Current situation of Meituan's business

In recent years, by actively providing richer local life services, Meituan has enhanced the activity of platform users, improved their stickiness and duration of use, and worked hard to create a super entrance of life services O2O that includes "eating, drinking and playing" at all levels of life. This is Meituan's phased success.

In the medium to long term, Meituan will continue to cut into other vertical life service categories other than catering (such as fitness, recruitment, housekeeping, medical beauty, etc.), and vertically expand infrastructure construction such as supply chain 2B business and cloud computing. Evolve to an enabling ecological enterprise. Since the beginning of 2019, Meituan's overall fundamentals have been continuously optimized, which is the root cause of the sharp reversal of its share price.

First, let's take a look at the main operating financial data for the first half of 1919: revenue 41.9 billion, a growth rate of 59%; transaction volume of 300 billion, a growth rate of 28%; and transaction users of 423 million, a growth rate of 18%. These three main data gradually slow down as the base increases. Net profit 90 million, + 102%; operating cash flow Q1 is-3.3 billion, Q2 is 3.1 billion. With the further improvement of business competitiveness and the slowing of business expansion to improve efficiency, profitability has been significantly improved; Commission income accounts for 68%, online marketing services account for 16%, online marketing business is developing rapidly, there is a lot of room for development, and it is likely to be the next cash cow in the future. This year, we have mainly expanded Meituan's grocery shopping business, and the business matrix around life services has become increasingly perfect.

Let's look at the following by business:

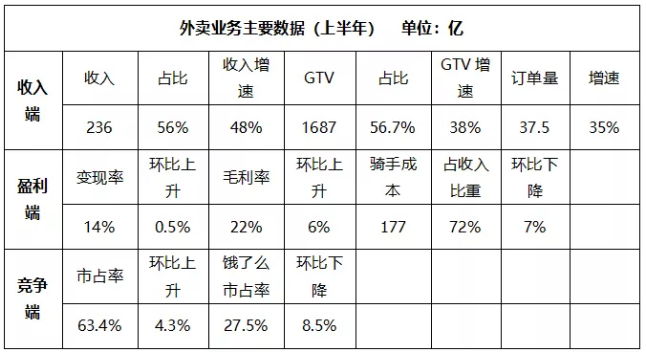

1. Takeout businessMeituan is the largest source of income, accounting for 56%.The core function is drainage.It has not made a profit yet, but we can already see the dawn of profit.

At the present stage, the takeout industry presents a duopoly pattern. Meituan is already an absolute leader in the industry, with a market share of 63% and continues to rise, with an overwhelming advantage, due to the user traffic at the C end (Meituan's basic disk of 350 million MAU, plus the drainage of 1.1 billion MAU Wechat's two first-level entrances) ele.me + less than 100 MAU basic disk Alipay has significant advantages in the number of merchants in the 700m MAU and B-end merchants (Meituan + Dianping 580W restaurant merchants > ele.me + word-of-mouth 350W catering merchants), and the distribution side is also better than ele.me (Meituan instant delivery daily order > ele.me hummingbird + Dianda). It is extremely difficult for ele.me to counter the super beauty group again, so we can only seek differentiation competition and focus on the third-and fourth-tier cities.

At the same time, the barriers to entry in the takeout industry are very high, including technical barriers such as map / search, the time / manpower / capital cost of long-term promotion of serial merchants, and the huge investment in building platforms and riders' teams. as the market share continues to rise, Meituan takeout's large-scale advantage will become more and more obvious, and the marginal variable cost will become lower and lower, unless there is a subversive new business model. Otherwise, no one in the takeout industry can pose a threat to Meituan.

In the case that absolute advantage has been established, the profitability of the takeout business is gradually improving, which is reflected in the increase in the commission rate at the income end, the increase in the volume of online marketing and the increase in cash flow rate and gross profit margin. The cost side of the scale effect and continuous heavy investment in the construction of intelligent scheduling system to reduce the cost-rider cost, and after entering the stock frequency increase stage, no longer need large-scale subsidies to obtain new users, the customer cost continues to reduce, and the focus turns to the increase of consumption frequency.

