November 16 news, after two years of gestation, the China Securities Regulatory Commission comprehensively promoted the "full circulation" reform of H shares. The CSRC said that steadily promoting the reform of the "full circulation" of H shares on the basis of pilot experience is conducive to promoting the consistency of the interests of various shareholders of H-share companies and the improvement of corporate governance, helping domestic enterprises to make better use of both domestic and foreign markets and resources for development, and is also conducive to the development of Hong Kong's capital market. So what is the full circulation of H shares? What are the main points of this reform? How large is the capital market involved and what is the impact on the Hong Kong A stock market?

What is the full circulation of H shares?

The CSRC decided to launch a pilot scheme for the full circulation of H-shares before the end of 2017. to put it simply, H-shares are the types of shares listed outside the Hong Kong stock market by Chinese-registered companies, including "foreign-funded shares" that can be traded in the Hong Kong stock market. and "domestic shares".

If the domestic shares of H-share companies have not been publicly listed in the domestic market, they are in a state of non-negotiability relative to the open market. This pilot project will allow relevant enterprises to transfer this share capital to the Hong Kong stock market. Corresponding to foreign capital shares (H shares), the shares of domestic companies that issue foreign capital shares to domestic investors are called domestic capital shares.

Foreign-funded shares must be "listed abroad", that is, they can be circulated and transferred in the securities exchange open to overseas companies, but they may take the form of overseas certificates of deposit or other derivative forms of stocks. Domestic stocks do not have to be listed on the domestic market. Before domestic stocks are publicly listed and traded in the domestic market, domestic stocks are in a state of non-circulation (relative to the open market).

On the other hand, the full circulation of H shares will allow the conversion of "domestic shares" into "foreign shares", all of which will be traded in the Hong Kong stock market, giving major shareholders the opportunity to reduce their holdings and cash out. It means that domestic enterprises listed under the H-share structure convert their domestic shares that have not yet been publicly traded into foreign shares and trade them publicly on the Hong Kong stock market.

The conditions for the comprehensive promotion of the full circulation of H shares are already in place.

Previously, the only case of full circulation of H shares was China Construction Bank Corporation listed in Hong Kong in October 2005 in the form of full circulation of H shares. In 2005, China Construction Bank Corporation listed in Hong Kong through H-share circulation, when the bank's domestic shares were specially approved to convert H-share circulation, but there have been no such cases since then.

On December 19, 2017, the CSRC announced that it would launch a pilot project of "full circulation" of H-share listed companies, with no more than three pilot companies, and would follow an orderly approach of "mature one, launch one". This is 13 years later, the Securities Regulatory Commission once again launched the H-share full circulation pilot.

With the approval of the State Council, the CSRC took Lenovo Holdings, AVIC and Shandong Weigao Group Medical Polymer as pilot companies to promote the development of "full circulation" of H shares, and completed the pilot projects on June 6, June 15 and August 7, 2018, respectively.

The stock prices of the three pilot companies have a smooth transition after the completion of the pilot, and have achieved good positive stock price volatility returns, indicating the market's recognition of the H-share full circulation pilot, and it is expected that full circulation will have a significant positive effect on the pilot companies.

Recently, Yi Huiman, chairman of the Securities Regulatory Commission, said that five of the nine measures for opening up China's capital market announced at the Lujiazui Forum in June this year have been implemented, and the remaining four will basically be landed by the end of the year, including the urgent issuance of guidelines on the full circulation of H shares.

On November 15, 2019, the CSRC said that on the basis of pilot experience, the reform of "full circulation" of H shares has been steadily promoted, which indicates that the reform of full circulation of H shares, which has been brewing for two years, has entered the fast track, and the conditions for the comprehensive promotion of full circulation of H shares are already in place.

A comprehensive list of the main points of the full circulation of H shares, what are the changes

Fully promote the full circulation of H shares:

No longer set some restrictions, in accordance with the principle of "mature one, launch one" in an orderly manner.

The objects of full circulation include domestic shares before and after listing, as well as uncirculated domestic shares held by foreign shareholders.

This full circulation is not only for H shares, but also for new shares listed in Hong Kong in the future, listed companies can apply on their own.

In principle, the application for the "full circulation" of H shares should be approved by the industry regulatory authorities in advance.

A company applying for "full circulation" of H shares shall comply with the rules and regulations of the Hong Kong Stock Exchange.

