Author / time and

According to the Buddhist sutra story, several blind people touch the elephant, those who touch the ears say that the elephant is like a dustpan, those who touch the legs say that the elephant is like a pillar, those who touch the belly say that the elephant is like a wall, and those who touch the tail say that the elephant is like a snake. This is a metaphor for extrapolating only from an one-sided understanding of things.

In the investment world, chasing the rise and killing the fall and listening to the wind is the rain, and the story of the blind touching the elephant is repeated every day. In this game of asymmetric information, you and I may be blind and are being deceived. Every value investor is struggling to see the truth and seize the opportunity.

Financial analysis skills are a required course for value investors on their way to growth. Buffett said that investment must understand financial accounting. This series of articles begins with the analysis of financial statements from the perspective of investment, trying to learn to read financial statements in the simplest and most efficient way. This is the first article, starting with the income statement that ordinary investors have the most contact with-- about "what to look at and how to look at it".

Financial analysis skills are a required course for value investors on their way to growth. Buffett said that investment must understand financial accounting. This series of articles begins with the analysis of financial statements from the perspective of investment, trying to learn to read financial statements in the simplest and most efficient way. This is the first article, starting with the income statement that ordinary investors have the most contact with-- about "what to look at and how to look at it".

(note: companies with A shares, Hong Kong stocks and US stocks use Chinese accounting standards CAS, international accounting standards IFRS and American accounting standards US GAAP respectively. There are differences in some details, but there is little impact on the understanding of the framework. This article and this series of follow-up articles mainly focus on Hong Kong stocks, even if the IFRS criteria are used. )

Income statement (Statement of Comprehensive Income)The consolidated income statement, also known as the consolidated income statement, is one of the three major accounting statements, which mainly calculates and shows the earnings of the company. The level of income and profit is the most direct indicator of a company's ability to make money, and it is also used and discussed most frequently, which can be said to be the statement that investors have the most contact with.

(note: there are differences in the translation of specific items of financial statements. in order to avoid confusion, new concepts that appear for the first time will be marked in English. )

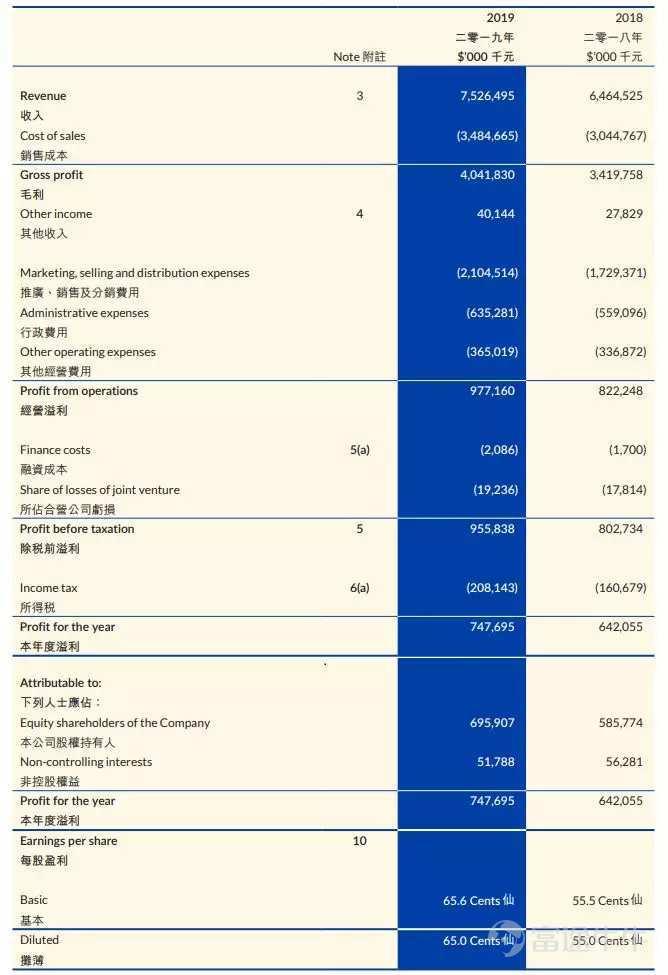

For the sake of comparability and disclosure transparency, there are many norms for the presentation of financial statements in accounting, which forms a certain reading threshold for ordinary investors. Take Vitasoy's profit statement for fiscal year 2018 as an example, listing a total of 20 items, plus 6 notes, which is so informative that it is easy to be puzzled at first glance.

