① The London market is gradually losing its historic dominance over where global mining companies are listed; ② Currently, London not only has setbacks in chasing the listing of high-growth technology companies, but it may also lose its advantage in the global mining industry; ③ analysts say that if the London Stock Exchange cannot maintain large mining groups, then it may be “marginalized” by the industry.

Financial Services Association, August 1 (Editor Zhou Ziyi) As a listing location for global mining companies, London now lags far behind the New York, Toronto, and Sydney exchanges. Investors warned that if several large mining groups switch overseas listings one after another, then the London Stock Exchange may be “marginalized” by the industry and withdrawn from this once dominant historical stage.

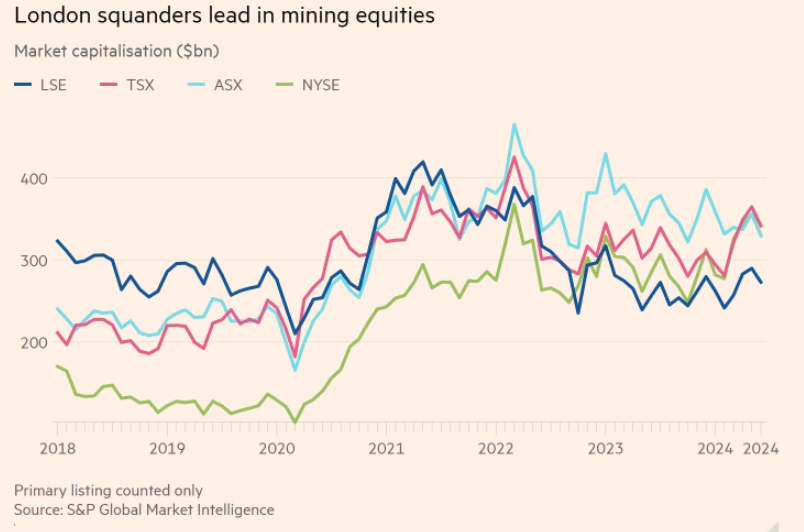

According to data compiled by S&P Global Market Intelligence (S&P Global Market Intelligence), the market value of mining stocks listed in London, England this year has shrunk from 322 billion US dollars in 2018 to 272 billion US dollars, while Australian, Canadian and US exchanges have surpassed it, and the mining stock market value of the latter three exchanges has all exceeded 325 billion US dollars.

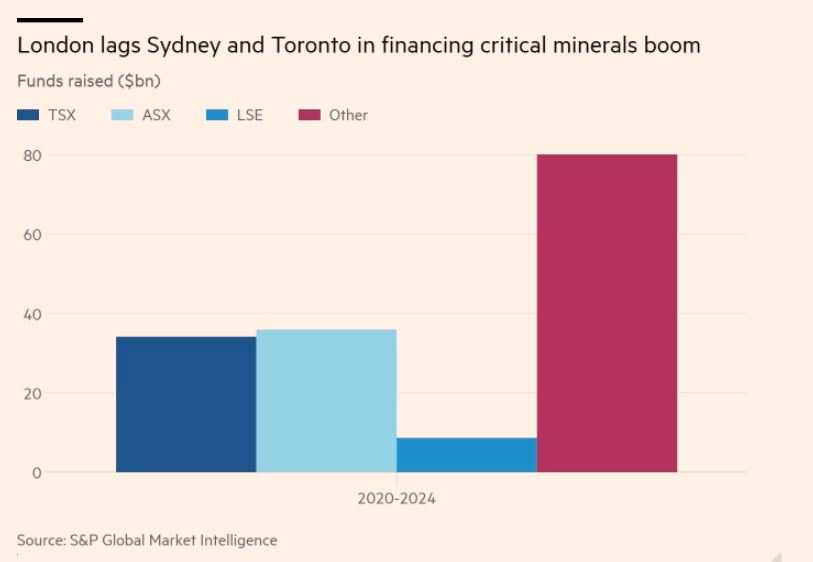

Judging from the funds raised by these mining stocks, London is also slightly behind. Since 2020, miners listed on the London Stock Exchange (LSE) have raised only $8 billion, less than a quarter of the capital raised in Sydney and Toronto, and the US is now the most attractive destination for large companies to go public.

Judging from the funds raised by these mining stocks, London is also slightly behind. Since 2020, miners listed on the London Stock Exchange (LSE) have raised only $8 billion, less than a quarter of the capital raised in Sydney and Toronto, and the US is now the most attractive destination for large companies to go public.

These data mean that not only is London currently experiencing setbacks in chasing the listing of high-growth technology companies, it may even lose its historical advantage in the global mineral resources industry.

Robert Crayford, portfolio manager at asset management company CQS, said that although the current market is focusing on the technology sector, it is also important for London that it cannot retreat further in the mining industry; otherwise, companies will shift to other centers, which will marginalize London.

Since the days of the British Empire, London has been a natural listing location for the global resources industry, as well as an innovation and support center for mining stocks and mining finance. Beginning in the late 19th century, London attracted large mining companies operating in regions such as South Africa and Australia, and then in the late 1960s, the London Stock Exchange contributed to another boom in Australian mining stocks.

The mining industry has also become increasingly important in recent years as it provides the key minerals for the clean energy transition. However, stronger liquidity and higher valuations in other markets are driving many companies to choose to move out of London, especially the US market.

Currently, 171 metals and mining companies are listed on the London Stock Exchange, accounting for 17% of the industry's global market capitalization. Most of the value is in a few large companies such as Glencore, Rio Tinto, and Anglo-American Resources Group, while the market capitalization of more companies is less than £0.1 billion.

London also suffered multiple blows in 2022, including: Russian gold producers were delisted from the London Stock Exchange after the Russia-Ukraine conflict broke out; BHP Billiton moved its main listing location to Australia when unifying its dual corporate structure; Rio Tinto was pressured by rights protection investors to follow BHP Billiton; Glencore is considering divesting its coal division to go public in New York; and Anglo-American Resources Group is selling assets after being close to being acquired by BHP Billiton.

Hayden Bairstow, a Perth-based analyst at financial consulting firm Argonaut, said that losing Anglo-American Resources Group or Glencore is a huge risk for the London market.

从这些矿业股筹集的资金来看,伦敦方面也稍显落后。自2020年以来,在伦敦证交所(LSE)上市的矿商仅筹集了80亿美元,不及在悉尼和多伦多筹集资金的四分之一,美国现在更是成为了大型企业上市的最有吸引力的目的地。

从这些矿业股筹集的资金来看,伦敦方面也稍显落后。自2020年以来,在伦敦证交所(LSE)上市的矿商仅筹集了80亿美元,不及在悉尼和多伦多筹集资金的四分之一,美国现在更是成为了大型企业上市的最有吸引力的目的地。