After the H-share company is in full circulation, it can issue additional shares within the territory, and the additional shares issued to the domestic main body are still domestic shares.

Domestic shareholders participate in the "full circulation" business of H shares through A-share securities accounts, and do not need to open new securities accounts.

Domestic shareholders shall choose a domestic securities company through the company to participate in the "full circulation" transaction of H shares.

The reform of H-share "full circulation" has no direct impact on the operation of A-share market.

Q: what are the main changes in the "full circulation" of H shares on the basis of the pilot project?

A: in 2018, the CSRC successfully completed the pilot project of "full circulation" of H shares. In 2019, on the basis of summing up the experience of the pilot project, the CSRC comprehensively promoted the "full circulation" reform. The full promotion of "full circulation" mainly involves the following changes:

First, summarize the good practices during the pilot period, form a rule system, and clarify it in the form of business guidelines.

Second, no longer set restrictions on the size of the company, industry, etc., in the case of meeting foreign capital access and other management regulations, the company and shareholders can make their own decisions and apply for "full circulation" in accordance with the law.

Third, there is no limit on the number of families and a time limit for completion, and it is promoted in an orderly manner in accordance with the principle of "mature one, launch one".

Q: what is the applicable object and scope of H-share "full circulation"?

A: the following types of shares of H-share companies or companies that intend to apply for initial public offering of H-shares may apply for "full circulation" of H-shares:

First, domestic shares held by domestic shareholders before overseas listing, second, additional domestic shares issued in China after overseas listing, and third, unlisted tradable shares held by foreign shareholders.At this stage, the "full circulation" shares are listed on the Stock Exchange of Hong Kong.

Q: what administrative licensing procedures are applicable for H-share companies and shareholders of relevant domestic unlisted shares to apply to participate in the "full circulation" of H-shares?

Answer: the application for "full circulation" of H shares shall be incorporated into the existing administrative license procedure of "overseas public offering of shares and listing (including additional issuance) of joint stock limited companies" by the China Securities Regulatory Commission. Combined with the characteristics of "full circulation" matters, the simplified and optimized catalogue of application materials and the main points of attention have been published on the website of the CSRC.

An H-share company may apply alone or when applying for overseas refinancing; an unlisted domestic joint stock limited company may also apply for overseas initial public offering.

Q: is it necessary to obtain the opinions of industry regulatory authorities and state-owned assets authorities in advance to apply for the "full circulation" of H shares?

Answer: financial, similar financial industry companies, and other companies that set access requirements for shareholder qualifications, should, in principle, obtain the consent of the industry regulatory authorities to apply for H-share "full circulation".

The company controlled by the state-owned shareholders and the application for "full circulation" of the shares held by the state-owned shareholders shall comply with the relevant provisions on the supervision and administration of state-owned equity.

Q: does a company's application for "full circulation" of H shares need to be approved by a general meeting of shareholders or a class of shareholders' meeting?

Answer: when a company applies for "full circulation" of H shares, it shall comply with the law, be fair and just, fully protect shareholders' right to know and participate, and perform the necessary internal decision-making procedures in accordance with the provisions of the Company Law and the articles of Association. According to the pilot experience, the three pilot companies have clearly defined the procedures related to "full circulation" matters in their articles of association, as well as the voting procedures that are not applicable to shareholders' meetings / class shareholders' meetings. Relevant matters shall also meet the requirements of the rules such as the listing decision of the Hong Kong Stock Exchange (HKEx-LD56-1).

Q: can H-share companies issue additional shares to domestic entities after "full circulation"?

A: according to the current laws and regulations, after H-share companies are in full circulation, the additional shares issued to domestic entities are still domestic shares.

Q: is it necessary to open a new securities account for relevant domestic shareholders to participate in the "full circulation" business of H shares?

Answer: domestic shareholders participate in H-share "full circulation" business through existing RMB ordinary stock accounts (that is, A-share securities accounts), and do not need to open new securities accounts.

Question: how do the relevant domestic shareholders buy and sell H shares through the "full circulation" mechanism of H shares?

Answer: domestic shareholders should choose a domestic securities company through the corresponding H-share company ("our company") to participate in H-share "full circulation" transactions. The specific path is to submit the trading entrustment order through the domestic securities company and transmit it to the Hong Kong securities company designated by the above-mentioned securities company through Shenzhen Securities Communications Co., Ltd. Hong Kong securities companies shall conduct corresponding securities transactions in the Hong Kong market in accordance with the rules of the Hong Kong Stock Exchange.

