Investors with a lot of money to spend have taken a bullish stance on Merck & Co (NYSE:MRK).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MRK, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 10 options trades for Merck & Co.

This isn't normal.

The overall sentiment of these big-money traders is split between 70% bullish and 20%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $93,721, and 9, calls, for a total amount of $344,552.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $105.0 to $130.0 for Merck & Co over the last 3 months.

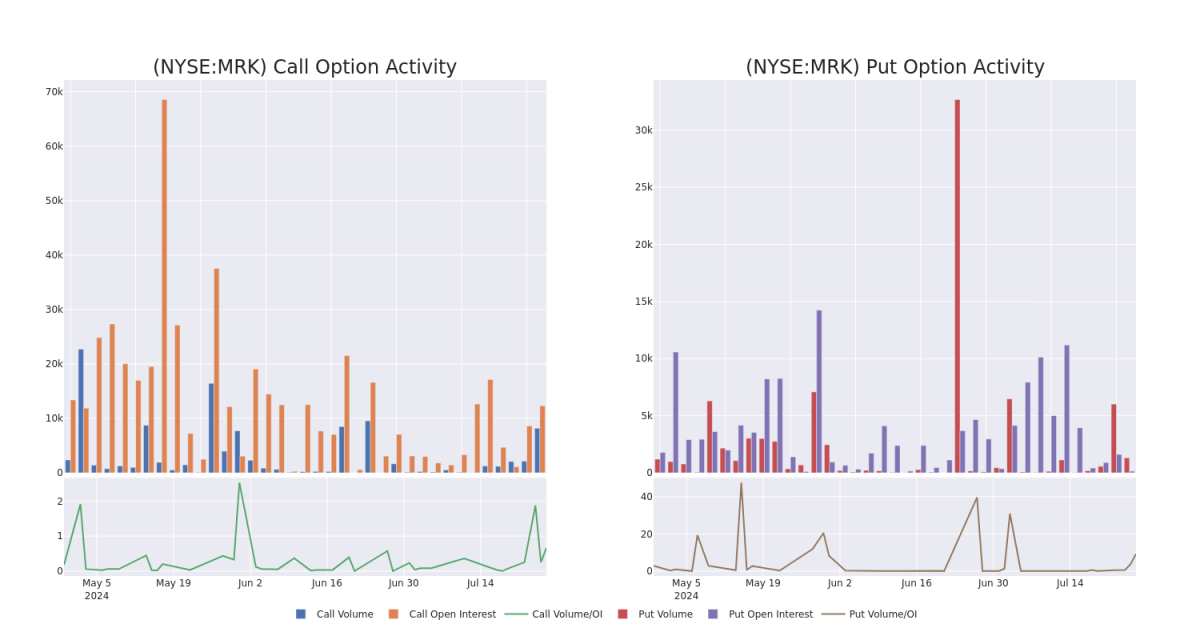

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Merck & Co's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Merck & Co's substantial trades, within a strike price spectrum from $105.0 to $130.0 over the preceding 30 days.

Merck & Co Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRK | PUT | SWEEP | BULLISH | 08/02/24 | $0.93 | $0.8 | $0.8 | $120.00 | $93.7K | 142 | 1.3K |

| MRK | CALL | SWEEP | BEARISH | 08/02/24 | $1.6 | $1.38 | $1.45 | $130.00 | $72.6K | 1.7K | 1.5K |

| MRK | CALL | SWEEP | BULLISH | 08/16/24 | $2.7 | $2.16 | $2.7 | $130.00 | $54.0K | 5.1K | 200 |

| MRK | CALL | SWEEP | BULLISH | 08/02/24 | $1.48 | $1.42 | $1.48 | $130.00 | $37.9K | 1.7K | 2.1K |

| MRK | CALL | SWEEP | BEARISH | 08/02/24 | $2.12 | $2.02 | $2.02 | $128.00 | $36.3K | 3.0K | 1.1K |

About Merck & Co

Merck makes pharmaceutical products to treat several conditions in a number of therapeutic areas, including cardiometabolic disease, cancer, and infections. Within cancer, the firm's immuno-oncology platform is growing as a major contributor to overall sales. The company also has a substantial vaccine business, with treatments to prevent pediatric diseases as well as human papillomavirus, or HPV. Additionally, Merck sells animal health-related drugs. From a geographical perspective, just under half of the company's sales are generated in the United States.

Having examined the options trading patterns of Merck & Co, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Merck & Co

- With a trading volume of 3,124,311, the price of MRK is up by 0.09%, reaching $125.96.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 4 days from now.

What Analysts Are Saying About Merck & Co

1 market experts have recently issued ratings for this stock, with a consensus target price of $134.0.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Merck & Co, which currently sits at a price target of $134.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Merck & Co options trades with real-time alerts from Benzinga Pro.