Investors with a lot of money to spend have taken a bullish stance on MercadoLibre (NASDAQ:MELI).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MELI, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 17 uncommon options trades for MercadoLibre.

This isn't normal.

The overall sentiment of these big-money traders is split between 35% bullish and 17%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $210,384, and 13 are calls, for a total amount of $483,327.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $1390.0 and $2020.0 for MercadoLibre, spanning the last three months.

Analyzing Volume & Open Interest

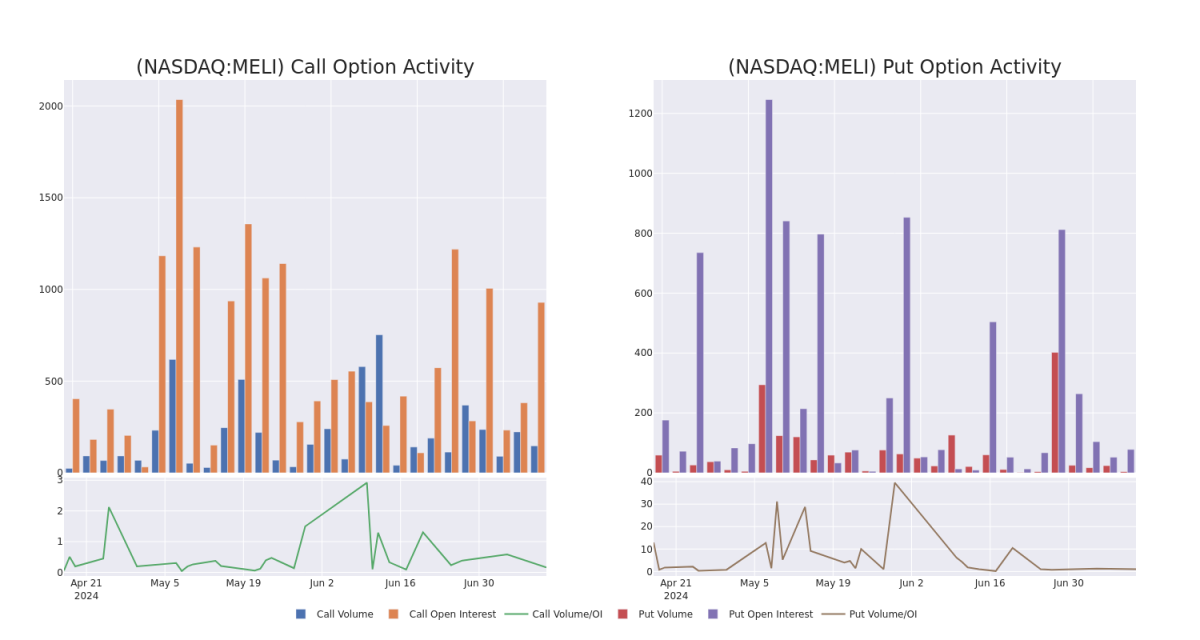

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in MercadoLibre's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to MercadoLibre's substantial trades, within a strike price spectrum from $1390.0 to $2020.0 over the preceding 30 days.

MercadoLibre Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | PUT | TRADE | NEUTRAL | 07/19/24 | $26.0 | $23.2 | $24.8 | $1750.00 | $104.1K | 46 | 16 |

| MELI | CALL | TRADE | NEUTRAL | 12/18/26 | $518.0 | $498.0 | $508.0 | $1700.00 | $50.8K | 11 | 0 |

| MELI | PUT | TRADE | BEARISH | 09/20/24 | $10.1 | $9.0 | $9.75 | $1390.00 | $49.7K | 84 | 0 |

| MELI | CALL | TRADE | BULLISH | 12/18/26 | $499.9 | $482.0 | $495.5 | $1740.00 | $49.5K | 0 | 0 |

| MELI | CALL | TRADE | BULLISH | 12/18/26 | $482.2 | $478.1 | $482.2 | $1740.00 | $48.2K | 0 | 1 |

About MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

In light of the recent options history for MercadoLibre, it's now appropriate to focus on the company itself. We aim to explore its current performance.

MercadoLibre's Current Market Status

- Trading volume stands at 159,941, with MELI's price down by -0.35%, positioned at $1755.0.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 16 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.