Under the H-share "full circulation" mechanism, domestic shareholders may only increase or decrease their holdings of the Company's shares circulating on the Hong Kong Stock Exchange in accordance with the relevant business rules. At present, this function has not been opened for technical reasons and will be launched according to the program when the technical system and other conditions are available.

9. Q: how are H shares "fully tradable" shares registered after cross-border transfer registration has been completed as required?

A: under the "full circulation" mechanism of H shares, the shares after cross-border transfer registration are registered in the register of shareholders of H-share companies in the name of the agent of Hong Kong Securities Clearing Limited (that is, "Hong Kong Clearing"). It is recorded in the account system of Hong Kong Clearing in the name of China Securities Registration and Clearing (Hong Kong) Limited (that is, "China Clearing Hong Kong").

Q: will the relevant domestic shareholders appear in the register of shareholders of overseas listed companies after the "full circulation" of H shares? Why?

A: no, the main reason is that the Hong Kong market implements a multi-level holding system based on indirect holding. In the Hong Kong market, if investors want to trade stocks, they need to centrally deposit the shares through securities companies and other institutions to Hong Kong settlement, which will eventually be reflected in the register of shareholders in the name of Hong Kong settlement agents. For domestic shareholders under the H-share "full circulation" mechanism, their shares are held in custody in China Clearing Hong Kong in the name of China Clearing Hong Kong and deposited in Hong Kong Clearing in the name of China Clearing Hong Kong, and appear on the register of shareholders of H-share companies with "Hong Kong Securities Clearing (Agent) Limited" as the ultimate nominal holder.

Q: how do domestic securities companies participate in the business related to the "full circulation" of H shares?

Answer: domestic securities companies participating in H-share "full circulation" transactions shall meet the relevant requirements of the brokerage business management of the China Securities Regulatory Commission, and verify the trading qualifications, funds, securities and prices involved in client entrustment. Check whether the funds and securities are sufficient, ensure that the target scope and foreign exchange quota entrusted by customers comply with the relevant regulations, and maintain normal trading order.

At the same time, participating securities companies should have the relevant technical systems and operation and maintenance capabilities required by "full circulation", and should meet the testing and acceptance of technical systems such as access to China Clearing and Shenzhen Exchange, so as to ensure the stable operation of the technical system.

Q: what is the impact of the H-share "full circulation" reform on the A-share market?

A: the H-share "full circulation" reform has no direct impact on the operation of the A-share market. The reform only involves single H-share companies listed only on the Hong Kong market. After the relevant domestic unlisted shares are converted into H-shares, all of them will be listed and traded on the Hong Kong Stock Exchange. A + H-share companies do not involve the issue of "full circulation".

At present, the stock of domestic unlisted shares of single H-share companies is small, which is only equivalent to less than 7% of the total market value of shares listed on the Hong Kong Stock Exchange. Pilot experience shows that pilot companies and relevant shareholders apply for the implementation of H-share "full circulation", pay more attention to the market-oriented valuation of domestic unlisted shares, and expand the circulation scale of the company's listed shares in Hong Kong. it is believed that this will attract more international investors to invest in H-share companies, which is conducive to the long-term development of the company and the interests of shareholders. After the implementation of "full circulation", H-share companies are affected by many factors, such as the management of state-owned assets, the maintenance of control and the level of market valuation. it is expected that the trading activities of relevant shareholders, especially major shareholders, will be limited and have little impact on the operation of the market.

Involving a market capitalization of 2 trillion yuan, a list of potential full-circulation companies

According to wind data, as of November 15, 2019, there are 280 H-share companies in the Hong Kong stock market, of which 118 are A-share companies, while the remaining 162 H-shares are only listed in Hong Kong shares and domestic shares are not in circulation. Among them, three companies have piloted full circulation of H shares. Considering that Lenovo Holdings, Shandong Weigao Group Medical Polymer and AVIC have piloted full circulation, this paper does not make a calculation. However, as of the 15th, 46 per cent of Lenovo's shares were still outstanding, valued at HK $17.6 billion. This paper excludes Lenovo Holdings and examines the remaining 161 pure H-share companies.

