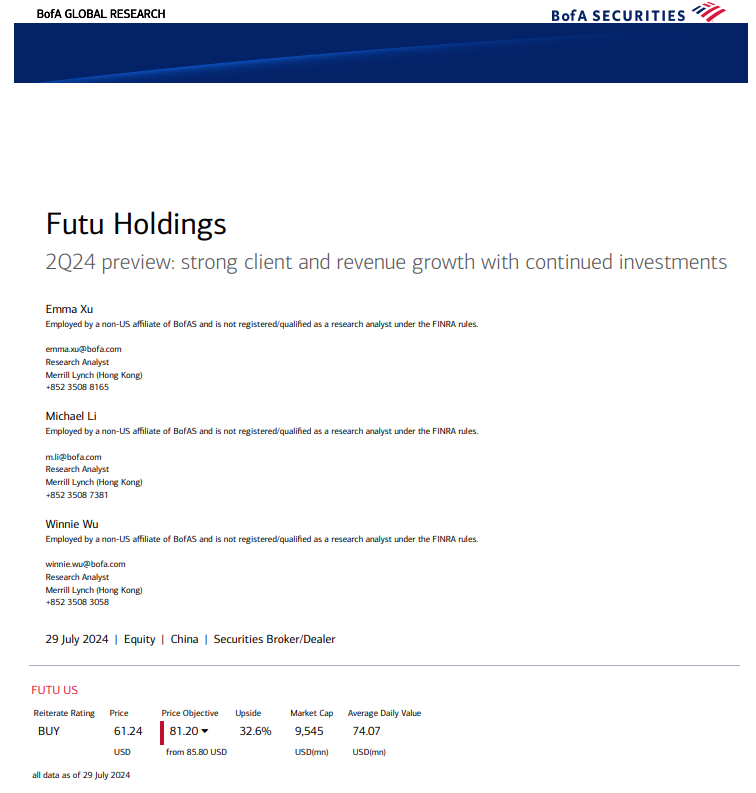

Bank of America reiterates Buy on Futu for its diversified market exposure, robust client and AUM growth, as well as encouraging developments in overseas markets and new products, while trimming the target price by 5% from USD85.80 to USD81.20.

Futu is expected to report 2Q24 results in late-August. BofA expects continued strong new paying clients in 2Q24, driven by robust client acquisition across major markets.

BofA pointed out the key things to watch in 2Q earnings :

1) Client/AUM growth: Will their strong growth momentum continue into 3Q?

1) Client/AUM growth: Will their strong growth momentum continue into 3Q?

2) Operational updates: Have the weaknesses of the HK market and China ADRs and the pullback in NASDAQ/Magnificent 7 stocks led to less active trading?

3) Airstar Bank: on June 7, Futu announced that it had completed a HKD440mn investment in Airstar Bank, a HK licensed virtual bank, to become the second largest beneficial owner holding indirectly 44.11% of the Bank. The plan and progress post the investment will be a focus.

Upside risks are better-than-expected capital market conditions, lower-than-expected competition and faster-than-expected client growth.

Downside risks are stricter-than-expected regulations, large US/HK market correction and intensified competition.