During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the financial sector.

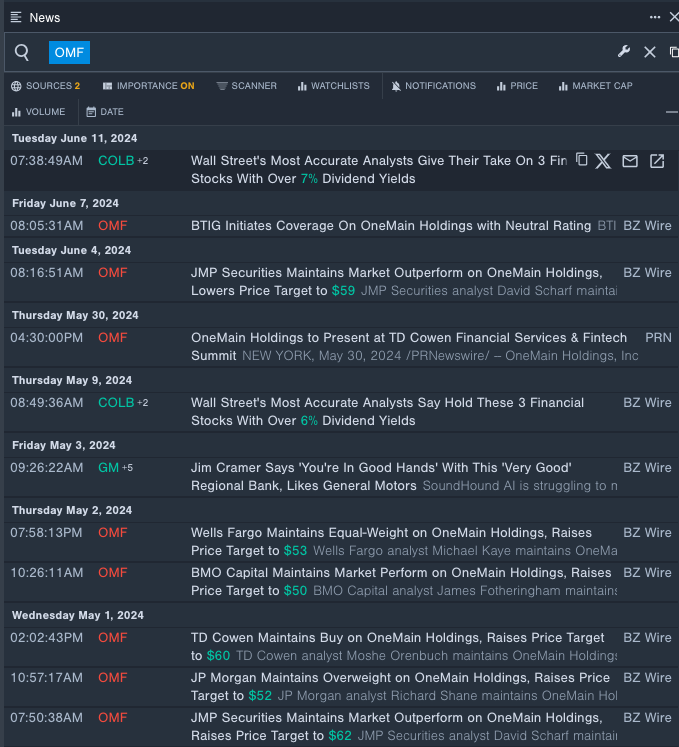

OneMain Holdings, Inc. (NYSE:OMF)

- Dividend Yield: 8.63%

- BMO Capital analyst James Fotheringham maintained a Market Perform rating and boosted the price target from $48 to $50 on May 2. This analyst has an accuracy rate of 74%.

- JP Morgan analyst Richard Shane maintained an Overweight rating and increased the price target from $51 to $52 on May 1. This analyst has an accuracy rate of 68%.

- Recent News: On April 30, OneMain Holdings posted better-than-expected quarterly earnings.

- Benzinga Pro's real-time newsfeed alerted to latest OneMain's news

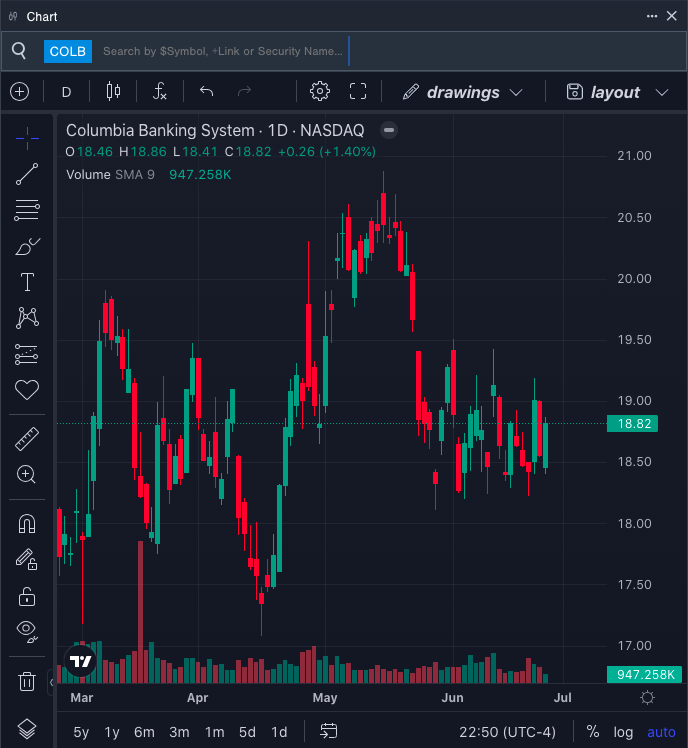

Columbia Banking System, Inc. (NASDAQ:COLB)

- Dividend Yield: 7.65%

- Piper Sandler analyst Matthew Clark reiterated an Overweight rating with a price target of $27 on June 5. This analyst has an accuracy rate of 64%.

- Barclays analyst Jared Shaw maintained an Equal-Weight rating and increased the price target from $20 to $21 on April 26. This analyst has an accuracy rate of 62%.

- Recent News: On May 13, Columbia Banking System announced a 36 cents per common share dividend.

- Benzinga Pro's charting tool helped identify the trend in COLB's stock.

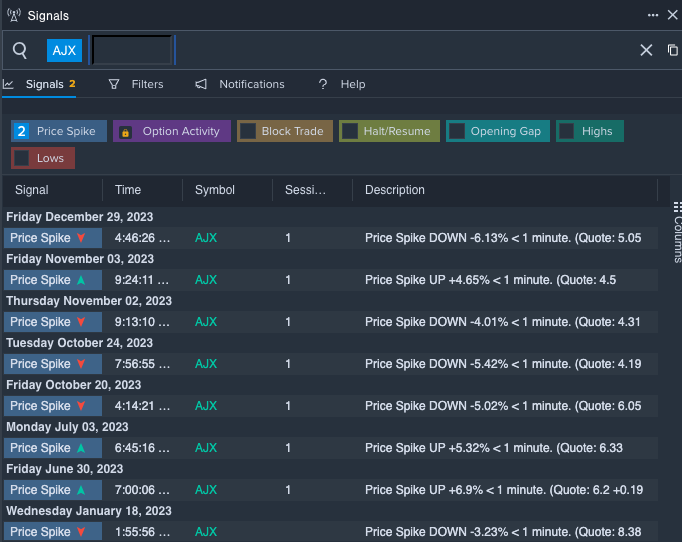

Great Ajax Corp. (NYSE:AJX)

- Dividend Yield: 6.69%

- JMP Securities analyst Steven Delaneydowngraded the stock from Market Outperform to Market Perform on Jan. 12. This analyst has an accuracy rate of 68%.

- Raymond James analyst Stephen Lawsdowngraded the stock from Outperform to Market Perform on July 6, 2023. This analyst has an accuracy rate of 65%.

- Recent News: On May 34, Great Ajax posted downbeat quarterly results.

- Benzinga Pro's signals feature notified of a potential breakout in Great Ajax's shares.