Financial giants have made a conspicuous bearish move on Roku. Our analysis of options history for Roku (NASDAQ:ROKU) revealed 17 unusual trades.

Delving into the details, we found 35% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 14 were puts, with a value of $622,545, and 3 were calls, valued at $194,560.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $65.0 for Roku over the last 3 months.

Insights into Volume & Open Interest

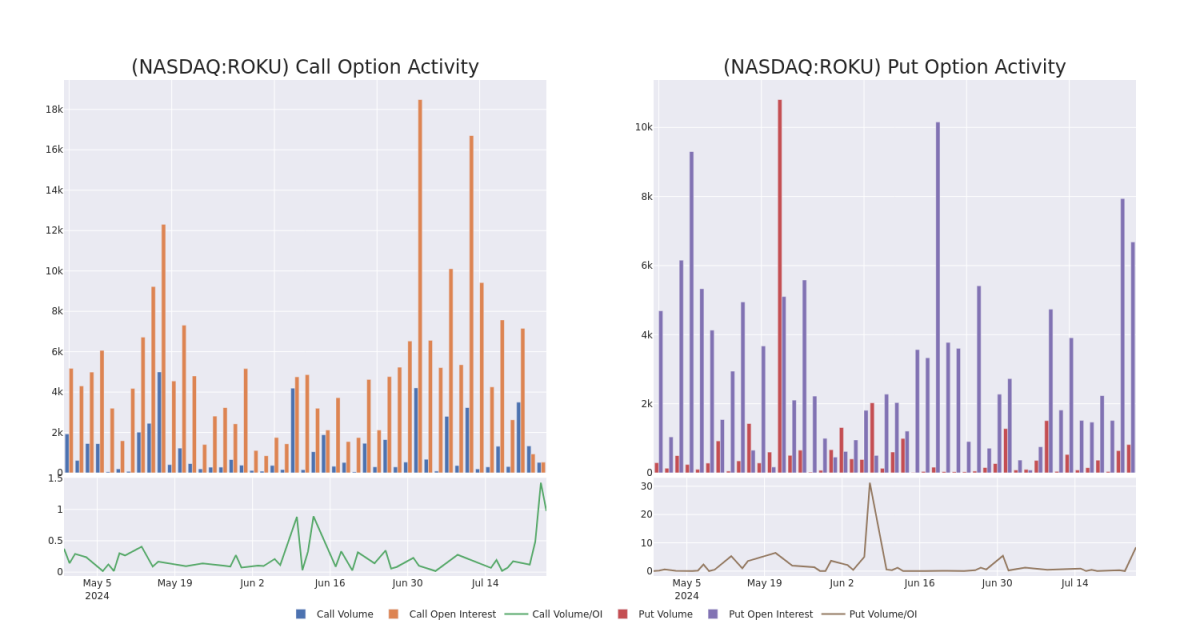

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Roku's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Roku's significant trades, within a strike price range of $50.0 to $65.0, over the past month.

Roku Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROKU | CALL | SWEEP | BEARISH | 08/09/24 | $6.0 | $5.85 | $5.85 | $56.00 | $117.1K | 278 | 245 |

| ROKU | PUT | TRADE | NEUTRAL | 10/17/25 | $12.0 | $11.5 | $11.75 | $55.00 | $63.4K | 113 | 54 |

| ROKU | PUT | SWEEP | BULLISH | 10/17/25 | $12.3 | $11.65 | $11.65 | $55.00 | $62.9K | 113 | 162 |

| ROKU | PUT | SWEEP | BULLISH | 10/17/25 | $12.85 | $11.65 | $11.65 | $55.00 | $62.9K | 113 | 54 |

| ROKU | PUT | SWEEP | BEARISH | 06/20/25 | $10.25 | $10.1 | $10.15 | $55.00 | $54.8K | 97 | 108 |

About Roku

Roku enables consumers to stream television programming. It has more than 80 million streaming households and provided well over 100 billion streaming hours in 2023. Roku is the top streaming operating system in the US, reaching more than half of broadband households, according to the company. Roku's OS is built into streaming devices and televisions that Roku sells and on connected televisions from other manufacturers that license Roku's name and software. Roku also operates the Roku Channel, a free, ad-supported streaming television platform that offers a mix of on-demand and live television programming. Roku generates revenue primarily from selling devices, licensing, and advertising, and it receives fees from subscription streaming platforms that sell subscriptions through Roku.

In light of the recent options history for Roku, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Roku

- Currently trading with a volume of 2,176,141, the ROKU's price is up by 0.2%, now at $55.7.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 7 days.

Expert Opinions on Roku

3 market experts have recently issued ratings for this stock, with a consensus target price of $85.0.

- In a cautious move, an analyst from Wedbush downgraded its rating to Outperform, setting a price target of $75.

- An analyst from Benchmark downgraded its action to Buy with a price target of $105.

- Reflecting concerns, an analyst from Wedbush lowers its rating to Outperform with a new price target of $75.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Roku with Benzinga Pro for real-time alerts.