When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. Long term Teva Pharmaceutical Industries Limited (NYSE:TEVA) shareholders would be well aware of this, since the stock is up 117% in five years. It's also good to see the share price up 26% over the last quarter. But this could be related to the strong market, which is up 13% in the last three months.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Teva Pharmaceutical Industries isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Teva Pharmaceutical Industries saw its revenue shrink by 2.5% per year. Given that scenario, we wouldn't have expected the share price to rise 17% per year, but that's what it did. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, this situation makes us a little wary of the stock.

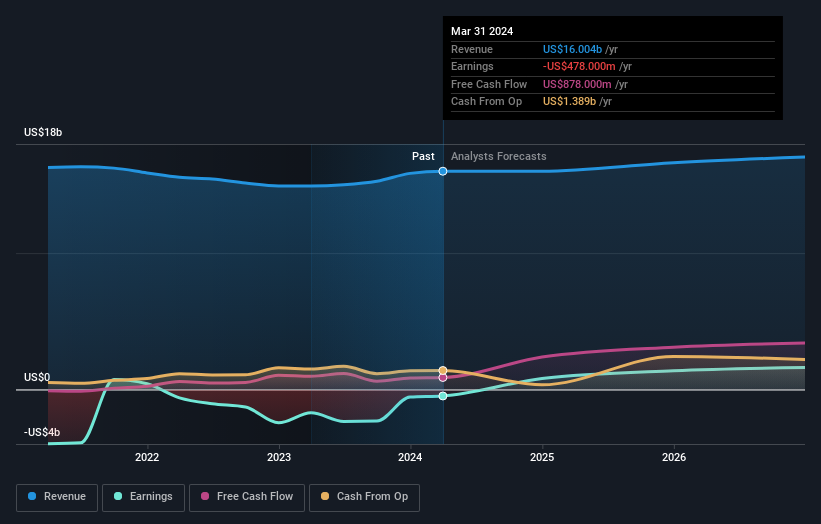

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Teva Pharmaceutical Industries is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

It's nice to see that Teva Pharmaceutical Industries shareholders have received a total shareholder return of 105% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 17% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com