Financial giants have made a conspicuous bullish move on Vistra. Our analysis of options history for Vistra (NYSE:VST) revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $60,260, and 6 were calls, valued at $598,581.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $75.0 to $100.0 for Vistra over the last 3 months.

Volume & Open Interest Trends

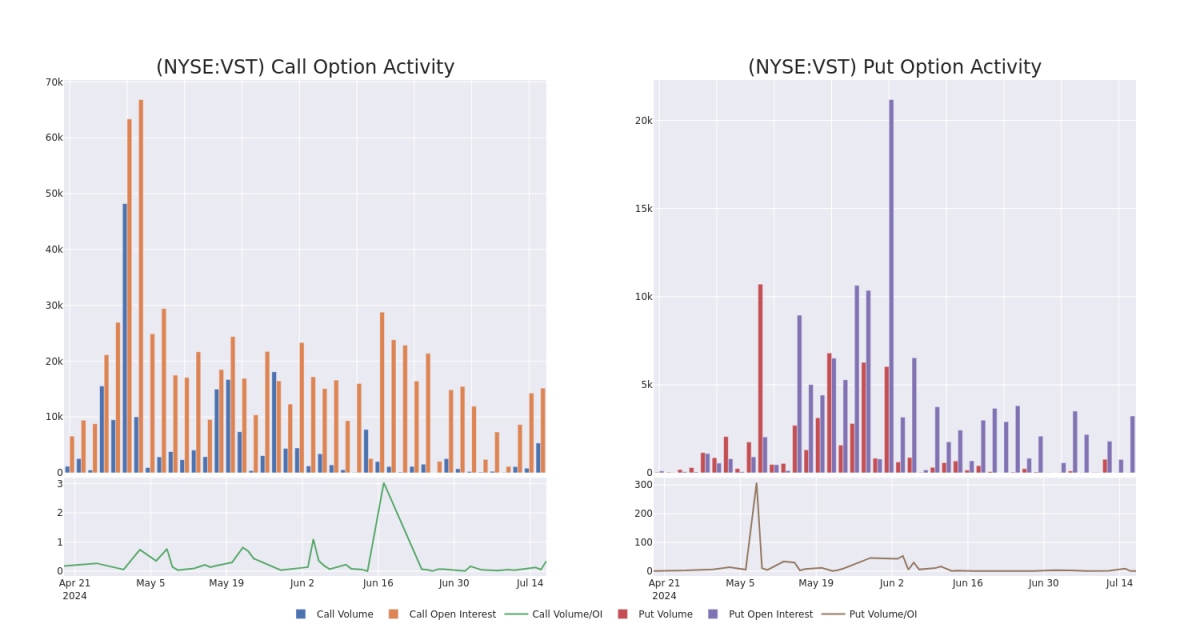

In today's trading context, the average open interest for options of Vistra stands at 3678.2, with a total volume reaching 5,345.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Vistra, situated within the strike price corridor from $75.0 to $100.0, throughout the last 30 days.

Vistra Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | CALL | SWEEP | NEUTRAL | 08/16/24 | $2.05 | $1.65 | $1.87 | $95.00 | $177.4K | 4.2K | 14 |

| VST | CALL | SWEEP | BULLISH | 08/16/24 | $1.15 | $1.05 | $1.15 | $100.00 | $162.7K | 10.9K | 714 |

| VST | CALL | SWEEP | BULLISH | 08/16/24 | $1.25 | $1.1 | $1.25 | $100.00 | $97.5K | 10.9K | 2.3K |

| VST | CALL | SWEEP | NEUTRAL | 08/30/24 | $7.3 | $6.9 | $7.3 | $81.00 | $73.0K | 1 | 0 |

| VST | CALL | SWEEP | BULLISH | 08/16/24 | $1.1 | $1.0 | $1.05 | $100.00 | $61.5K | 10.9K | 128 |

About Vistra

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

Having examined the options trading patterns of Vistra, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Vistra

- With a trading volume of 52,028, the price of VST is down by -3.59%, reaching $82.79.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 22 days from now.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.