The SSE composite index fell 0.61% this week, with four consecutive weekly declines.

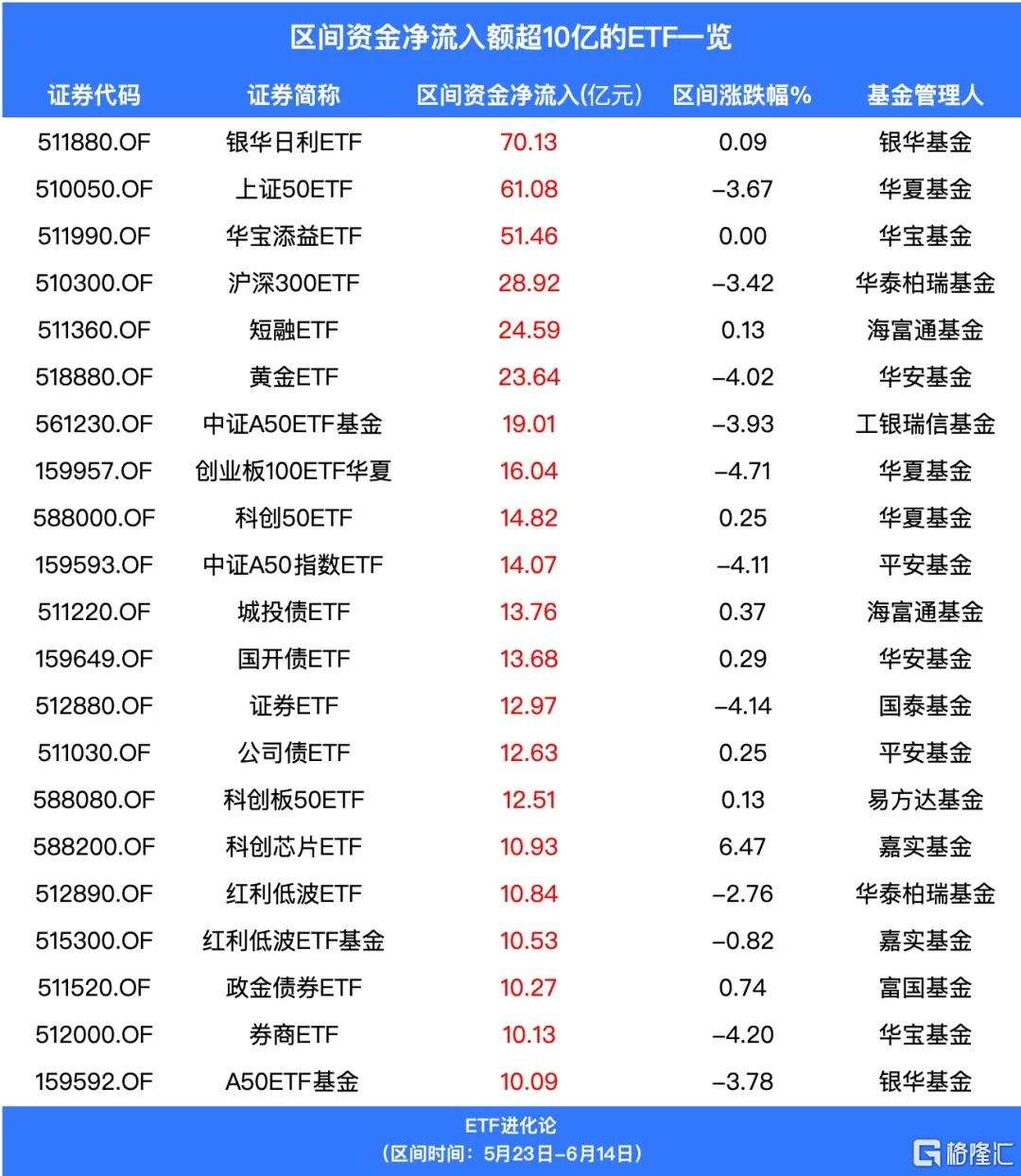

Since May 23, the market has been in a volatile correction. Between May 23 and June 14, about 57.1 billion yuan of ETF capital entered the market for buying.

During the market adjustment, the net inflows of CSI A50 and hwabao wp listed money market fund-a reached 7 billion and 5.1 billion yuan, respectively, between May 23 and June 14.

The broad-based index ETFs were favored by investors. Data shows that between May 23 and June 14, the most popular stock ETF was huaxia shanghai 50 ETF, with a net inflow of up to 6.1 billion yuan. HuaTai-PB CSI300 ETF also had notable net inflows of 2.89 billion yuan.