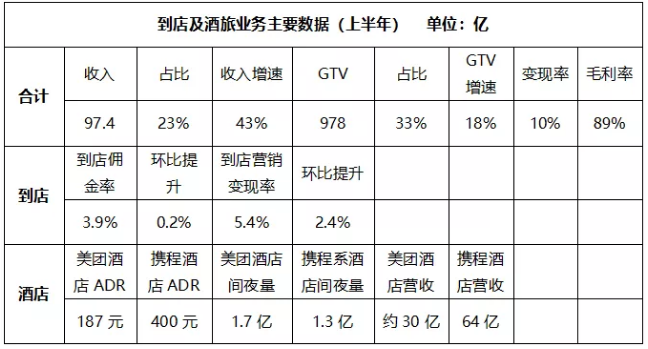

2. Arrival and wine travel businessStrong profitability, income accounts for only 23%, but the gross profit margin is as high as 89%, gross profit accounts for 59%, is Meituan's core profit business, of which hotel business income accounts for about 70%, hotel business 30%, the two realization rate is the same.The light assets and high profitability of the hotel and wine travel business generate high-quality cash flow, which can feed other asset-heavy bloodshed businesses.

A, arrival business(Meituan comments) it is the largest restaurant service platform in China, with a monopoly position. The barriers to store business are higher, and long-term push to obtain merchant resources, Dianping's UGC community building and brand word-of-mouth accumulation are all core competencies that are extremely difficult to replicate. It is very difficult for competitors to create another comment. At present, only word of mouth can slightly resist, but the overall strength is far from each other. At present, the focus of profit has shifted from commission to advertising services. Under the advantage of scale, we will continue to develop merchants' marketing demand (recommended weeding marketing + search bidding ranking), promoting a steady increase in the realization rate and gross profit margin. It also provides strong support for Meituan's cross-selling high gross profit business such as leisure and entertainment, beauty industry, wedding and parent-child services.

B, hotel businessAt first, the demand for local accommodation and leisure tourism in third-and fourth-tier cities formed differential competition with Ctrip, which mainly focuses on business travel demand in first-and second-tier cities. Overnight volume and GTV are in a rapid growth channel, but there is still a big gap between ADR and total revenue.

Meituan has established a firm foothold in the hinterland of Trip.com. In the future, if you want to surpass Ctrip to become the industry leader, you need to infiltrate Gaoxing Hotel. Gaoxing Hotel will be the main battlefield between Meituan and Ctrip in the near future. it is also the winner or loser of the new ranking battle in the hotel reservation industry.

Trip.com 's main advantage lies in the brand reputation accumulated over the past decade, especially the high recognition of foreign hotel brands for Trip.com, while Gaoxing hotel will pay more attention to the brand and strength of its partners than low-star hotels. But Meituan still has a terrible competitive strength, which frightens the Trip.com department.

First,Meituan has an overwhelming advantage at the traffic entrance.Needless to say, for the downstream Gaoxing Hotel Group, it will not exclude one more channel, especially one with such a large flow, and as Meituan's business in the low Star Hotel becomes more and more prosperous, the brand reputation will naturally spread, and the acceptance of Gaoxing Hotel will be gradually liberalized.

Secondly, how to effectively develop derivative business in Gaoxing Hotel has been a big problem in the industry for a long time, that is, at present, accommodation income of Gaoxing Hotel only accounts for about 40%, and related consumption such as catering / hot springs / entertainment accounts for 60%. However, they are not good at these related business, and there are often some problems, such as residents are not interested, high cost, difficult to standardize and so on, and the operation efficiency is low.

Both Trip.com and Meituan have discovered this part of the business opportunities and have invested a lot of energy in exploring, but it is obvious that Trip.com 's competitiveness is definitely not as good as that of Meituan, who started with "eating, drinking and making merry".Meituan has more experience and channels in the localized consumption scene, and can package or split up the fragmentary hotel non-accommodation items and sell flexibly, thus helping the hotel to improve its overall revenue.

Meituan has successively introduced the concept of "new accommodation", "CD model", "Wine + X", "Wine College", "Wine Merchant City" and other measures, which have achieved remarkable results. Many Gaoxing hotels have cooperated with Meituan, and more and more Gaoxing hotels are considering cooperating with Meituan.

Trip.com naturally will not sit back and wait for death. In addition to adopting similar tactics to guard the base camp in the field of high-star hotels, Trip.com is also speeding up his march into low-star hotels and attacking each other's hinterland.

But on the whole,In this war, Meituan is stronger than Trip.com in terms of flow, technology, empowering means, and financial strength. Meituan is in the rhythm of active attack, with large room for turnover adjustment and high tolerance for mistakes, and Trip.com passively defends. He was dragged into the style of play that Meituan is good at, the tolerance for mistakes is low, and the situation is very disadvantageous. Personally, he is more optimistic that Meituan will finally win the war and become the new king of the industry.

3. Meituan's new businessRevenue 8.6 billion, accounting for 20%, the fastest growth, but the largest losses, many businesses are still in the stage of spending money and groping. ButThe investment in new business is not a borderless money-burning expansion, but based on the core advantages of the platform, while creating a perfect high-frequency life platform, exploring the next profit growth point.After suffering big losses last year, Meituan has learned his lesson and is clearly inclined to explore new businesses run by a lighter asset model.

