In 2001, a white paper issued by Japan's Ministry of Trade and Industry called China "the factory of the world" for the first time.

The name goes hand in hand as China has grown into the world's second-largest economy for more than a decade.

Until one day, people quietly found that China's industry also began to move out.

From the labor-intensive textile and clothing industry, to some heavy industries and highly polluting industries, and then to the consumer electronics industry chain. For a time, there was widespread concern that China's manufacturing industry might enter a "hollowing out" phase.

In fact, however, this is not the first migration of the global industrial chain, nor will it be the last.

After reviewing the history of industrial changes in Japan, South Korea and Taiwan in the past 60 years, Guotai Junan's macro team explained to us the inevitability of China's industrial relocation and several conditions necessary for industrial relocation to achieve economic shift.

Industrial transfer:Accidental or inevitable?

In fact, from the analysis of economic theory, the comparative advantage between countries and the continuous change of product life cycle make the regional industrial transfer inevitable to some extent.

From the perspective of comparative advantage, the international industrial transfer will first start from the industries that have lost their comparative advantage (marginal industries), and then transfer in turn.

In this process, countries in East Asia often adopt the combination of import substitution strategy and export-oriented strategy (wild goose array model) to improve their domestic technology level through import, and then through the improvement of production and the development of foreign markets. Exports further drive growth.

When the industrial comparative advantage disappears, the industrial transfer will be carried out again.

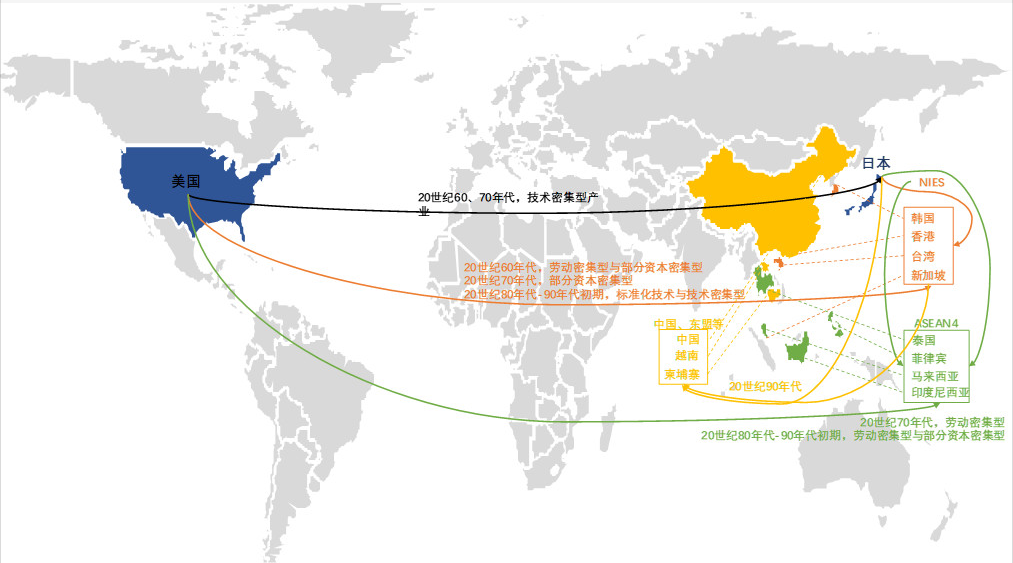

▼ The course of global industrial transfer

Source: Guotai Junan Securities Research. NIES countries include South Korea, Taiwan, Singapore, etc., while ASEAN4 countries include Indonesia, Malaysia, Philippines, Thailand and so on.

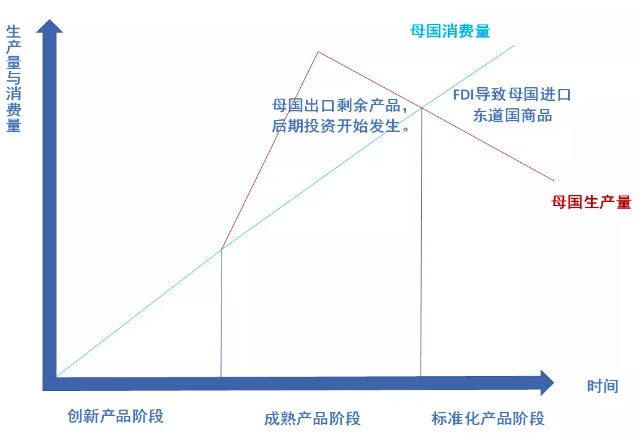

From the point of view of product life cycle, it can be divided into innovative products, mature products and standard products in different stages.

For developed countries, the production of innovative products is concentrated at home, the production of mature products begins to gradually transfer to other developed countries, and the production of standard products begins to transfer to developing countries.

