Source: landlord economics

Author: ID of the landlord

In 2019, Buffett ran into a lot of trouble. his dinner was photographed by a controversial "currency boss" in China and then cancelled, his cash holdings were complained by investors, and more importantly, Berkshire's performance this year lost sharply to the S & P 500, the benchmark for US stocks.

Is Buffett really out of order? Don't jump to conclusions, Buffett can become a stock god, there are three things about him.

Excellent 1: have a good eye

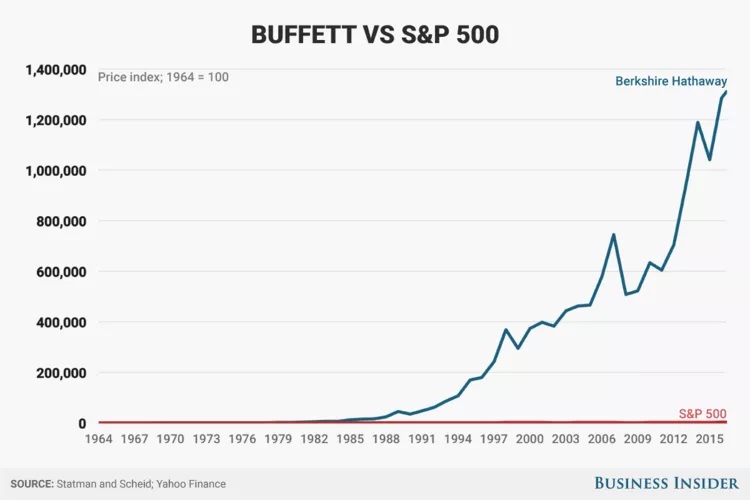

The stock god's vision is unusual, which shows that Berkshire's share price rose by an average of 20.9% a year in the 52 years from 1965 to 2017, far exceeding the average annual rate of 9.9% for the S & P 500 over the same period.

If we stretch the earnings chart to 1964-2015, Berkshire's performance directly pushes the S & P 500 benchmark into a horizontal line.

Berkshire Hathaway VS S & P 500 1964-2015 (1964)

Take Coca-Cola Company as an example, this is one of the most beautiful decisions of the stock god.

In 1988, Buffett bought $500m of Coca-Cola Company, increased his holdings by $400m in 1989 and $300m in 1994, making a cumulative investment of $1.3 billion, when Coca-Cola Company's market capitalization accounted for 25 per cent of Berkshire's book value. Ten years later, in 1998, his position rose to $13.3 billion, a stock tenfold in ten years and a net profit of $12 billion in ten years, and Berkshire continues to hold Coca-Cola Company ever since.

Berkshire Hathaway position on January 1, 2019

How did he think about it when he bought Coca-Cola Company?

Buffett, a sweet tooth enthusiast and insightful, found that Coca-Cola Company accounted for a high proportion of the bottle caps discarded around the retail machine, and he very much agreed with Coca-Cola Company's moat. At the time, he and Munger concluded that it would be impossible to find the best marketing team on the planet and want to replicate such a Coke brand for $100 billion (Coca-Cola Company's market capitalization was only $20 billion at the time).

Another consideration is that Coca-Cola Company's gross profit margin is very high (more than 80%). As long as Coca-Cola Company sells more, the profit will naturally be higher, and Coca-Cola Company's sales have increased steadily over the past 80 years. Even so, at the end of the 1980s, there were still many people in less developed parts of the world who had not tasted Coke. They were thinking: how much will Coca-Cola Company sell by 2000, 2025 and 2050? The results are fascinating.

At that time, Coca-Cola Company had a price-to-earnings ratio of 15 times, a price-to-book ratio of about 5 times, and a cheap valuation. Buffett seized this opportunity. Most analysts analyze earnings forecasts for only a few quarters, but few have such an accurate judgment about the span of decades.

Outstanding point 2: the national luck is strong enough

No one's success can leave the era, Buffett's success is actually a manifestation of American success, in his life, the U. S. national luck all the way up, which also makes the United States stock market leader. If Buffett had been born in a war-torn poor country, he would not have achieved what he is today.

GDP of USA, China and Japan (1960-2017)

Buffett's luck from the United States is not just to invest, but to enjoy it from birth. He was born into a middle-class family in the United States.Living in separate houses (villas) and driving private cars from an early age, this was the general standard of living of the middle class in the United States in the 1930s.Throughout the twentieth century, it is hard to find another country with a better fortune than the United States.

