The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

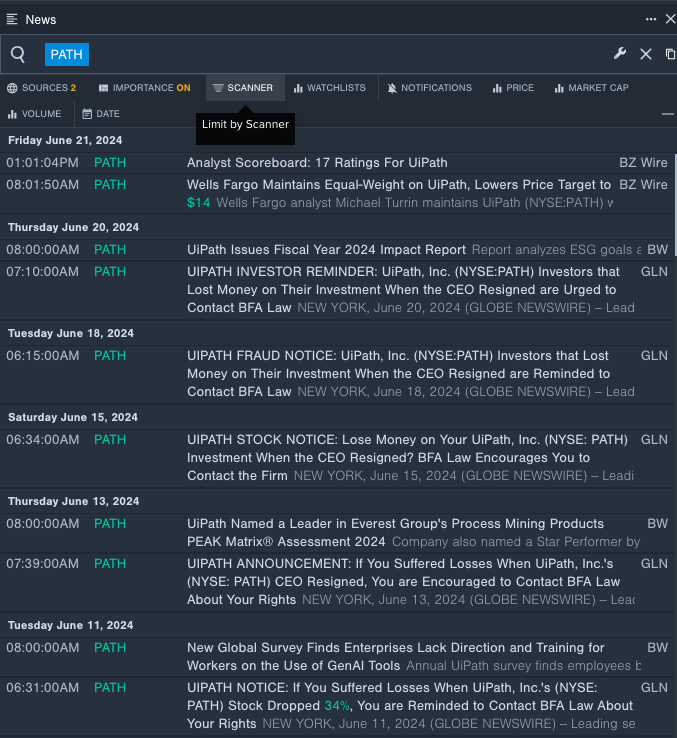

UiPath Inc (NYSE:PATH)

- On June 21, Wells Fargo analyst Michael Turrin maintained UiPath with an Equal-Weight and lowered the price target from $15 to $14. The company's stock fell around 36% over the past month and has a 52-week low of $11.07.

- RSI Value: 27.99

- PATH Price Action: Shares of UiPath gained 0.6% to close at $12.03 on Monday.

- Benzinga Pro's real-time newsfeed alerted to latest UiPath's news.

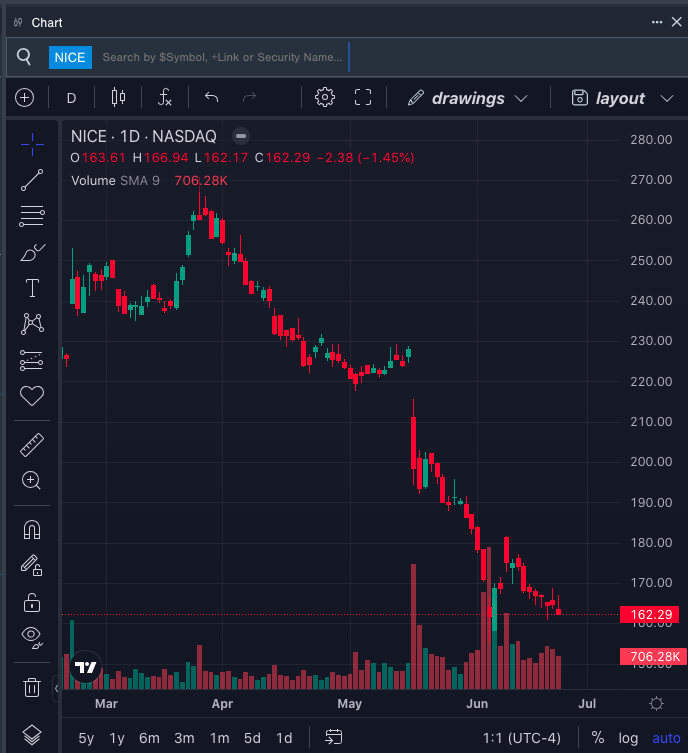

Nice Ltd (NASDAQ:NICE)

- On June 10, NICE announced a deal valued at over $100 million. NICE's CXone will replace current incumbents in the Asia-Pacific region after the company secured the 8-digit ACV deal.. The company's stock fell around 15% over the past month. It has a 52-week low of $149.54.

- RSI Value: 24.95

- NICE Price Action: Shares of Nice fell 1.5% to close at $162.29 on Monday.

- Benzinga Pro's charting tool helped identify the trend in NICE's stock.

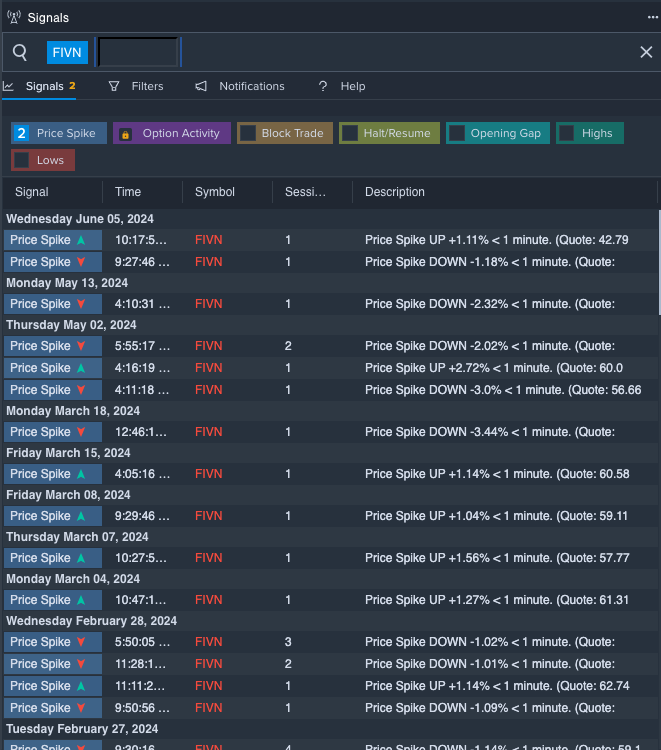

Five9 Inc (NASDAQ:FIVN)

- On June 14, Morgan Stanley analyst Lauren Lieberman maintained Five9 with an Equal-Weight and lowered the price target from $70 to $50. The company's stock fell around 16% over the past month and has a 52-week low of $39.89.

- RSI Value: 28.14

- FIVN Price Action: Shares of Five9 fell 1.6% to close at $40.87 on Monday.

- Benzinga Pro's signals feature notified of a potential breakout in Five9's shares.

Read More: How To Earn $500 A Month From FedEx Stock Ahead Of Q4 Earnings