Source: Guotai Junan Securities Research

The industrial transfer between different regions of East Asia is in fact a classic textbook case in economics. With an understanding of them, it is not difficult to understand the relocation of industries that have begun to take place in China.

Three countries:A necessity

Reviewing the four waves of global industrial transfer that have been completed, the early industrial transfer was concentrated in the 1960s, when the United States transferred labor-intensive and some capital-intensive industries to Japan and Asian emerging industrial economies.

In the second wave, in the 1970s, the United States began to transfer technology-intensive industries to Japan, while Japan began to transfer some capital-intensive industries to Asian emerging industrial economies. Asian emerging industrial economies transfer labor-intensive industries to some ASEAN countriesThe gradient of industrial transfer appears on a global scale.

In the third stage (1980s), the United States and Japan began to transfer standardized capital and technology-intensive industries to Asian emerging industrial economies. at the same time, the United States, Japan and some Asian emerging industrial economies transferred labor-intensive and capital-intensive industries to ASEAN.

In the fourth transfer trend (after the 1990s), the figure of China began to show. As the successor of a big country, China began to welcome the transfer of labor-intensive related industries from the United States, Japan and Asian emerging industrial economies.

Japan

In the industrial transfer in the 1960s and 1970s, we found thatThe relocation of industries is basically consistent with the pace of the trade war between Japan and the United States.It often follows the path of "expansion of exports to the United States-intensification of trade frictions with the United States-voluntary export restrictions on Japan" or "trade protection by the United States-decline in the number of Japanese exports-gradual transfer of industries".

Generally speaking, neither industrial transfer nor trade war has affected Japan's industrial upgrading and industrial development trend.

One evidence is that the share of Japan's secondary industry increased rapidly after the war and stabilized in the 1970s. The process of industrial transfer and the continuing impact of the trade war between Japan and the United States have not significantly reduced the share of Japan's secondary industry.

In the process of industrial relocation, the industry share of labor-intensive and capital-intensive industries in Japan decreased, focusing more prominently on the textile industry, steel, wood and paper products. The weight of high-tech industries gradually increased in this process, and the economic structure continued to upgrade.

We believe that the above-mentioned changes in the industrial structure itself are in line with the objective law of economic development. From this dimension, the trade war has only accelerated the process of reallocation of the above-mentioned resources.

In terms of Japan's coping strategies for trade frictions and industrial transfer, in addition to upgrading technology-related inputs such as research and development, for the automobile and home appliance industries, Japan has invested directly in the United States to set up factories in the United States, and at the same time actively expand and seize other international markets. and the production of strict procurement of domestic parts and other requirements have brought support to the industry.

Data source: Guotai Junan Securities Research, Ministry of General Affairs of Japan

South Korea

In 1973, the South Korean government issued the Declaration on heavy Chemical industrialization, which identified iron and steel, petrochemical, shipbuilding, automobile manufacturing and other industrial sectors as the focus of export strategy. and the computer, precision instruments, electrical machinery and other technology-intensive industries to implement import substitution, began the third industrial restructuring.

In the 1980s, due to South Korea's increased investment in the heavy chemical industry, there was excess capacity in the domestic heavy chemical industry, forcing the South Korean government to make a new round of industrial restructuring.

Through foreign direct investment, South Korea has transferred some low value-added labor-intensive industries overseas (mainly receiving countries in China and some ASEAN countries). At the same time, through the introduction of high-quality foreign investment, focus on the development of high value-added technology-intensive industries such as computers, electronics, precision machinery and so on.

In the whole process of industrial transfer in South Korea, in the subdivision of industrial structure, the weight of high-tech industries represented by electronics and computer continues to increase, while the weight of labor-intensive industries represented by textiles and clothing decreases.

However, the overall manufacturing weight of South Korea did not decrease significantly at this stage, and from the perspective of direct investment, the peak of South Korea's foreign transfer was in the early 1990s.

Taiwan of China

Since the 1960s, Taiwan has undertaken labor-intensive, capital-intensive and technology-intensive industries from the United States and Japan for three times.

The introduction of foreign investment has further optimized the allocation of resources in Taiwan, the structure of export products has been continuously optimized, and technology-intensive industries represented by electronic information have developed rapidly.

In the 1970s and 1980s, Taiwan began to gradually transfer labor-intensive industries to some ASEAN countries. after the 1990s, the transfer speed of Taiwan's outward industries began to accelerate obviously, and the mainland has become its largest industrial grounding.

In the whole process of industry relocation, the proportion of manufacturing industry in GDP in Taiwan has declined as a whole, but the proportion of technology-intensive industries in manufacturing GDP has increased.

From the perspective of industry segmentation, the weight of electronic components industry has increased significantly. The weight of textile, food and beverage related industries decreased significantly.