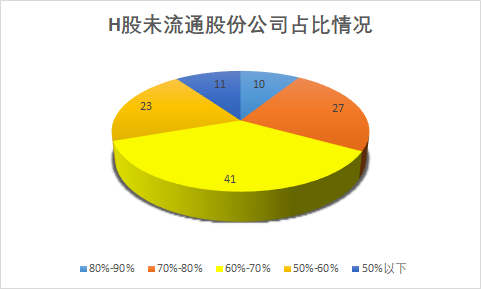

Of the 161 H shares, 149 companies account for more than 50% of the non-tradable shares, which means that in all H shares, almost all listed companies are dominated by non-tradable shares. Of these, 12 account for more than 80%, 27 between 70% and 80%, 41 between 60% and 70%, 23 with 50-60%, and only 11 with less than 50%. The smallest proportion of non-tradable shares is 9% of rich birds.

Among them, South Soft has the highest proportion of non-tradable equity, accounting for 84.6%, with a total market capitalization of only HK $230 million. China Reinsurance, Jiujiang Bank, Shanxi Merchants Bank, Yitai Coal, China Telecom Corporation, Hengtou Securities, Guangzhou Agricultural and Commercial Bank, Central Plains Bank and Jiutai Agricultural and Commercial Bank all accounted for more than 80 per cent.

Among them, the highest non-tradable market capitalization is Postal Savings Bank of China's HK $316.3 billion, followed by China Telecom Corporation and China Tower Corporation's unoutstanding shares with a market capitalization of more than 200 billion. The non-tradable share capital of the three enterprises accounted for 75.5%, 82.85% and 72.49% respectively, which was significantly higher.

It should be pointed out that the rich bird's non-tradable shares account for only 9.12%, but the company is currently in a debt crisis and is facing delisting. Only AVIC and Shandong Weigao Group Medical Polymer have converted to 100% Hong Kong shares after completing the pilot project of full circulation of H shares, while Lenovo Holdings has achieved the pilot process of full circulation of H shares, but 54 per cent of its shares have not yet been converted into tradable H shares.

It is worth mentioning that among these pure H shares, there are as many as 16 bank shares, which is one of the relatively high sectors.

At the same time, in this batch of pure H shares, some companies have already had the meaning of returning to A, among which there are many large and small bank stocks. The one that attracted the most attention was undoubtedly Postal Savings Bank of China, who set the record for the largest IPO fund-raising in the world in the past two years. Postal Savings Bank of China's A-share prospectus was disclosed on the official website of the China Securities Regulatory Commission on June 28 this year.

On the evening of September 6, the China Securities Regulatory Commission issued a notice approving the application for A-share IPO issuance of Chongqing Agricultural Commercial Bank. This means that Chongqing Agricultural Commercial Bank is about to be listed on the main board of the Shanghai Stock Exchange, which will become the 34th A-share listed bank and the first A-share listed agricultural commercial bank in the country. The announcement shows that Chongqing Agricultural Commercial Bank intends to issue no more than 1.357 billion shares this time, and all the funds raised will be used to replenish capital and improve the capital adequacy ratio after deducting the issuance expenses.

In addition, Huishang Bank, Guangzhou Agricultural and Commercial Bank, Harbin Bank, Shengjing Bank, Jinzhou Bank, etc., have also announced plans to return to A-shares, and many of them have submitted A-share prospectuses to the CSRC.

According to Sina Hong Kong stock statistics, if the market value of domestic shares is estimated based on the current H-share prices, the uncirculated domestic stock market value of these companies is about HK $2.01328 trillion. As of the end of October, the total market value of Hong Kong shares was 31.8 trillion Hong Kong dollars. Unoutstanding domestic shares account for about 6.33% of the total market capitalization of the Hong Kong stock market. If the full circulation of H-shares is fully implemented in the future, it will undoubtedly have a significant impact on the Hong Kong stock market.

The attack of 2 trillion yuan market reform will have an overall impact on A shares, Hong Kong stocks and enterprises.

For enterprises,

Improve the level of corporate governance and improve the structure of H shares

Tianfeng Securities pointed out that the full circulation reform allows domestic shareholders to reduce their holdings in the Hong Kong market directly without going through the VIE structure, which will attract more inland companies to list in Hong Kong through the H-share model, which will help to improve the structure of H-shares. Chuancai Securities said that "full circulation" to expand H-share financing channels, improve corporate governance, raise the level of valuation.