Here are three martial arts secrets of dismantling the income statement. Remember it, learn it, and use it, the income statement will become extremely simple and clear.

1. What does the income statement look at-- revenue, profit and cost.

2. What do you think of the income statement-- attack volume, share and change.

3. Whether there are analytical methods-repeated comparison and deep attribution.

Recite the martial arts secret books more than once, and let's begin to practice:

I. what does the income statement look at-- important subjects and logical relationships

What does the income statement look at? Look at income, profit and cost, no matter how many subjects and notes there are in the income statement, all ghosts and ghosts can be included in these three gourds.

Income mainly refers to "operating income (Revenue)", that is, the income earned by an enterprise from selling products or providing labor services in normal business activities during a certain period of time.

Cost expenses can be understood as the costs paid to maintain normal business activities, including "operating costs (Cost of sales)" and "period expenses" (Period Expense / Period cost).

Profit items are the income of the combination of operating income and cost items, reflecting the profitability of different caliber.

The logical relationship of the three categories is shown in the figure above: take Vitasoy International as an example, the revenue generated from the sale of soy milk, lemon tea and other products in fiscal year 2018 (April 1, 2018-March 31, 2019) was operating income of HK $7.526 billion.

"operating cost" is the direct cost of raw materials, labor costs, production line and workshop rent during the production of soy milk and other products in fiscal year 2018.There is a strong matching relationship between operating cost and operating income, and the attribution object and attribution period are determined.

In contrast to operating costs, period expenses are those that cannot be matched, which are recognized by accounting in the current period of expenditure. For example, the "cost of sales" (Selling Expenses;Marketing Costs), the TV and online advertising of Vitasoy in the current period, whether it can be transformed or not is uncertain, and the cycle of its effect is also uncertain.

The second is the "administrative cost" (Management Fee/Management Fees/Managing Costs), which usually includes management-related expenses, as well as costly R & D expenses. The effects of these management expenditures, or investment in new product research and development, are long-term and cannot be apportioned to which period.

In addition, the common expense items are "financial cost" (Finance costs)-financing interest on current expenses, and "income tax expenses" (Income tax)-enterprise income tax payable in the current period.

"Gross profit" is the most direct profit indicator, which is often used to measure the profitability after deducting the most direct cost of production and operation.

"operating profit" (Profit from operations) is the deduction of period expenses on the basis of gross profit, that is, all costs incurred at the operating and production levels of the enterprise have been deducted. Operating profit is regarded as an important indicator of an enterprise's ability to make money continuously.

"pre-tax profit" (Profit before taxation), usually deducting financial costs from actual operating profit, as well as non-recurrent items such as losses and gains, includes financing expansion and some non-recurrent items.

"net profit" (Profit), which is the net amount of the total profit paid by the enterprise income tax, is the measure of the final profitability of the enterprise in the current period.

The above is the income, cost and profit that the income statement depends on. It is very simple and easy. Take a look at this chart again, consolidate the important projects and logical relationships, and then we move on to the second layer of the income statement-- how to see it.

II. What do you think of the income statement-- volume, share and change

1. Absolute mass-size and status

Absolute volume, that is, the size of the enterprise, the key items are operating income and net profit, through horizontal and vertical comparison to locate the size and industry status of the enterprise.

Vitasoy, for example, had operating income of HK $7.526 billion in fiscal year 2018, HK $3.012 billion in fiscal year 2009, HK $748 million in fiscal year 2018 and HK $301 million in fiscal year 2009. The scale has doubled in ten years.

The vertical comparison reflects the growth of scale in the time dimension, while the horizontal comparison helps to find the position of Vitasoy in the same industry (see figure below). The scale of Vitasoy is not too large in the Hong Kong food and beverage sector, ranking 11th.

