Fresh Del Monte Produce Inc. (NYSE:FDP) shares have had a really impressive month, gaining 27% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.3% in the last twelve months.

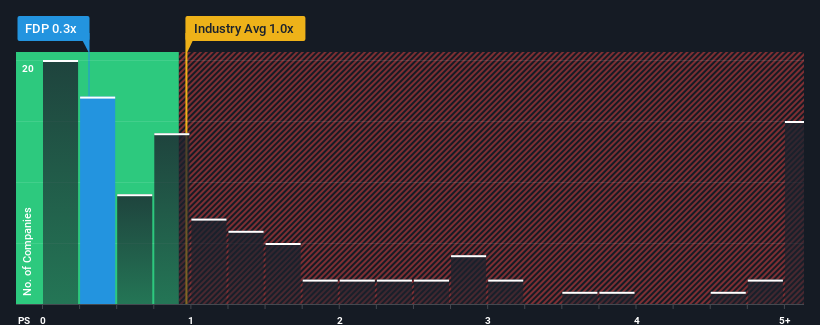

Although its price has surged higher, Fresh Del Monte Produce may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Food industry in the United States have P/S ratios greater than 1x and even P/S higher than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Fresh Del Monte Produce's Recent Performance Look Like?

Fresh Del Monte Produce could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Fresh Del Monte Produce's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Fresh Del Monte Produce?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Fresh Del Monte Produce's to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Fresh Del Monte Produce's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.3%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 4.5% during the coming year according to the one analyst following the company. With the industry predicted to deliver 3.0% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Fresh Del Monte Produce's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Fresh Del Monte Produce's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Fresh Del Monte Produce currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Fresh Del Monte Produce you should be aware of.

If you're unsure about the strength of Fresh Del Monte Produce's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com