Pinduoduo's "ten billion subsidy" has always been the focus of market debate. Before we evaluate subsidy behavior, we need to ask a question:

What is the nature of subsidies?

We thought"subsidy" is essentially the input of resources.

If a large amount of money has been kept in the bank, then no matter how much money is good for the company itself, and if you put this large amount of money into the company, it can greatly accelerate the expansion of your own business.

The benefits of subsidies are obvious. However, subsidies are not omnipotent. In fact, the results of subsidies are very different.

1. The triple realm of subsidy

1.1 the business model does not run well.

Many entrepreneurial projects are based on pseudo-demand, and the company's business model does not work. In this case, subsidies can only bring temporary growth and false prosperity.Once subsidies are stopped, the demand for subsidies will fade quickly, and the company's bad business model will be revealed.

Jiedaibao is a typical case.Loan Baoding is located in the loan of acquaintances. Through the connection mechanism between people on the Internet, acquaintances can have transactions directly, which can effectively reduce or even eliminate information asymmetry. At the same time, reputation constraints and credit punishment mechanisms among acquaintances can effectively reduce the risk of default.

The company has a strong shareholder background and is a famous Jiuding investment. The whole financing process is very smooth, according to news reports: the first round of 2 billion yuan in August 2015, the second round of financing of 2.5 billion yuan in January 2016, with a valuation of 50 billion.

In June 2015, "Daibao" was officially launched, and immediately began to vigorously subsidize the promotion of Daibao APP. According to the official rules of the event, "if A successfully invites 100 new users, you will get 2000 yuan." If each of these 100 new users invites another 100 users, A will get 100000 yuan. "at a time, the information of inviting friends to sign up for" loan treasure "spread widely among acquaintances.

The company has invested 6 billion subsidies to promote Daibao, established a huge push channel to promote Daibao APP, downloading a total of more than 100m users. According to this estimate, the per capita cost of getting passengers is about 50 multiple.

However, it turns out that the Laibao model doesn't work: borrowing is a low-frequency demand, and people are willing to download Laibao APP to get subsidies, but most people don't really use it. The huge subsidies invested by the company have not been exchanged for many truly active users.

1.2 the barrier of the leader is too high to break.

In some industries, although the business model is established, the barriers of the leaders are so high that it is difficult for newcomers to break through with subsidies.In this industry, the head effect is often very significant. The industry leader can make a lot of money, while the followers can only make a meagre profit. If the result of the subsidy can only be second-and third-rate players at most, then the long-term value of the subsidy is not high.

Typical cases such as "come and go" attacked Wechat in that year.The Wechat Initiative was launched on January 21, 2011. By June 2011, Wechat had added 200000 users a day, and its biggest competitor, Mi Xiao, had little chance of winning. By the end of 2011, Wechat's victory was clear. By February 25, 2012, Wechat had more than 100m registered users and its status was unshakable.

Although Wechat is dominant, the Internet giants are still one after another, such as XIAOMI's rice chat, NetEase, Inc's easy letter, the 360th message and the grand kiki. In particular, BABA, the boss of the e-commerce industry, launched Communication, known as ALL IN, in September 2013. it is said that all BABA employees must invite 100 people to download the APP by the end of the year, or else the year-end bonus will be cancelled. Jack Ma also personally carried some stars for the "come and go" platform.

However, Wechat's network effect is so strong that "communication" can not shake Wechat's position in the social field of acquaintances. Half a year later, "intercourse" stepped down sadly and ended in failure. After that, the nail made by the "back and forth" team is another matter.

There is a similar situation in the operating system, database and other key links of the software industry, the barriers of the leaders are too high, and the latecomers simply rely on subsidies to shake the monopoly position of the leaders.

1.3 the rush of the leader

If a business model is long-term strong and established, then when others do not understand, the company continues to increase investment, widen the gap with its competitors, and widen its own moat. In the long run, when the company becomes the absolute leader, it will naturally be able to get rich returns.

In the face of uncertainty in innovative business models, it is very difficult to continue to invest in expanding the moat, testing leaders' business foresight and ability to stick to long-term value. So far, the one who has done the best is Amazon.Com Inc's Bezos.

In Bezos's letter to shareholders in 1997, Bezos wrote:

Based on our focus on long-term goals, many of the decisions we make and the ways we measure our gains and losses are different from those of other companies. We will make more sustained long-term investment decisions for the goal of "strengthening long-term market leadership" rather than focusing on short-term profits and Wall Street's reaction. We will not hesitate to invest in opportunities that will help improve our market leadership.

In the process, it may cost us some loss, but we will learn something valuable from each case. If we are asked to choose between optimizing GAAP reports and maximizing future cash flow, we will not hesitate to choose the latter.

Amazon.Com Inc's e-commerce business and cloud computing business are groundbreaking and are facing great uncertainty. Bezos not only saw their strong business model early on, but also insisted on increasing investment in the long run and widening the gap between them and their competitors. Judging from the financial data, Amazon.Com Inc did not begin to make a profit until 2002 and continued to make a small profit. Behind this is Amazon.Com Inc using disguised subsidies (increasing the allocation of resources) to build his moat.

