever Goldman Sachs Group makes a prediction, some netizens will tease: if Goldman Sucks say "sell", buyboy! (if Goldman Sachs Group TMD says to sell, buy it quickly.)

"Ten guesses are not right", Merrill Lynch Bank of America

For 2019, BofA vowed to make ten research decisions:

As a wholeMerrill Lynch Bank of America is also completely wrong about the overall macro tone.. Since mid-2019, major countries around the world have begun to cut interest rates, quantitative easing has once again become a hot topic, the dollar remains strong, and the judgment of emerging market bonds and foreign exchange is relatively accurate.

Sadness Big Moon, online turning point

Morgan Stanley believes that two major turns will take place in the macro-economy in 2019:

First, global economic growth is slowing, inflation is rising, and the G4 central bank will turn to tightening policy; 2019 is the decisive year for the transition from QE to QT, and the G3 (US, European and Japanese) central banks are expected to raise interest rates and shrink the table at the same time.

Second, global economic growth will begin to outperform the US, which will lead to a weaker dollar. Economic growth in the United States will slow in 2019, mainly due to reduced policy support for economic growth in the United States, as the labor market tightens, the impact of fiscal stimulus in the United States weakens, and the impact of the withdrawal of the monetary policy of leniency puts pressure on its economic growth momentum.

In terms of asset types, Morgan Stanley summed up the five major market turns: the dollar will fall after reaching an interim peak, the interest rate curve in Europe and the United States tends to converge, emerging market assets will outperform the market, US stocks and high-yield bonds underperform, and value stocks outperform growth stocks.

After reading the strategic analysis of Morgan Stanley, I felt sorry for him.With the exception of long gold, almost none of them is right.

2020: growth is still bleak, you and I are not in charge.

In fact, the level of analysts of major investment banks is very high, all famous school background + years of research experience, but most of the forecasts at the beginning of the year are still wrong, which can only show that accurate prediction of the future is a very unreliable thing.

After all, the investment strategy of securities firms is the judgment of professionals, but there are too many uncertain factors in policy, risk preference and capital.

Under the pain of hitting the face year after year, the styles of Daxing people are also different. Some are still confident in their forecasts and win the trust of a large number of investors (but if they are wrong, it will hurt to hit them in the face); others are proficient in a hundred kinds of fortune-telling skills of muddy water and slime, and can match the market no matter how they go, guaranteed to have no fault, but to no avail, and can only be spat by investors as "correct nonsense".

As an investor, it is necessary to read the brokerage analysis report, but it is not necessary to believe blindly. In this process, we should pay more attention to the logical rationality of the report, rather than just want to see, also see the conclusion, "buy it"!

It also confirms the importance of Buffett's investment philosophy.

Buffett has said that if you try to predict where the stock market will go tomorrow or next year, you have already lost half of it.

Buffett also said that the most important thing in life is not how much money you make, but to find a game that suits you, live a life that suits you, and find a good partner.

With such a normal mind, let's take a look at the big banks' forecasts for the new year 2020 at the end of 2019.

After all, "everything in advance is established, not in advance is waste", for us investors (leeks), this sense of ritual is still necessary.

Still optimistic group

Goldman Sachs Group's Seven viewpoints: global growth trend remains the same, looking for foreign exchange spreads in emerging markets

The Goldman Sachs Research newspaper analyzed its views on cross-asset transactions.Seven ideas and their investment strategies:

1. Global economic growth is stable.Keep long Treasuries flat, long emerging market stocks and hedge; long S & P Goldman Sachs Group GSCI total return index at 407; long cyclical stocks VS defensive stocks through GSXPFYDE index.

2. Quality is the first.The recent excellent performance of the BB index has gone a little too far, and the CDX investment grade performance is expected to be better in the future.

3. The Fed stands idly by.It is moderately optimistic about medium-term inflation in the US, but negative about inflation compensation in the euro zone.

4. Don't confront the ECB.

5. Great progress in Brexit.The Brexit process is expected to be closer to a settlement after the general election. This would not only reduce the long-term premium, but also allow yields to price potential fiscal expansion, leading to further decoupling of UK interest rates from euro rates.

6. Emerging market foreign exchange: seek spreads.Shorting the euro and long the Mexican peso offer a very attractive yield: a nominal annualised yield of about 8 per cent. Since we proposed this deal five months ago, spreads have so far accounted for more than half of the potential total return; on the basis of total returns, the rouble is one of our favorite bulls in emerging market foreign exchange markets; on the other hand, we recommend withdrawing money from the Canadian dollar, which is to some extent highly sensitive to risk sentiment and oil prices.

