① China Resources 39 spent 6.2 billion yuan to acquire 28% of Tianshili's shares and became a shareholder of Tianshili Holdings. ② This transaction will help China Resources 39 accelerate and supplement innovative Chinese medicine pipelines, enhance innovative drug research and development capabilities, establish a leading advantage in the field of traditional Chinese medicine, help the two sides to develop synergies in the traditional Chinese medicine industry chain, and empower each other in the fields of Chinese herbal medicine cultivation, innovative R&D, intelligent manufacturing, and channel marketing.

In the face of thousands of announcements from listed companies every day, what should I read? Announcements of important matters are often tens of pages or hundreds of pages, what is the point? I don't know if a bunch of jargon in the announcement is good or bad? Please take a look at the “Speed Reading Notice” section of the press department of the Financial Association. Our national reporters will bring you an accurate, fast, and professional interpretation on the night of the announcement.

Finance Association, August 4 (Reporter Zhang Liangde) The mystery that the market has been looking forward to for many days since Tianshili (600535.SH) announced plans to restructure and suspend trading last Thursday was finally revealed today. Today, China Resources 39 (000999.SZ) and Tianshili announced at the same time that China Resources 39 will spend 6.2 billion yuan to acquire a controlling interest in Tianshili and include Tianshi Li, one of the leading innovative Chinese medicine companies, into the map.

Many industry insiders believe that China Resources 39 and Tianshili are highly complementary. After successfully completing the merger and acquisition of Tianshili, China Resources 39's strength in the field of innovative traditional Chinese medicine and cardiovascular and cerebrovascular traditional Chinese medicine was significantly enhanced; for Tianshi, China Resources 39, which added a state-owned background, also had the effect of “1+1 is greater than 2” in expanding product sales channels and participating in national negotiations.

Many industry insiders believe that China Resources 39 and Tianshili are highly complementary. After successfully completing the merger and acquisition of Tianshili, China Resources 39's strength in the field of innovative traditional Chinese medicine and cardiovascular and cerebrovascular traditional Chinese medicine was significantly enhanced; for Tianshi, China Resources 39, which added a state-owned background, also had the effect of “1+1 is greater than 2” in expanding product sales channels and participating in national negotiations.

China Resources acquires Tianshili for 6.2 billion yuan in 39

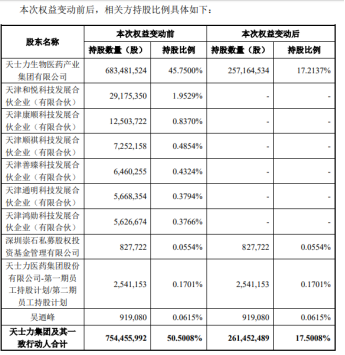

According to the announcement, Tianshili Group, the controlling shareholder of the company, and its co-actors intend to transfer 28% of the company's shares to China Resources 39 at a total transfer price of 14.85 yuan/share, with a total transfer price of about 6.212 billion yuan. The controlling shareholders of the company will be changed to China Resources 39. The actual controllers will be changed from Yan Kaijing, Yan Xijun, Wu Naifeng, and Li Weihui to China Huarun. Trading of the company's shares will resume on Monday.

The transfer price is 14.85 yuan, which is only a 5.26% premium compared to the closing price of 14.08 yuan/share the day before the company suspended trading. Since the share ratio transferred by China Resources 39 did not reach 30% this time, the tender offer was not involved.

Prior to this change in equity, the number of shares held by the company was about 0.683 billion shares, accounting for 45.7500% of the total share capital. The nine concerted actors held a total of 70.9745 million shares of the company, accounting for 4.7508% of the company's total share capital.

This change in the actual control of Tianshili has caused heated discussions in the pharmaceutical industry and capital market. Shen Yong, chairman of the China Medical Health Development Promotion Expert Committee and chairman of Beijing Shengshi Kanglai Traditional Chinese Medicine Marketing Planning Company, told the Financial Federation reporter, “With recent changes in pharmaceutical policies, pharmaceutical companies with state-owned backgrounds have certain advantages in various policy entry declarations, as well as in communicating and negotiating drug promotion with hospitals and pharmacies. The Tianshili Group has been developing for more than 30 years, and the second generation has successfully taken over. For the long-term development of the company and in order to improve competitiveness, joining China Resources 39 can achieve the effect of '1+1 is greater than 2'.”

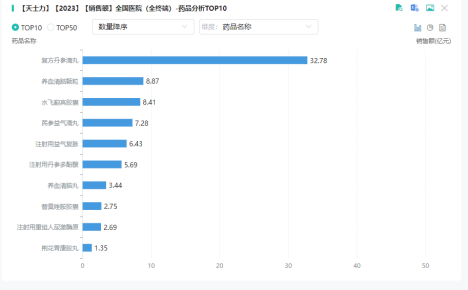

Tasly's 2023 retail sales data for hospitals and pharmacies nationwide (Image source: Yao Rongyun)

As one of the leading innovative Chinese medicine companies, Tasly spent 1.315 billion yuan on R&D in 2023, and R&D investment accounted for 17.73% of the pharmaceutical industry's revenue in 2023, far higher than the 0.935 billion yuan of Eling Pharmaceutical (002603.SZ) and 0.772 billion yuan of Kangyuan Pharmaceutical (600557.SH). By the end of 2023, there were 98 products under development, including 25 modern traditional Chinese medicine products, including 18 Class 1 innovative drugs.

China Resources 39 said that this transaction will help China Resources 39 accelerate complementary innovative Chinese medicine pipelines, continue to deepen the traditional Chinese medicine development system, improve innovative drug research and development capabilities, and establish a leading advantage in the field of traditional Chinese medicine; it will help China Resources 39 consolidate its leading position in the industry, enhance its core competitiveness, and strengthen the traditional Chinese medicine industry chain by fully integrating the resources of both parties, give full play to the collaborative value of R&D, and enhance innovation and development capabilities.

多位业内人士认为,华润三九与天士力互补性较强,在成功完成对天士力的并购之后,华润三九在中药创新药及心脑血管中药领域的实力得到了显著增强;对天士力来说,加入国资背景的华润三九,对于拓展产品销售渠道、参与国谈等也有“1+1大于2”的效果。

多位业内人士认为,华润三九与天士力互补性较强,在成功完成对天士力的并购之后,华润三九在中药创新药及心脑血管中药领域的实力得到了显著增强;对天士力来说,加入国资背景的华润三九,对于拓展产品销售渠道、参与国谈等也有“1+1大于2”的效果。