Increase the market participation of Chinese enterprises

BA Shusong, chief China economist of Hong Kong Exchanges and Clearing, said: for the financial market, the full circulation of H shares enriches the market participation of Chinese companies listed in Hong Kong and increases the trading volume and liquidity of the market. Lin Zijun, executive director of the Ministry of Finance and Technology of Linda Holdings (0.181, 0.181 and 0.181), said: after the H shares are fully circulated, the interests of shareholders are tied together, which is conducive to the development of the company's business. Yan Zhaojun, an analyst at Sino-Thai International Strategy, said: on the positive side, full circulation can align the interests of domestic shareholders with those of other shareholders, which is conducive to enhancing the value of the company.

Invigorate enterprise assets and improve liquidity

Wen Tina, chief executive of Boda Capital International, said: the full circulation of H shares plays a very important role in turning unlisted corporate shares into liquid assets and foreign exchange assets. this kind of liquid assets and foreign exchange assets can be traded and bought and sold on secondary listings. The revitalization of this kind of assets is of great significance to the development of state-owned enterprises and makes the development of enterprises more flexible.

Shorten the AH price difference

For dual-listed companies, full circulation helps to make prices fairer and reduce AH price differentials, says Mr Lin. On the impact of a company with a wide price gap like Citic Construction Investment, he said: Citic Construction Investment H shares may be helpful, but the overall market needs time to digest, the price difference also needs time to repair, CITIC Construction Investment A shares or under pressure.

Stock prices of companies with high valuations or backward industries are under pressure

Yan Zhaojun, an analyst at Sino-Thai International Strategy, said: in the short term, after full circulation, the number of outstanding shares has increased, increasing potential shareholder selling pressure, and some domestic shareholders may sell. For some shares, the circulation of H shares increases the supply of shares in the market, and if the performance is not good, it will increase the pressure to sell short, said Mr Lin.

Wen Guanlin, director of Huisheng Tianji family office and wealth management strategist, said that the full promotion of full circulation is good for valuable companies, and it is very likely to bring selling pressure to companies that already have high valuations or backward industries.

Wen Jie, wealth management strategist at Everbright Sun Hung Kai, said he agreed with the CSRC that full circulation will attract more international investors to invest in H-share companies, which is conducive to the company's long-term development. However, we should pay attention to the short-term negative impact of the increase in tradable shares on stock prices in the future.

The following are the 10 companies with the highest price-to-earnings ratios in pure H shares. Among them, rich bird tops the list and is still suspended; Changan Renheng is valued at nearly 90 times, and its share price has plummeted in September and has nearly halved so far this year. Heng Investment Securities is valued at 66 times and is up 56% this year.

For the Hong Kong stock market

Strengthen Hong Kong's status as an international financial centre

BA Shusong, chief China economist of Hong Kong Exchanges and Clearing, said in "promoting the full circulation of H shares to improve the efficiency of resource allocation" that from the perspective of historical background, policy logic, reform purpose and market environment, there is a basic logical difference between the full circulation of H shares and the reform of non-tradable A shares. The full circulation of H shares has obvious positive significance for the listed H shares to promote enterprise reform, strengthen the function of capital market and promote Hong Kong's status as an international financial center.

Help to attract overseas capital and mainland enterprises to list in Hong Kong

BA Shusong said that from the perspective of China's financial policy, the full circulation of H shares can provide a new platform for the mixed ownership reform of state-owned enterprises and new opportunities to attract overseas capital. Wen Tianna said that the full flow of H shares is tantamount to taking the initiative to go out, which is more direct than the Shanghai-Lun Stock Connect, and Hong Kong is China's international market and is free from foreign interference or threats. H-shares are foreign exchange assets, and the role of H-shares still exists before the mainland capital account is opened.

The HKEx will be seen as a big winner of full circulation, with about 2 trillion yuan of unoutstanding shares released in the future. Market participants believe that this is conducive to attracting more Chinese enterprises to list in Hong Kong.

Give full play to the synergistic effect of Hong Kong shares and A shares

Wen Tianna said: the full circulation of H shares can be brought into play in the value of the enterprise. at present, the market value of Hong Kong shares listed is only 10% of the total share capital, 15% of the total share capital, and the main corporate shares are not included. After the full circulation of H shares, the market value of Hong Kong shares will increase significantly, and Hong Kong stocks are China's international market, which will have a better synergy effect with the mainland A-share market.