Buffett's childhood photos

Buffett said when attending the 100th anniversary celebration of Forbes magazine in 2017.There is only one way for the American stock market, and that is to go uphill。He believes that within 100 years, the Dow will rise above 1 million points (when the Dow was about 22000 points).

He's right, that's how American stocks used to go. Even if a man wasn't as discerning as Buffett, he bought the S & P 500 for $10, 000 in 1950, and today's value, excluding past dividends, has reached $1.8 million, 180 times in nominal terms and 18 times in terms of inflation.

S & P 500 Index 1928-2019

Merit # 3: live long enough

The most fastidious investment is compound interest, as a friend of time.As mentioned in the first part, Buffett's Berkshire Hathaway grew by an average of 20.9% a year in the 52 years from 1965 to 2017, which may be far less than the A-share gods such as Xu Xiang and Brother Zhao. Take Xu Xiang as an example, the annualized return of his products is about 200%, which is 10 times that of Buffett. Unfortunately, Xu Xiang's path is so wild that he was eventually arrested on suspicion of manipulating the securities market and insider trading, and the 200% annualized return was not sustained.

Buffett has been strong in his high earnings for more than half a century, precisely because compound interest is also growing in power in the later stage of a growing base. Buffett acquired 96% of his wealth after the age of 60.

Buffett is worth 14 to 87 years old.

Over the past decade, although Berkshire has lost its edge over the S & P 500 (full income) and has lost significantly to the NASDAQ, which focuses on information technology. But it is important to understand that the bulls of US stocks in the past decade have been mainly driven by technology stocks, while Buffett's vast majority of investments have been concentrated in traditional industries such as finance and consumption. Berkshire has achieved a very good result in this case, which is on a par with the S & P 500.

Buffett is currently worth $86.5 billion, and every extra year Buffett lives can increase his wealth by more than $18 billion, based on the average rate of return over the past 50 years. It is said that the richer people are, the more afraid they are of death. That's the reason!

At the 2019 shareholder meeting, Buffett, 89, and Munger, 95, answered six hours of questions and a total of more than 50 questions from investors. The 90-year-old body has a high load output of six hours under the spotlight, which many young people can't do. Buffett is a real winner in life if he earns more and lives a long time.

Buffett and Munger, Berkshire Hathaway shareholders' meeting in 2019

The stock god lost to himself.

Although Buffett is such a lucky stock god, but with the passage of time, he also gradually can not escape his past predictions.

Buffett has always believed that index funds can easily beat active funds.He thinks 99% of market participants should buy index funds instead of buying and selling stocks themselves.

In order to prove his point of view, Buffett posted a "ten-year bet" on Long Bets on December 19, 2007, with a bet of $500000, designating Girls Inc.of Omaha as the beneficiary, and if Buffett wins the bet, the organization will get all the money he won. He thinks:Any professional investor can choose at least five hedge funds, and over a long period of time, professional investors choosing hedge funds will lag behind S & P 500 funds that charge only nominal fees.

In the end, this group of hedge funds carefully selected by professionals all lost to the S & P 500.

The performance of five FOF funds and S & P 500 index funds in ten-year bet contracts all lost to S & P 500.

It's not just the FOF fund that gambles.In fact, Berkshire can no longer beat the index.

Let's take a look at Berkshire's performance. On December 31, 2008, Berkshire Class A shares closed at $96600. By December 31, 2018, Berkshire Class A shares closed at $306000. Buffett's Berkshire 10-year total income is 317%. Since Berkshire has never paid a dividend, this is the total income of shareholders.

On December 31, 2008, the S & P 500 full-income index (including dividends) closed at 1452.98, on December 31, 2018, the S & P 500 full-income index (including dividends) closed at 5035.45, and the S & P 500's decades-long total income (including dividend income) was 347%.It can be seen that Buffett lost 30% to the S & P 500 full income index during the decade from 2008 to 2018.

Since 2019, the S & P 500 is up 23%, while Berkshire is up only 9.3%.Buffett once predicted that active investment could not do more than passive investment, and in the end, he could not escape this prediction.

Some people have made statistics on Buffett's historical achievements:

From 1957 to 1975, Buffett earned an average annual income of 21.0%, which was his debut period.

From 1976 to 1998, Buffett earned an average annual income of 30.4%, his peak.

From 1999 to 2018, his average annual income was 9.4%, which is his old age.

The change in stock god's performance is inextricably linked to changes in American industry, and the absence of technology stocks may be his biggest regret over the past two decades, but even so, in terms of the amount of money Berkshire manages, his achievements are still commendable.

Edit / Jeffy