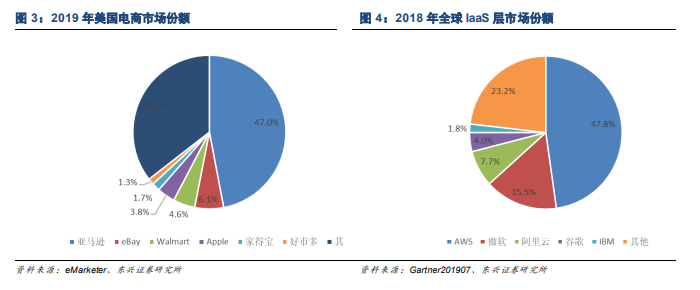

As a result, Amazon.Com Inc's e-commerce business and cloud computing business (AWS) are far ahead. According to eMarketer, Amazon.Com Inc's e-commerce business has a 47% market share in the United States in 2019, far surpassing eBay, which ranks second. In terms of cloud computing business, Amazon.Com Inc's AWS in 2018 has a global market share of 47.8% in the IaaS layer, significantly ahead of Microsoft Corp, who ranks second.

two。 Business models are crucial.

Through the above three cases, we can see that in order for subsidies to work, the following conditions must be met:

1. The business model itself is established for a long time; entrepreneurial projects under all kinds of pseudo-demand have no commercial value at all, let alone the value of subsidies.

2. The business model itself has high barriers; only the business model with high barriers has the significance of subsidies, otherwise the long-term value of subsidies is not great.

3. Subsidies should be able to make the company a leader; subsidies that simply follow the leader often fail.

In retrospect, what should we think of Pinduoduo subsidies?

2.1 platform e-commerce is a powerful business model

The business model of Pinduoduo is platform e-commerce, which is fully established and has very high barriers.We can say that Pinduoduo may not be able to make it, but we must admit that there is an essential difference between its business model and that which is not established at all.

Taobao Tmall has verified the feasibility and high barriers of this business model. As of fiscal year 2019, BABA's annual active consumers of China's retail platform reached 650 million, GMV reached 5.7 trillion, and BABA's core e-commerce EBITA profit margin was as high as 69.3%. Such a high EBITA profit margin fully proves the high barriers of the platform e-commerce model.

2.2 Pinduoduo's differentiation strategy defines a new e-commerce track.

If Pinduoduo is also doing platform e-commerce, then a crucial question is: is the business model of Puduo the same as Tmall on Taobao?

If the answer is the same, Pinduoduo wants to copy a Taobao Tmall, then no matter how much the subsidy is, it is likely to fail. However, if Pinduoduo makes a different e-commerce platform that can create new value for users, then its probability of winning will be greatly increased.

From the point of view of many, fast, good and provincial, users have different feelings about BABA, JD.com and Pinduoduo: Taobao Tmall's advantage is more and good; JD.com 's advantage is fast and good; Pinduoduo's advantage is province.

In my opinion, this is because Pinduoduo has adopted a differentiated development strategy and redefined an e-commerce track: putting customer needs first.Provide the most cost-effective goods.In the way of implementation, through the direct connection between the user and the factory, a large amount of traffic will be collected into limited goods to create a popular style to achieve "small profits and quick turnover".

If Pinduoduo adopts a differentiated development strategy, then the investment of huge subsidies is actually accelerating the development of the company and improving its long-term competitiveness. We agree that Pinduoduo should provide subsidies at the current stage.

Recently, the thunderstorm of Taoji can be seen that Pinduoduo's track already has a moat, which can not be caught up by any startup company. The thunderstorm of Taoji is also due to the rapid development of Pinduo, which leads to the healthy development of the business model of similar companies.

2.3 "10 billion subsidy" is in line with Pinduoduo's direction of marching into the middle and high-end market.

At present, Pinduoduo already has a large number of users, but the per capita consumption is still very low.As of 2019Q3, Pinduoduo's annual active buyers have reached 536 million, and APP has risen to 430 million. However, the per capita consumption of each active buyer is only 1567 yuan, which is only 6 yuan per person of Tmall's on Taobao.

The "10 billion subsidy" will accelerate Pinduoduo's entry into the middle and high-end market, which is of great value at the present stage.Through the "10 billion subsidy", we can change Pinduoduo's impression of "low price and low quality" in the minds of users, make consumers dare to buy goods with higher unit prices in Pinduoduo, and attract middle and high-end users to use Pinduoduo; in turn, drive the purchase of more brand goods, enhance Pinduoduo's attractiveness in brand merchants, thus forming a virtuous circle.

Of course, in the long run, the "ten billion subsidy" can weaken Pinduoduo's deficiency in brand merchants.However, relying solely on subsidies is difficult to break Tmall's absolute advantage in the brand merchant market, and Pinduoduo's upgrading path in the future needs other ways to achieve.

In short, under the premise that the business model of Pinduoduo is feasible and powerful, Pinduoduo defines a new e-commerce track, and the investment of huge subsidies will accelerate the company's business development and improve its long-term competitiveness. We believe that the "ten billion subsidy" is of great value at the present stage, and this kind of subsidy is recognized. And in this process, Pinduoduo's operating cash flow is positive, and the book cash exceeds 40 billion yuan, which is enough to support the continuation of Pinduoduo's subsidy behavior.

We are still optimistic about the long-term development of Pinduoduo, forecasting that revenue will reach 34 billion in 2019, 55.5 billion in 2020 and 76.6 billion in 2021, up 159 per cent, 63 per cent and 38 per cent respectively over the same period last year. It is considered that we can refer to the valuation of the price-to-sales ratio adopted by SaaS and give the 18-month target price of $67 according to 10 times PS at the end of 2020. Maintain the "highly recommended" rating.

3. Risk hint

The risk that Pinduoduo's product upgrade is less than expected; the risk that competition intensifies far more than expected; and the risk that supply chain transformation is not as expected.

Edit / Sylvie