This article synthesizes from American Stock House and lesis.

Authors: 3D prediction, lesis

Investors often ask the question of which ETF to buy. Before answering, the author usually asks: are you doing short-term work? Or medium-and long-term?

Because different trading strategies require different types of ETF. If it is short-term trading, the author will choose to synchronize with the rise and fall of the market, but the volatility of ETF is greater, because the purpose of short-term speculation is to obtain greater profits with higher risk.

As for long-term investments (including retirement investment accounts) should choose which ETF or fund, this is the topic to be discussed today.

In the US stock market, the most familiar and most traded ETF areS & P 500 ETF-SPDR (SPY.US) $、$PowerShares QQQ Trust, Series 1 (QQQ.US) $、Russell 2000 Index ETF (IWM.US) $And$Financial Industry ETF-SPDR (XLF.US) $Wait.

Among them, ETF, which tracks the broader index of US stocks (rather than industry index or foreign index), is usually divided into large stocks (such as SPY and DIA), technology stocks (such as QQQ), medium-sized stocks (such as MDY) and small stocks (such as IWM), and mutual funds are basically classified in this way.

So, which ETF is suitable for long-term holding?

The author believes that the selection criterion should be that its long-term return is greater than the market index, and the volatility is less than the market index. The broader index here is the S & P 500 recognized by the investment community, not the Dow Jones Industrial average, which is often quoted by the news media.

Let's take a look.Long-term return rate:

In the 10 years from 2001 to 2010, the US stock market experienced two bear markets and two bull markets, with basically zero return on the large-cap index and zero return on the tech index, but small and medium-sized stocks were profitable and made a lot of money.

Judging from the historical performance in the past, as long as the US economy is growing positively, large stocks, technology stocks, small stocks, and medium stocks will all be profitable, but small and medium stocks tend to have higher returns. Thus it can be seen that ETF and mutual funds of small and medium stocks are long-term investors.Long-term holdingThe first choice.

It is worth noting that in the bullish period, the index ETF, which tracks midcap stocks, is more competitive and share prices are more explosive.

Let's take a look at volatility:

I said earlier.The criteria for choosing ETF, except that the long-term return is higher than the market index, it is less volatile than the market index.

The so-called "less volatility" means that when the stock market enters a medium-and long-term decline band (such as a bear market), the ETF we choose also falls, but the decline is relatively small, the loss of holding positions is smaller, and the psychological pressure on long-term investors is lower.

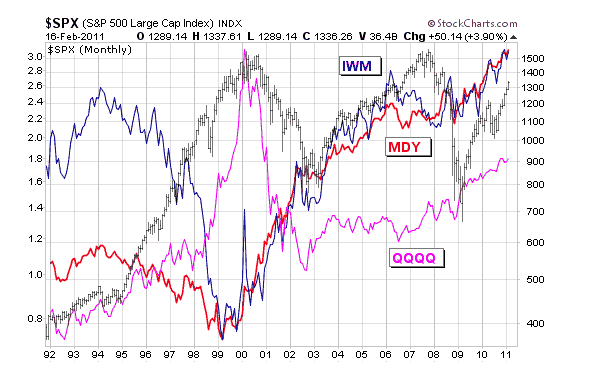

The following figure shows small-cap ETF (Russell 2000 Index ETF (IWM.US) $), medium-sized ETF (S & P midcap index ETF-SPDR (MDY.US) $) and technology stock ETF ($PowerShares QQQ Trust, Series 1 (QQQ.US) $) and the relative strength curve of Seven P 500 index. It can be seen that the US stock market suffered a heavy blow during the 2008 financial crisis, but IWM, MDY and QQQ all performed well and did not fall more than the broader market index.

However, in the bear market from 2001 to 2002, the QQQ of technology stocks fell sharply, while the relative strength curve of small-cap and medium-sized stocks rose, indicating that the decline and volatility were less than the broader index.

If we further compare small-cap IWM with mid-cap MDY, we will find that mid-cap stocks are less volatile. Between 2002 and early 2003, for example, small-sized indexes fell more than medium-sized ones.

In addition, the US stock market rose continuously between 1994 and 1999, with small-cap stocks rising relatively small, and medium-sized stocks rising less than large-cap stocks and technology stocks, but stronger than small-cap stocks.

To sum up, track the ETF index of midcap stocks (for example, those that track the Simpp 400 midcap indexS & P midcap index ETF-SPDR (MDY.US) $) more suitableLong-term holding.Far-sighted, 10, 20 years, long-term hold, do not give up do not leave, this is the most successfulLong-term investment.

(PS: the above discussion only represents the author's point of view and does not constitute the basis for investment decision)

Click to watch the introductory course on ETF!

Edit / Phoebe