Financial giants have made a conspicuous bullish move on Aon. Our analysis of options history for Aon (NYSE:AON) revealed 15 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $1,149,657, and 5 were calls, valued at $263,241.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $270.0 to $330.0 for Aon during the past quarter.

Volume & Open Interest Development

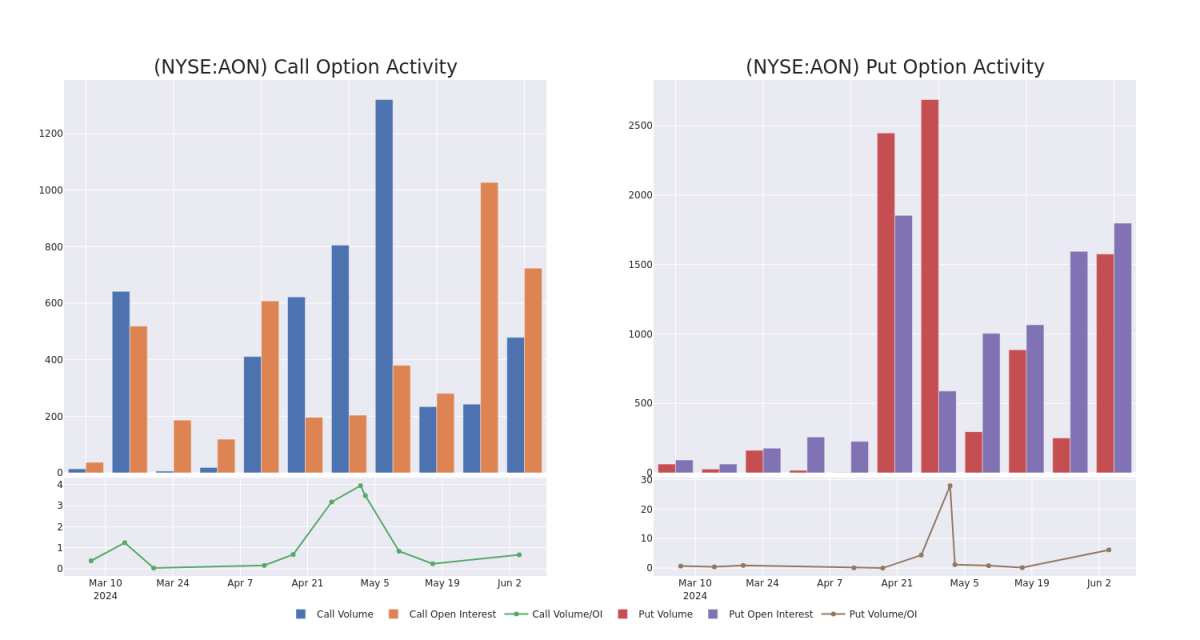

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Aon's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Aon's whale activity within a strike price range from $270.0 to $330.0 in the last 30 days.

Aon 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AON | PUT | SWEEP | BULLISH | 06/21/24 | $46.1 | $44.6 | $44.7 | $330.00 | $191.9K | 272 | 115 |

| AON | PUT | TRADE | NEUTRAL | 06/21/24 | $46.3 | $43.3 | $44.8 | $330.00 | $165.7K | 272 | 72 |

| AON | PUT | TRADE | BULLISH | 06/21/24 | $46.1 | $44.4 | $44.6 | $330.00 | $165.0K | 272 | 177 |

| AON | PUT | TRADE | BULLISH | 06/21/24 | $46.0 | $44.4 | $44.6 | $330.00 | $142.7K | 272 | 209 |

| AON | PUT | SWEEP | BULLISH | 06/21/24 | $46.3 | $44.5 | $44.7 | $330.00 | $98.1K | 272 | 272 |

About Aon

Aon is a leading global provider of insurance and reinsurance brokerage and human resources solutions. Its operations are tilted toward its brokerage operations. Headquartered in London, Aon has about 50,000 employees and operations in over 120 countries.

Having examined the options trading patterns of Aon, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Aon's Current Market Status

- Currently trading with a volume of 429,584, the AON's price is down by 0.0%, now at $281.26.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 52 days.

Expert Opinions on Aon

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $308.6666666666667.

- In a cautious move, an analyst from B of A Securities downgraded its rating to Underperform, setting a price target of $306.

- An analyst from Citigroup has revised its rating downward to Neutral, adjusting the price target to $309.

- An analyst from Deutsche Bank has revised its rating downward to Hold, adjusting the price target to $311.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Aon options trades with real-time alerts from Benzinga Pro.