7. The central bank has not completely "relaxed".Goldman Sachs revised its view and expects the Bank of Thailand to cut interest rates by another 25 basis points in the first quarter of 2020, while the Bank of Korea is expected to cut another 25 basis points in 2020.

Morgan Stanley: China's economy will improve

Global economic growth will be boosted from the first quarter of 2020 as trade tensions slow and monetary policy relaxes. In addition,With US growth at the end of the cycle, emerging markets will drive a turnaround in the global economy.

Morgan Stanley wrote in the report:

Global economic growth has been declining for seven quarters, and global growth is likely to recover from the first quarter of 2020 as trade tensions and monetary policy ease and relax at the same time for the first time since the downtrend began.

For ChinaChina's economy will improve next year, with economic growth gradually rising to 6% in the first half of the year and 6.1% by the end of the year. The uncertainty of the Sino-US trade talks next year will be less than that of this year, which will help reduce the uncertainty of the business environment and help companies regain their confidence.

In addition to bank lending, local governments will also issue special bonds to inject liquidity into the market to meet investment demand, and broad credit growth is expected to remain at 11% to 11.5% in the next 12 months. Morgan Stanley predicted againThe exchange rate of the yuan will gradually stabilize, with the yuan rising 2.4% against the dollar by the end of next year to about 6.85 yuan to the dollar.

The MSCI China Index expects profit growth of 10% in the next two years, with a target price of 85 points respectively for next year.The target price of Shanghai and Shenzhen 300s next year is 4180 points.

Buddhist pessimism group

Blackrock: seek capital preservation first and then profit

Blackrock predicts that the weakening of overall economic fundamentals will drag down investment returns in 2020.In addition, the outlook for global growth, corporate profits and consumption has darkened.

The US presidential election will be held in November 2020, and the global trade situation has not yet eased, which has become the main source of uncertainty in global financial markets. therefore,The main direction of investment in the coming quarters is the protection of capital and income, with growth as a secondary objective.

Investment should focus on high-quality assets and actively strengthen the resilience of the investment portfolio.. At present, there are only a few ideal sources of income in the market. Asian credit bonds are expected to perform milder than expected in 2020 and continue to show attractiveness to global investors, which is beneficial to the prospects of the credit bond market. A focus on sustainability also helps to increase the resilience of portfolios by reducing exposure to environmental, social and governance (ESG).

Blackrock is now mainly worried that economic fundamentals will move in the market around 2020, monetary easing and other unexpected policy measures will be greatly reduced, and the lagging effect of easing policy will gradually be reflected in economic activity.

Interest rates in major regions of the world are already low or even negative.We question whether monetary policy can really stimulate economic growth.The peak period for companies to lower their profit forecasts may have passed, and the hope that corporate profitability will suddenly improve is itself a risk.

BoCom International Hongyi:The overall market opportunity is limited

Global economic cycle bottoming repair.2019 was indeed a year of twists and turns, contrary to the pessimism that prevailed at the end of 2018. Nevertheless, these are synchronized or lagging economic changes. After the sell-off in 2018, the market has rebounded significantly. As a result, the rise in market prices in 2019 is likely to reflect the current recovery of lagging economic variables. Unless the improvement in fundamentals is much better than expected in the future, the stock market will not rise significantly further.

China's super pig cycle worsens the short-term inflation outlook.Inflationary pressures are likely to soar until after the Spring Festival and limit monetary policy options in the short term. This embarrassment of monetary policy is likely to hinder the momentum and room for the stock market to rise in the short term. Unless external factors are introduced, such as large inflows of foreign liquidity, the Chinese stock market will remain a zero-sum game.

The overall market opportunity is limitedHowever, Shanghai and Shenzhen 300, A50, Shanghai 50, offshore Chinese stocks and other indices that can best reflect the "leading effect" should still provide investment opportunities.

The decline in global yields suggests that the long-term failure of cyclical stocks, small-cap stocks and emerging markets is not over, but some traders may try to profit from the recent oversold rebound. Us stocks may still have new highs, but long-term trends are more important than short-term fluctuations.

2020 there will be a big change group anyway.

