Deep-pocketed investors have adopted a bullish approach towards Adobe (NASDAQ:ADBE), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ADBE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Adobe. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 25% bearish. Among these notable options, 6 are puts, totaling $247,961, and 6 are calls, amounting to $251,735.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $400.0 to $515.0 for Adobe during the past quarter.

Insights into Volume & Open Interest

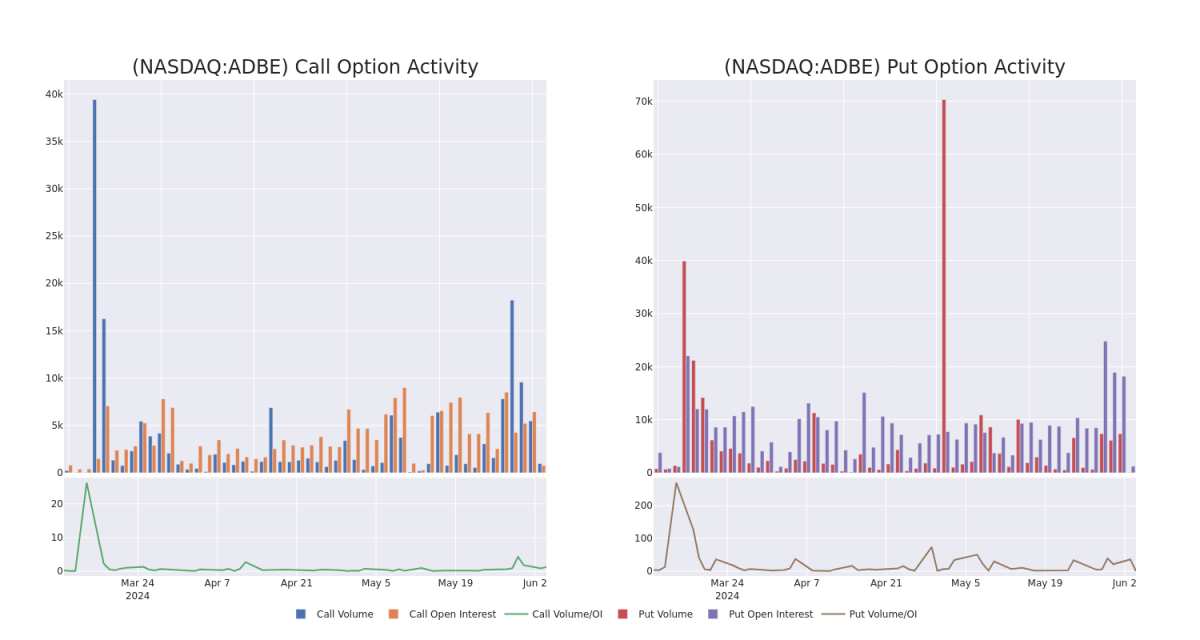

In today's trading context, the average open interest for options of Adobe stands at 201.0, with a total volume reaching 1,045.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Adobe, situated within the strike price corridor from $400.0 to $515.0, throughout the last 30 days.

Adobe Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADBE | PUT | TRADE | BULLISH | 06/07/24 | $32.0 | $28.15 | $29.63 | $475.00 | $94.8K | 170 | 33 |

| ADBE | CALL | SWEEP | BEARISH | 06/18/26 | $116.65 | $115.5 | $115.5 | $440.00 | $92.4K | 1 | 439 |

| ADBE | CALL | TRADE | NEUTRAL | 12/20/24 | $80.0 | $75.7 | $77.85 | $400.00 | $38.9K | 20 | 0 |

| ADBE | PUT | SWEEP | BULLISH | 06/07/24 | $40.05 | $34.25 | $37.2 | $480.00 | $36.4K | 23 | 0 |

| ADBE | CALL | TRADE | BEARISH | 06/18/26 | $116.95 | $114.85 | $114.95 | $440.00 | $34.4K | 1 | 468 |

About Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizin,g and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

In light of the recent options history for Adobe, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Adobe's Current Market Status

- With a trading volume of 294,864, the price of ADBE is up by 1.68%, reaching $446.41.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 9 days from now.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Adobe with Benzinga Pro for real-time alerts.