From the perspective of direct investment, although the industrial transfer of Taiwan began in the 1970s and 1980s, the gap between foreign direct investment and foreign direct investment did not increase until after the 1990s. The formal starting point of industrial transfer from the perspective of direct investment should be after the 1990s.

After entering the 21st century, Chinese mainland has basically inherited 60% of the industry's overseas production in Taiwan.

From the perspective of industry segmentation, Taiwan has made an extensive transfer to the mainland in the areas of leather, fur products, electronics, computer and optical products, equipment and so on. In terms of basic metals and non-metallic minerals and chemicals, Taiwan chooses other Asian countries to transfer.

Those in the process of industrial relocationThe same and different

The industrial transfer in East Asia basically follows a similar law:

FirstUndertake labor-intensive industries in developed economies and use exports from labor-intensive industries to drive economic growth

meanwhileMainly import technology and capital-intensive products, vigorously develop the industrial base and achieve technological breakthroughs

When the stage of economic development reaches a certain levelThen transfer the industries that have lost their comparative advantage to the late-developing countries, and export capital and technology.

In the relocation of industries, all countries mainly adopt the way of foreign direct investment. However, whether it is Taiwan's triangular trade, or Japan's production in external areas and domestic raw material procurement standards, all reflect that industrial transfer is not the migration of the whole industrial chain.But the transfer of the relatively inferior link of the country in the industrial chain.Most of them are labor-intensive.

This not only accords with the objective law of economic development, but also effectively promotes the transformation and upgrading of the domestic economy.

However, industrial transfer has higher requirements for the quality of labor force, institutional environment and industrial base, and at the same time, it is necessary to avoid the hollowing out of domestic industry or over-reliance on the tertiary industry.

On the whole, the commonness of industrial transfer in East Asia still focuses on the following points:

1. The path law of industrial relocation basically follows the order of labor-intensive, capital-intensive and technology-intensive industries.

two。 In the relocation industry, the transfer scale of labor-intensive industries is large (concentrated in textiles and wood products), and there is a transfer phenomenon of labor-intensive links (processing and assembly) in high-tech-intensive industries.

3. The relocation of industries does not mean that the weight of the manufacturing industry in the overall economy has decreased. The manufacturing industries in Japan and South Korea have remained stable in the process of industrial relocation, mainly due to the improvement of high-tech industries.

4. The period of industrial relocation is relatively long, whether it is the trade war between Japan and the United States or the disturbance of the economic cycle, the phenomenon of short-term large-scale centralized transfer has not occurred in Northeast Asia, and the industrial transfer has basically lasted for more than 10 years, even reaching 20-30 years. The time of transfer depends on the industrial scale of the country and the capacity of the host country.

Who "drove" away the manufacturing industry?

So, can we use a quantitative indicator to examine which industries will be relocated?

In order to answer this question, we passedRevealed comparative advantage (RCA) coefficientTo observe the changes in the comparative advantage of the transferring countries.

We found that in the first half of the 1990s, there was a rapid decline in RCA in labor-intensive industries in both Taiwan and South Korea, and RCA began to stabilize in the second half. At the same time, the RCA of technology-intensive industries has increased to varying degrees at this stage.

▼ Taiwan of China

Data sources: Wind, Guotai Junan Securities Research

▼South Korea

Data sources: Wind, Guotai Junan Securities Research

In contrast, in China, at this stage, the RCA of labor-intensive related industries has increased to a certain extent, while the RCA of technology-intensive industries is also rising slowly.

We believe that the rise in RCA in China's technology-intensive industries during this period is more due to the transfer of labor-intensive links in the production process (assembly, processing), that is, the comparative advantages of all types of industries at this stage are concentrated in the labor cost advantage.

If we further combine the production capacity index, in South Korea in the middle and late 1980s, the production capacity index of labor-intensive related industries began to decline, but the capacity index of high-tech-intensive industries showed a certain upward trend in the late 1980s, which is also consistent with the results of the added value weight in our industrial structure.

▼ changes in South Korean labor-intensive industries capacity index

Source: Wind, Guotai Junan Securities Research

▼ Changes in production capacity Index of High-tech Industry in South Korea

Source: Wind, Guotai Junan Securities Research

Japan's textile industry declined rapidly in the 1970s, while iron and steel fell to a low level around the 1970s and 1980s. From the 1960s to the early 2000, the overall manufacturing capacity index experienced two rounds of fluctuations, in which the second round of manufacturing capacity index improvement background is the high-tech industry (machinery-related) capacity index upward.

▼ Labor-intensive and capital-intensive in JapanChanges in industry production capacity index

Source: Wind, Guotai Junan Securities Research

Does the industry upgrade and the industry falls?

So, does the "collective run" of the industrial chain mean "draining from the bottom" to the relevant industries of our country? This may not be the case.

