Whales with a lot of money to spend have taken a noticeably bearish stance on Texas Instruments.

Looking at options history for Texas Instruments (NASDAQ:TXN) we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $309,043 and 5, calls, for a total amount of $583,472.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $195.0 to $210.0 for Texas Instruments over the recent three months.

Insights into Volume & Open Interest

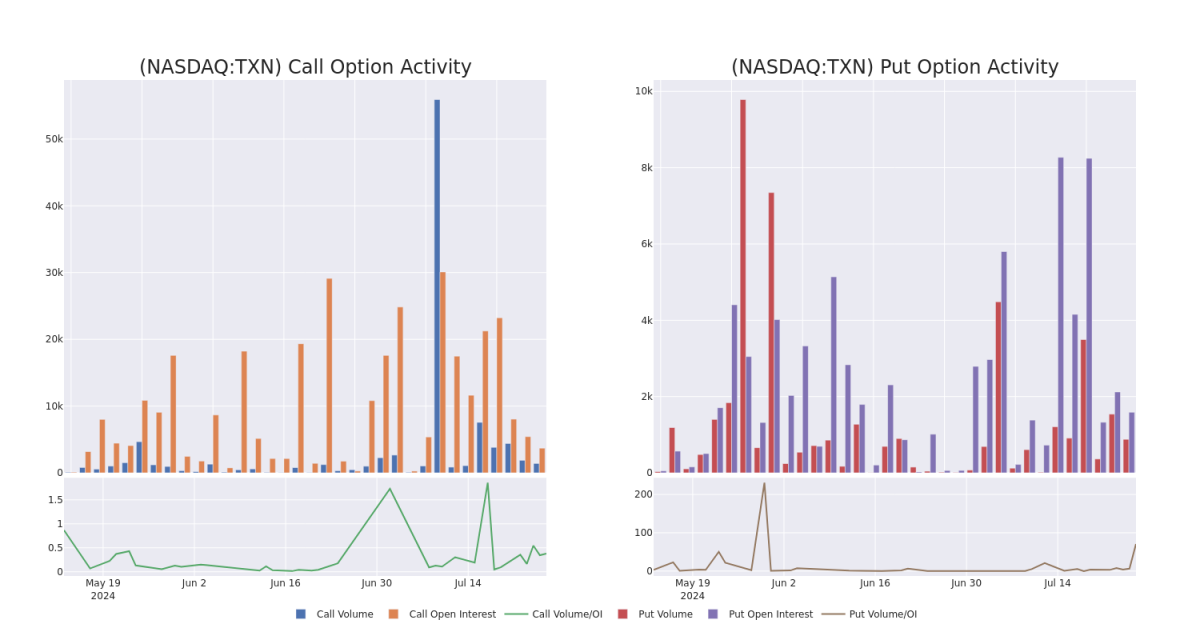

In today's trading context, the average open interest for options of Texas Instruments stands at 586.22, with a total volume reaching 2,282.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Texas Instruments, situated within the strike price corridor from $195.0 to $210.0, throughout the last 30 days.

Texas Instruments Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | CALL | TRADE | BEARISH | 10/18/24 | $6.6 | $6.45 | $6.5 | $210.00 | $455.0K | 2.0K | 700 |

| TXN | PUT | SWEEP | BEARISH | 08/30/24 | $6.45 | $6.4 | $6.4 | $200.00 | $76.8K | 20 | 126 |

| TXN | PUT | SWEEP | BEARISH | 08/09/24 | $4.75 | $4.7 | $4.7 | $202.50 | $52.1K | 2 | 113 |

| TXN | PUT | SWEEP | BEARISH | 09/20/24 | $5.6 | $5.45 | $5.6 | $195.00 | $45.3K | 1.4K | 106 |

| TXN | PUT | SWEEP | NEUTRAL | 08/02/24 | $3.85 | $3.75 | $3.75 | $202.50 | $37.3K | 71 | 201 |

About Texas Instruments

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world's largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

Current Position of Texas Instruments

- Currently trading with a volume of 3,109,633, the TXN's price is up by 1.61%, now at $200.33.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 88 days.

What The Experts Say On Texas Instruments

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $198.8.

- An analyst from Baird has decided to maintain their Neutral rating on Texas Instruments, which currently sits at a price target of $200.

- An analyst from Deutsche Bank persists with their Hold rating on Texas Instruments, maintaining a target price of $185.

- Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for Texas Instruments, targeting a price of $250.

- An analyst from Morgan Stanley has decided to maintain their Underweight rating on Texas Instruments, which currently sits at a price target of $156.

- An analyst from Truist Securities has decided to maintain their Hold rating on Texas Instruments, which currently sits at a price target of $203.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Texas Instruments with Benzinga Pro for real-time alerts.