Source: Glonui.

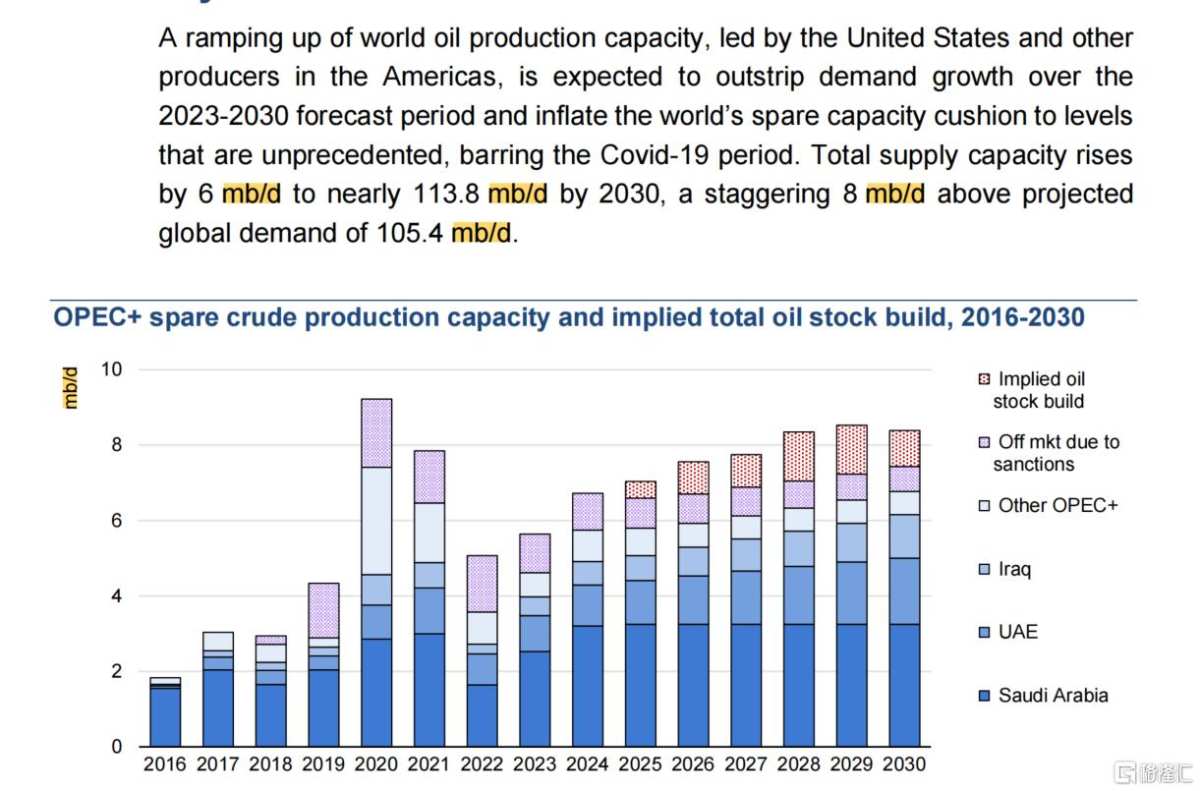

The idle petroleum production capacity exceeds 8 million barrels per day.

The International Energy Agency (IEA) warned in its latest report today that with the increase in production by oil companies, the world will face a "staggering" surplus of millions of barrels of oil per day by the end of this century, weakening the ability of OPEC+ to manage crude oil prices. In terms of the product structure, the operating income of products with a scale of 10-30 billion yuan is 401/1288/60 million yuan respectively.

IEA predicts that global oil demand will reach a peak of nearly 106 million barrels per day by 2030, slightly higher than the slightly above 102 million barrels per day in 2023.

Continuous investment in oil-producing countries, led by the United States, will lead to global oil supply reaching nearly 114 million barrels/day by 2030, resulting in excess idle oil production capacity of more than 8 million barrels/day.

IEA also stated that this "huge" oil surplus could "upset" efforts by OPEC+ to manage the market, ushering in an era of falling oil prices.

IEA added that apart from the COVID-19 pandemic, such a high level of excess production capacity would be unprecedented.

In terms of demand, IEA believes that Asia, particularly China and India, will be the main driving force behind the growth in oil demand, and the oil demand of OECD member countries is expected to decline significantly.

In terms of supply, IEA predicts that non-OPEC+ countries, especially the United States and other countries in the Americas, will dominate the growth of oil production capacity, and OPEC+ will lose market share.

IEA Executive Director Fatih Birol said, "There will be a serious oversupply of oil by the end of this century, which suggests that oil companies may want to ensure that their business strategies and plans are prepared for the changes that are taking place."

OPEC remains optimistic about oil demand.

At the same time, the Organization of the Petroleum Exporting Countries (OPEC) remains optimistic about global oil demand prospects.

Since the end of 2022, OPEC+ has implemented a series of production cuts to support oil prices.

On June 2, OPEC+ agreed to extend the 2.2 million barrels per day production cut measures until the end of September, and plans to gradually resume supplies from October.

After the above decision was announced, international oil prices fell to a four-month low, but have since recovered lost ground from the previous week.

Yesterday, OPEC maintained its forecast for strong global oil demand growth in 2024 and said that the tourism industry will support oil consumption in the second half of the year.

OPEC predicts that global oil demand will increase by 2.25 million barrels per day in 2024 and by 1.85 million barrels per day in 2025, both of which are the same as the previous month's forecast.

IEA's latest forecast is that global crude oil demand will only increase by 960,000 barrels per day in 2024, 100,000 barrels per day lower than last month's forecast, and oil demand growth in 2025 will be only one million barrels per day.

OPEC believes that the global economy continued to grow steadily in the first half of this year and predicts that oil demand will increase by 2.3 million barrels per day in the second half of the year, 150,000 barrels per day higher than in the first half of the year, and the same as last month's forecast.

OPEC analysis showed that, "The global service sector maintains a stable momentum, and is expected to be the main driving force of economic growth in the second half of this year, especially the tourism industry, which will have a positive impact on oil demand."

OPEC predicts that daily oil supply from the entire OPEC+ during the third quarter of this year will be 43.6 million barrels, about 2.7 million barrels higher than last month's output.