At that time, due to the industrial transfer of Taiwan's traditional industries, most enterprises only transferred production links, such as the transfer of manufacturing plants to the mainland, but the headquarters of Taiwan-funded enterprises still chose to stay in Taiwan, China, and finally formed.Taiwan accepts orders and mainland productionThe mode of division of labor.

Most Taiwan enterprises with overseas investment are involved in triangular trade, that is, goods are shipped and destined for other economies without going through Taiwan, but the payment is settled in Taiwan.

The triangular trade in Taiwan is mainly concentrated in people's livelihood industry and metal machinery, among which machinery and equipment manufacturing and textiles account for more.

By comparing the operation of the enterprises involved in triangular trade and those that are not involved, we can see that the enterprises with higher intensity of foreign investment (making full use of external advantage resources) have defeated other enterprises in the increase of profit margin and added value rate.

▼ Those engaged in triangular trade and those who are not engaged in triangular tradeDifferences in the development of Taiwan enterprises

Source: office of Comptroller, Accounting and Accounting, Taiwan Executive Yuan, "Research on the changes of traditional Manufacturing Industries in China", Guotai Junan Securities Research

From the perspective of actual use of assets, the long-term assets of enterprises engaged in triangular trade expand rapidly, all belong to the category of large enterprises, and the long-term profitability of such enterprises has improved significantly.

In addition, from the two dimensions of innovation growth (R & D and technology investment) and total factor productivity improvement, we can find that foreign investment mostly improves the industry from the perspective of innovation growth, while the industries with obvious differences are concentrated in technology-intensive (equipment manufacturing, automobile) and metal products related industries.

From the point of view of profit, the change of industry profit does not strictly correspond to the relocation of industry, and the profit of transfer industry will fluctuate in the process of transfer, but the profit level of high-tech industry continues to rise. profits in labor-intensive industries generally decline with the rise in labor costs.

So we come to the conclusion thatThe relocation of industries does not necessarily have a negative impact on China.Although temporary frictional unemployment may be caused by changes in the industrial structure, it is likely to provide positive support in terms of profit improvement, industrial upgrading and trade promotion:

1. Due to making full use of external advantage resources, the profits of domestic related industries may be further improved in the midst of cost reduction.

two。 To accelerate the upgrading of domestic industries, on the one hand, industrial undertaking and industrial transfer complement each other, on the other hand, resource reallocation can make up for other technology-intensive links in the transfer industry.

For example, at the stage of the transfer of the automobile industry in that year, Japan focused more research and development efforts on the production of spare parts, and strictly purchased domestic products through Japanese car assembly, which made Japan constantly leap upward in the automobile production chain. to enhance the competitive advantage of the industry.

3. Promote the occurrence of complementary trade.The research of Schmitz and Helmberger (1970) shows that:

When the technologically advanced home country invests in the basic industries of the resource-rich host country, the export of capital goods of the home country will increase, and the vertically integrated production between developed and developing countries can create trade and realize trade complementarity.

In comparison, labor-rich countries will prefer capital-and technology-intensive products (demand exists, but domestic supply is scarce), so increase direct investment in countries with sufficient labor endowments, it will further increase the demand for capital and technology-intensive products in these countries, so the relocation of industries (international direct investment) will enhance complementary trade.

Conclusion

It is worth noting that the discussion on the scale of industrial transfer mentioned above is based on long-term volume, and the industrial transfer in Japan and Taiwan has lasted for 20-30 years.

At present, under the circumstances that the internal and external environment continues to change profoundly, we believe that China's future industrial transfer may have the following characteristics:

The transfer volume made in China is different from that of Japan, South Korea and Taiwan.

After the 1990s, China has the ability and space to fully undertake the transfer of relevant industries in various countries, and the concentration of industrial receiving countries will accelerate the speed of industrial transfer to a certain extent. But at present, the relocation of Chinese industry will be decentralized, which will further restrict the speed of industrial transfer.

The volume of China's domestic demand and the scale of its labor market are different from other countries and regions in Northeast Asia.

Therefore, in terms of transfer, the extent of transfer may be weaker than the historical transfer of other countries, and the domestic demand support for textile clothing and other consumer goods will bring certain constraints to the relocation of the industry.

Industrial transfer will aggravate the differentiation of domestic enterprises

With the continuous improvement of the added value of the domestic high-tech industry, the added value of the domestic manufacturing industry as a whole will not face contraction, and it may be closer to the situation of Japan in this regard.

The deepening of the global vertical division of labor will be more conducive to the development of high-tech industries and effectively hedge the negative impact on employment and output brought about by the momentum contraction of the old economy.

In the future, the performance of enterprises involved in foreign investment within the industry may be better than that of other enterprises in the industry, and the differentiation of domestic enterprises will be more obvious.

Edit / Edward