Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term Bristol-Myers Squibb Company (NYSE:BMY) shareholders, since the share price is down 38% in the last three years, falling well short of the market return of around 21%. And more recent buyers are having a tough time too, with a drop of 38% in the last year. The falls have accelerated recently, with the share price down 20% in the last three months.

If the past week is anything to go by, investor sentiment for Bristol-Myers Squibb isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Bristol-Myers Squibb became profitable within the last five years. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. Bristol-Myers Squibb has maintained its top line over three years, so we doubt that has shareholders worried. A closer look at revenue and profit trends might yield insights.

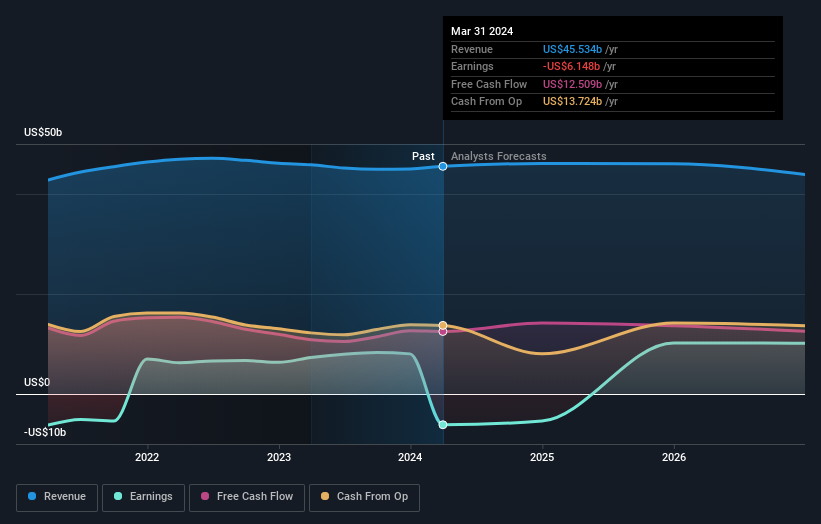

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Bristol-Myers Squibb in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Bristol-Myers Squibb, it has a TSR of -32% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Bristol-Myers Squibb shareholders are down 35% for the year (even including dividends), but the market itself is up 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 1.3%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Bristol-Myers Squibb that you should be aware of before investing here.

Bristol-Myers Squibb is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com