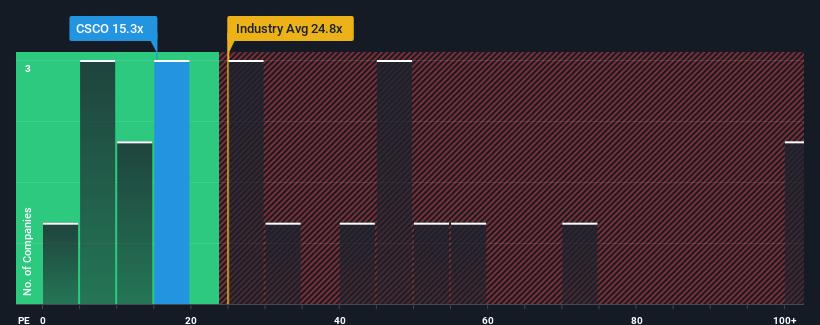

There wouldn't be many who think Cisco Systems, Inc.'s (NASDAQ:CSCO) price-to-earnings (or "P/E") ratio of 15.3x is worth a mention when the median P/E in the United States is similar at about 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Cisco Systems has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

NasdaqGS:CSCO Price to Earnings Ratio vs Industry June 19th 2024

Keen to find out how analysts think Cisco Systems' future stacks up against the industry? In that case, our free report is a great place to start.

Is There Some Growth For Cisco Systems?

Cisco Systems' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a decent 7.0% gain to the company's bottom line. The solid recent performance means it was also able to grow EPS by 24% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 1.2% per year over the next three years. With the market predicted to deliver 10% growth each year, that's a disappointing outcome.

With this information, we find it concerning that Cisco Systems is trading at a fairly similar P/E to the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

What We Can Learn From Cisco Systems' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Cisco Systems' analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Cisco Systems that you should be aware of.

Of course, you might also be able to find a better stock than Cisco Systems. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.