CSI A50 ETFs had the largest net inflows, with ten CSI A50 ETFs all receiving net inflows since May 23, totaling 6.277 billion yuan. Among them, ICBC Credit Suisse CSI 300 Index ETF and Ping An China A50 ETF had the most net inflows, with 1.9 billion yuan and 1.4 billion yuan respectively.

Double innovation ETFs also received inflows, with more than 1 billion yuan of net inflows into huaxia growth enterprises ETF, huaxia CSI science and innovation board 50 ETF, and e-fund CSI science and innovation board 50 ETF.

On the industry-themed ETF side, the huatai-pb csi dividend low volatility etf continued to be sought after. Since May 23, both huatai-pb CSI dividend low volatility ETF and jiashi CSI 300 dividend low volatility ETF have received net inflows of more than 1 billion yuan.

In addition, multiple brokerage, chip, baijiu, and pharmaceutical industry ETFs have received additional funds.

Huaxi Securities' research report pointed out that since the beginning of the year, the A-share market has experienced a rebound in oversold prices driven by liquidity and risk preferences during March and April. At the end of April, A-shares rose further under the influence of the Hong Kong stock market. Since May 20, both the Hang Seng Index and the Shanghai Composite Index have entered a phase of adjustment with a shrinkage of turnover; less than 20% of stocks have increased. As of now, the main A-share indices have returned to the level of early March. On the one hand, the market lacks confidence in the economic recovery with intensive real estate policies being released and in the data verification phase. On the other hand, policy has been explicitly strict and under the game of existing stockpiles, stocks with potential risks of delisting, small-cap stocks and ST stocks have undergone major corrections, leading investors to be cautious.

Looking ahead, Huaxi Securities pointed out that from the three aspects of valuation and asset comparison, trading sentiment, and investor behavior, the current A-share market is in a "relatively bottom range," which has already met the characteristics of the bottom market from history. On the issue of valuation and asset comparison, the latest A-share valuation percentile is in the 16% percentile of the past three years, and the Shanghai and Shenzhen 300 risk premiums are close to the three-year average +1 std. The stock bond yield difference has fallen to -0.9%, close to the three-year average -2 standard deviations, and similar to historical bottom markets. On trading sentiment, A-share turnover and turnover rate have shrunk significantly compared to the previous highs, and the proportion of strong stocks has fallen to 18%, lower than the average low points of previous bottom markets. For investor behavior, the Shanghai stock exchange has seen two consecutive months of decline in the number of new accounts opened, and the issuance scale of equity funds has fallen further than last year's low base period, and the industry capital reduction has significantly decreased since October 2023. At the same time, the enthusiasm for A-share repurchases has increased significantly.

Huaxi Securities believes that the current A-share market is in a "relatively bottom range" based on the analysis of the three factors of valuation and asset comparison, trading sentiment, and investor behavior. The risks of large-scale index decline are limited. In the third quarter, corporate profits are still in the trough period, and investors still have concerns about the real estate fundamentals and subsequent policy efforts. The market will fluctuate and the overall A-share market will gradually rise. On the style side, dividends and technology themes may rotate. Key areas of focus in the future include monetary policy, capital markets, and reform policies.

In terms of the ratio of valuations and major asset classes, A-share valuations are at the 16% percentile of the past three years. The Shanghai and Shenzhen 300 risk premiums are almost at the three-year average +1 std, and the difference in stock bond yields has fallen to -0.9%, approaching the three-year average -2 standard deviations.

In terms of trading sentiment, A-share trading volume and turnover rate have significantly decreased from previous highs, and the proportion of strong stocks has fallen to 18%, lower than the average low points of previous bottom markets.

In terms of investor behavior, the number of new accounts opened by the Shanghai stock exchange has declined for two consecutive months, and the issuance scale of equity funds has fallen further compared to the low base period of the same period last year. Industry capital reduction has decreased significantly since October 2023. At the same time, A-share repurchase enthusiasm has increased significantly.

Looking ahead, from the three aspects of valuation and major asset class ratios, trading sentiment, and investor behavior, the current A-share market is in a "relatively bottom range," and the risk of sharp index declines is small. In the third quarter, corporate profits are still in the trough period, and investors still have concerns about the real estate fundamentals and subsequent policy efforts. The market will fluctuate, and the overall A-share market is expected to gradually rise in volatility. On the style side, dividend and technology themes may rotate. In the future, the focus will mainly be on monetary policies, capital markets, and reform policies.