Radware Ltd. (NASDAQ:RDWR) shareholders should be happy to see the share price up 11% in the last month. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 37% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Since Radware has shed US$58m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Because Radware made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last three years, Radware's revenue dropped 0.8% per year. That is not a good result. The annual decline of 11% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

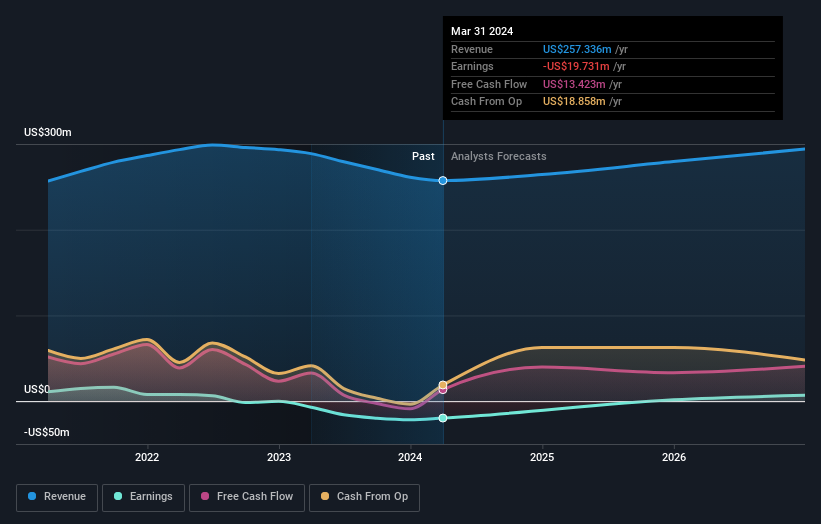

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Radware's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Radware shareholders are down 5.3% for the year, but the market itself is up 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 5% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. You could get a better understanding of Radware's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Radware may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.