Increase the turnover rate, improve the liquidity of Hong Kong stocks, and the market value of Hong Kong stocks has increased significantly.

Once H shares are fully circulated, the market value of H shares listed in Hong Kong will increase greatly, and the market capitalization of many H shares which are undervalued in blue chips due to lack of liquidity will help push up the market value of Hong Kong stocks.

Wen Guanlin said that the full circulation of H shares can increase the turnover rate, improve the overall activity, and improve the efficiency of the company's curtain capital in the capital market.

Lin Zijun said that generally speaking, H shares will have a certain discount compared with the general stock valuation (because there are fewer outstanding shares, the fund will also consider liquidity risk when considering liquidity risk). After full circulation, for some high-quality stocks, the fund can allocate more funds, which is beneficial to the stock price. For the market, it is a symbol of further opening up, but for Hong Kong stocks, liquidity will help to some extent, but it is believed that it is gradual and the phased process will not break out suddenly.

HKEx becomes the biggest winner

The HKEx will be seen as a big winner in the full float of H shares, with about HK $2tn of unoutstanding shares released in the future. A spokesman for the CSRC said that at present, the stock of domestic shares in H shares is not large, only equivalent to less than 7% of the total market value of shares listed on the Hong Kong Stock Exchange. Market participants believe that this is conducive to attracting more Chinese enterprises to list in Hong Kong.

For the A-share market

The CSRC said: the H-share "full circulation" reform has no direct impact on the operation of the A-share market. The reform only involves single H-share companies listed only on the Hong Kong market. After the relevant domestic unlisted shares are converted into H-shares, all of them will be listed and traded on the Hong Kong Stock Exchange. A + H-share companies do not involve the issue of "full circulation".

Promote corporate governance and improve the financial leverage of A-share shareholders

As most of the shareholders holding domestic shares are major shareholders, including the central government and local governments, the conversion of undervalued domestic shares into fully tradable H shares will help those shareholders to cash out or raise funds. This will improve the financial leverage of the mainland government and major shareholders, and even make the mainland banking system more robust.

Reduce the cost and risk of listed companies

Luo Shangpei, director of Galaxy International Securities Business Development, said that in terms of corporate governance, full circulation reform also has many benefits. First of all, after the "full circulation" of H shares, there will be no need to set up a red chip structure to complete the restructuring, reduce listing costs and risks, and help improve the quality of corporate governance and the feasibility of foreign supervision of management.

Promote more H-share companies to return to A-share

Luo Shangpei, director of Galaxy International Securities Business Development, said that after H shares are fully circulated, the possibility of red chips returning to A shares will increase. In addition, as the full circulation of H-shares is a reciprocal structure for A-shares and H-shares, companies that fail to meet the conditions for A-share listing can first be listed in H-shares and return to A-shares when the time is ripe.

Impact on investors

For investors, there is no doubt that they are most concerned about three aspects.

First, is there a corresponding compensation mechanism for the non-tradable share structure reform such as the full circulation of H shares? After all, for the vast majority of enterprises, the cost of holding shares from state-owned shares or corporate shares and institutional original shares is too low, once parity is liberalized, it may undoubtedly mean a huge and unequal difference in shareholding costs for shareholders in the secondary market.

Second, will the arrival of the full circulation of H shares have a major impact on the stock price? After all, most companies have twice as many non-tradable shares as free-floating shares, which undoubtedly means huge selling pressure.

Third, will it lead to a change in the control of the underlying company, thus changing the company's business direction and strategy, and ultimately affect the performance of the company? Because full equity circulation means that equity will be determined by the market in most cases, this gives the barbarians outside the door some opportunities to come in and raise their cards.

However, the above worries of investors may be a little unnecessary from the relatively stable and healthy outcome of the changes in the share prices and ownership structure of the three companies that have been successfully piloted before. The Securities Regulatory Commission has clearly stressed that in the future, we should adhere to the principle of positive, steady and gradual progress, and promote the full circulation of H shares in an orderly manner in a mature way. Therefore, it is impossible for multiple stocks to implement the reform of full circulation of H shares at the same time, and the impact on the incremental supply of Hong Kong stock market will be negligible.

For investors, this means that they can have a better understanding of their choices in the future and have more likely returns in the future. As the agency said, the selling pressure on stocks with high valuations increases, and it is undoubtedly a major boon for undervalued, high-quality companies.

Attached is the list of 161 pure H shares.

Edit / Edward