Benzinga's options scanner has just identified more than 11 option transactions on Home Depot (NYSE:HD), with a cumulative value of $442,678. Concurrently, our algorithms picked up 4 puts, worth a total of 247,751.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $325.0 to $390.0 for Home Depot over the recent three months.

Analyzing Volume & Open Interest

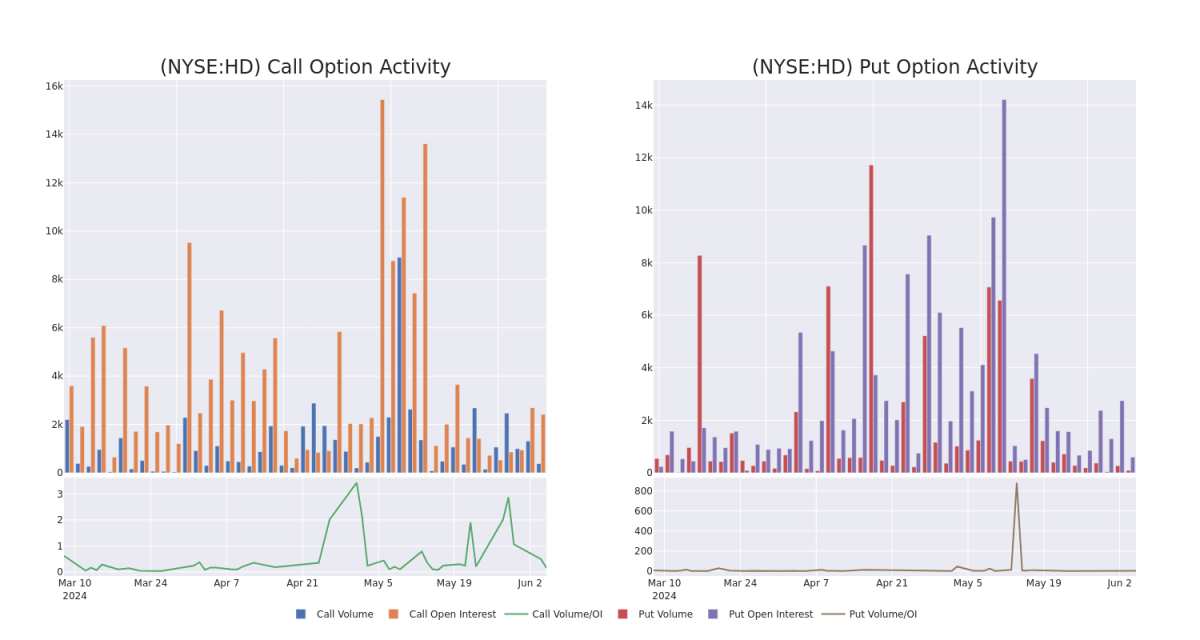

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Home Depot's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Home Depot's whale activity within a strike price range from $325.0 to $390.0 in the last 30 days.

Home Depot Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

HD | PUT | TRADE | BULLISH | 07/19/24 | $18.95 | $17.3 | $17.85 | $345.00 | $89.2K | 427 | 52 |

HD | PUT | SWEEP | BULLISH | 09/20/24 | $65.25 | $62.15 | $63.29 | $390.00 | $75.7K | 58 | 12 |

HD | PUT | TRADE | NEUTRAL | 07/19/24 | $32.55 | $30.7 | $31.61 | $360.00 | $47.4K | 5 | 15 |

HD | CALL | SWEEP | BULLISH | 08/16/24 | $12.3 | $12.15 | $12.3 | $330.00 | $45.5K | 315 | 36 |

HD | CALL | TRADE | BULLISH | 07/05/24 | $8.8 | $7.9 | $8.58 | $325.00 | $42.9K | 13 | 50 |

About Home Depot

Home Depot is the world's largest home improvement specialty retailer, operating more than 2,300 warehouse-format stores offering more than 30,000 products in store and 1 million products online in the United States, Canada, and Mexico. Its stores offer numerous building materials, home improvement products, lawn and garden products, and decor products and provide various services, including home improvement installation services and tool and equipment rentals. The acquisition of distributor Interline Brands in 2015 allowed Home Depot to enter the maintenance, repair, and operations business, which has been expanded through the tie-up with HD Supply (2020). The additions of the Company Store brought textile exposure to the lineup, while Redi Carpet added multifamily flooring.

Where Is Home Depot Standing Right Now?

With a trading volume of 219,932, the price of HD is down by -0.45%, reaching $326.79.

Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

Next earnings report is scheduled for 69 days from now.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.