Investing in stocks inevitably means buying into some companies that perform poorly. But long term Healthcare Services Group, Inc. (NASDAQ:HCSG) shareholders have had a particularly rough ride in the last three year. Unfortunately, they have held through a 64% decline in the share price in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 24% lower in that time. On the other hand the share price has bounced 9.4% over the last week.

While the stock has risen 9.4% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

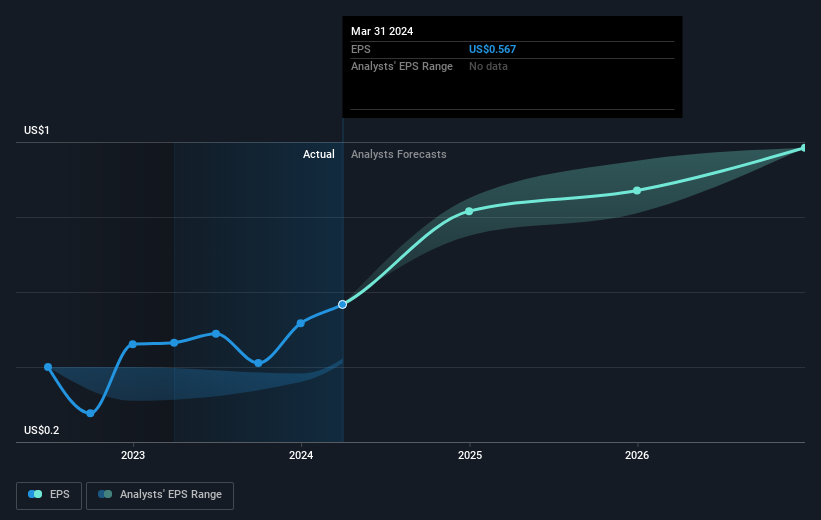

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the three years that the share price fell, Healthcare Services Group's earnings per share (EPS) dropped by 25% each year. This change in EPS is reasonably close to the 29% average annual decrease in the share price. That suggests that the market sentiment around the company hasn't changed much over that time, despite the disappointment. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Healthcare Services Group has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Healthcare Services Group's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Healthcare Services Group's TSR of was a loss of 61% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Healthcare Services Group shareholders are down 24% for the year, but the market itself is up 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you would like to research Healthcare Services Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com