JPMorgan Chase & Co: the big wheel will be2020The year is coming

JPMorgan Chase & Co said2020The year is likely to be a "big turn", that is, retail investors suddenly switch from bond funds to equity funds. The last time this happened was in 2013, when analysts said the "extremely cautious stance" of retail investors this year was confusing and a drag on the stock market.

More money has flowed into the bond market in years such as 2012 and 2017 (as it did in 2019), and inflows into the bond market will usually be weak in the following year. After the Fed cut interest rates, yields on cash and bonds were significantly lower than before, so this forecast is reasonable.

As for China, Zhu Haibin, chief economist of JPMorgan Chase & Co China, said:

There will be a bottom rebound in the first half of 2020, with a monthly growth rate of about 6%.

Cyclical factors come from the stabilization of investment in infrastructure and manufacturing industries. Although the growth rate of real estate investment will slow significantly, the sales share of the top 10 real estate companies will further increase in the future.

UBS: global economy squatting before jumping

With the easing of the trade war between the United States and China and the effectiveness of the monetary policies of central banksGlobal economic growth is expected to recover in the second half of 2020, and it needs to be "negative" in order to "Tailai".

The overall global economy has been declining since the world's two largest economies began a trade war in early 2018, but trade is not the only factor contributing to the slowdown, UBS said. It was also during that period that central banks began to withdraw some of their stimulus policies and began to actively shrink their global balance sheets.

With the end of 2019, central banks around the world have resumed printing money, expanding balance sheets and lowering interest rates, all of which will have a positive impact on the world economy.Increase global economic growth in 2020 from 2.4% to 2.6%.

For China, UBS recommends high-quality dividend-paying stocks and companies dominated by domestic demand and consumption because they are less affected by changes in trade and corporate spending; bond investment takes a "middle way" because yields on safe bonds are too low and credit risk on high-yield bonds continues to rise; commodities are bullish on precious metals relative to cyclical commodities.

The biggest attraction in the future is 5G, where China will lead the high-tech field and climb up the value chain.

Zhaoyin International: hit the water in mid-stream

Trade frictions, negative interest rate environment and China's economic growth target are the three clues to understand the global economic outlook in 2020.

First, since the beginning of this year, the negative impact of global trade frictions has rapidly spread to the upstream and downstream of the global industrial chain through China, the "factory of the world", and global manufacturing activities have shrunk. In next year's US election, the intensity of trade frictions may decline, or lead to a pick-up in global trade and manufacturing.

Second, the era of negative interest rates in the world's major economies is approaching, while China's interest rates are normal, China's asset attractiveness will increase significantly, and the scale of foreign capital inflows is expected to continue to expand to help the economy maintain external equilibrium.

Third, next year, China will build a moderately prosperous society in an all-round way as scheduled. There is no need to overemphasize the growth target of GDP, and more attention should be paid to the "quality" rather than "quantity" of economic growth.

In overseas markets, US debt interest rates or interval fluctuations, the hub at 1.6% Rue 1.8%, US stocks have periodic downside risks. The flexibility and resilience of RMB exchange rate are enhanced, and the USDCNY exchange rate fluctuates repeatedly around 7.0. there is a medium-term long opportunity for gold. Fixed collection market, interest rate center downward, rhythm or twists and turns, it is recommended to allocate every high yield; urban investment bonds are relatively safe, industrial bonds are carefully selected, and pay attention to the tail risk of real estate debt. In the equity market, the A-share center is expected to rise in 2020, and the index is likely to run in the range of 2700-3500.

Summary of S & P 500 forecasts

Finally, the target prices for the S & P 500 index for 2020 are presented for your reference.

Part of the content is compiled by Fu Tu Information, integrated wind information, investment bank research report, network information and so on.

Reference article:

Goldman Sachs Group: seven ideas and Strategies of Global transactions in 2020

BoCom International Hongyi: BoCom International released Investment Prospect for 2020

"Macroeconomic and Capital Market Prospect of China Bank International in 2020: mid-stream attack"

Blackrock's Investment Outlook in 2020: us stocks stand aside, Japanese and emerging Market Stock Markets welcome opportunities

"how many predictions have been realized by investment banks in early 2019? "

"dazzled! Distracted! Read the 2020 outlook report of the investment bank in one breath.

Edit / Sylvie, Iris

Choose the rich way cash treasure, the investment threshold is low, the income is endless all the year round, effectively enhance the income level of idle funds, one-second redemption helps investors to seize the market opportunity. Click the link below to invest in Futu Cash Bao: https://www.futu5.com/cashpromotion?channel=486&subchannel=17