2. Proportion analysis-- earning power

Secondly, we need to do some preliminary processing on the income statement in order to further analyze the profitability of the enterprise. The following figure shows a percentage analysis of Vitasoy's profit statement for fiscal year 2018 (each item / operating income). The percentage analysis focuses on "gross margin", "operating margin", and "net interest rate". Through these three indicators, we can quickly locate the earning power of the enterprise and its key factors.

Net interest rate = net profit / operating income, compared with the absolute volume, the form of ratio is more conducive to horizontal and vertical comparison. In fiscal year 2018, the net interest rate of Vitasoy was 9.94%, which was higher than that of the Hong Kong beverage industry as a whole.

While Weeta's net profit has continued to rise over the past 10 fiscal years, the net interest rate has fluctuated significantly, peaking in 2017 and stabilizing at more than 9.5% in the past two years.

In order to further locate the reasons for the fluctuation of Vitasoy's net interest rate, continue to look at the changes in gross profit margin and operating profit margin. Different from the trend of net interest rate, Vitasoy International's gross profit margin has increased year by year since fiscal year 2011. It can be speculated that with the expansion of scale and upgrading of production lines, the production cost of products has been significantly controlled.

Excluding the impact of operating costs, a further look at the operating profit margin, from the image, we can see that over the past decade, the trend of Weeta Milk profit margin is highly consistent with the net profit trend. It can be inferred that the net interest rate fluctuation mainly comes from the change of the period cost, the reason has been found, the next step is the specific period cost item proportion analysis, will not repeat here.

3. Changing trend-- growth capacity

In addition to the proportion, another common way to deal with changes is to calculate changes. The chart below is a growth analysis of Vitasoy's profit statement for the last 10 fiscal years (benchmark / year-1), focusing on the growth and sustainability of revenue and net profit.

The focus of revenue growth capacity analysis is attribution, different attribution, the elasticity of growth is not the same. Take the income model of Vitasoy as an example: operating income = product sales * product price, the growth drive mainly comes from:

1) sales growth of existing products

The first product is in a period of rapid growth, and the growth of sales volume leads to revenue growth, which is the most flexible at this stage.

The second product is in the stock competition period, and the increase in market share leads to revenue growth. The characteristic of this stage is that the growth rate has slowed down and the growth space is limited.

2) the price increase of existing products

When the products of enterprises determine a certain market position and brand effect, they can also increase revenue by raising prices. Compared with sales growth, price increase is a sub-level of growth, to a certain extent, will lead to the loss of users.

3) the launch of new products

The third way to promote income growth is to expand the product line. from the point of view of investors, expanding the product line is a secondary growth mode, which needs to bear the early R & D investment, promotion and sales costs and the risk of new product failure. But correspondingly, the innovation of new products and new business is beneficial to the long-term development of enterprises.

The focus of the analysis of net profit growth capacity is whether it is sustainable, and the operating cost is the most sustainable with the improvement of scale expansion and technological renewal; the administrative cost is the same.

Sales expenses need a specific analysis, there is a brand and channel construction after the natural and benign improvement; may also be poor management, reduce promotion expenditure, short-term decline in costs, but have a negative impact on revenue in the long run.

On the other hand, the increase in net profit caused by non-recurrent items such as one-time government subsidies is regarded as unsustainable and does not affect the long-term judgment of enterprises.

What do you think of the income statement? The analytical tools are repeated comparisons and deep attributions. On this basis, we can find the scale and status from the volume, identify the key influencing factors from the proportion, and try to analyze the future from the changes.

Summary:

Finally, a picture is used to summarize this article, hoping to be helpful to all spectators. Space is limited, and many places can only go so far. The next article will take a specific company as an example to disassemble each trick in detail. See you next time.

财务分析技巧是价值投资者成长路上必修的一课,巴菲特有言,投资必须懂财务会计。本系列文章着手于投资角度的财报分析,力图用最简单、最高效的方法学会看财报,此为第一篇,从普通投资者接触最多的利润表开始讲起——关于「利润表看什么,怎么看」。

财务分析技巧是价值投资者成长路上必修的一课,巴菲特有言,投资必须懂财务会计。本系列文章着手于投资角度的财报分析,力图用最简单、最高效的方法学会看财报,此为第一篇,从普通投资者接触最多的利润表开始讲起——关于「利润表看什么,怎么看」。