Non-meals arrive at the restaurantIn terms of positioning, the fast donkey purchase of the 2B-end catering supply chain and the purchase of vegetables by Meituan on the 2C side are still in the exploratory stage, with a small scale and need to be tested continuously.TravelIn terms of business, cost reduction is the core policy.Online car hailingThe industry still does not see a profit point. DiDi Global Inc. accounts for more than 90 per cent, and 15-20 per cent of takerate is still losing a lot of money, let alone Meituan, who is 5-8 per cent. Meituan's car-hailing business is transformed into an aggregation platform model, which uses Meituan platform to connect users with third-party ride-hailing service providers, does not participate in the daily operation of taxi-hailing business, and only charges a certain commission from third-party service providers. Accelerate the development of car-hailing business with the mode of lighter assetsshared bikesBusiness is the most criticized piece of business, and the industry is still in a round of reshuffle and is not yet on the right track. Since the beginning of this year, the company has obviously changed its thinking on bike sharing, no longer pursuing scale expansion, but reducing losses and seeking profits through meticulous operations.

With the substantial reduction of depreciation, reducing the volume of investment, raising the starting price, it will accelerate the integration, reduce losses and drain the platform. In addition, Meituan is also actively laying out some light-mode business, such as restarting the sharing portable battery business, cooperating with merchants to carry out recruitment business, training staff, and so on.The loss of innovative business will continue, but in addition to achieving an independent business profit model, it is more important for Meituan to further consolidate the advantages of the platform and deepen the moat, and should take a positive view of the short-term losses of new business.

Meituan's strategic thinking

The core strategic thinking of the company is to transform the local service industry with the help of Internet technology and thinking, that is, to improve the operational efficiency of businesses and optimize the quality of service around the three directions of establishing connections, improving ecology and improving efficiency. cover as much as possible all aspects of users' daily life, break through the barriers between food, accommodation, shopping and entertainment, and form a perfect ecological circle.It is reflected here by the circle diagram of China and Thailand.

Meituan already has business involved in the five major aspects of daily life of "food, drink / shelter / transportation / shopping / entertainment", and more new business is being explored and cultivated. In whichCatering is the core of the company's business, the most important basic plate, and the most in-depth field of development. This is because catering is the consumption scene with the highest consumption frequency and the most fixed demand in people's daily life, which can bring huge user flow and cash flow, and is the mainstay both strategically and financially. On the basis of deeply digging the surplus value of the catering industry chain, and then making use of the high-frequency consumption characteristics of the platform for flow aggregation and cross-selling, expanding other consumption scenarios, realizing business expansion and turning the flywheel of rapid development, that is, the "Food+Platform" strategy put forward by the company.

At present, Meituan's business has covered more than 200 categories of life services, and the vast majority of them are related businesses with economic attributes of scope, that is, the company uses existing resources, core technologies, marketing capabilities and channels, as well as management capabilities to develop related business. the combination of business can bring cost reduction or income increase, resulting in network effect and scale effect.

而In choosing new business development, Meituan's idea is「Taking into account the large scale of the market」和「There is room for improvement in concentration.」Two dimensionsThat is, after entering a new industry, it is possible to change the industry, increase market share, develop network effect and scale effect in large industries, and re-feed the original business and expand business boundaries through platform / capital / technology and other variables in a short period of time.

After horizontally laying out many consumption scenarios that are directly oriented to C-end usersMeituan's next strategy is to expand 2B business vertically.This is why Meituan began to develop businesses such as ERP restaurant management system / supply chain solutions for merchants.The construction and provision of infrastructure such as supply chain management and cloud computing will be the focus of medium-term development in the future.This is also the necessary development path for large ecological enterprises. Tencent and BABA want to develop earlier and have entered this stage. In the more distant future, proprietary management, mergers and acquisitions, investment, unrelated diversification. Wait, wait.

At the tactical level, Meituan is good at "brand flexible positioning" and "imitation and improvement"."flexible brand positioning" refers to the adoption of different brand strategies according to specific business, such as the need to use Meituan's main brand to quickly occupy the mental share of users, traffic-oriented taxi hailing and hotel business. It is named "Meituan +" (Meituan taxi, Meituan Hotel, Meituan takeout, etc.) If you need continuous and meticulous operation to build a community culture and word-of-mouth-oriented business, you should choose another brand, such as "Dianping", "Cat's Eye Movie", "Hazelnut House", etc., which is the embodiment of strong hierarchical positioning ability.

After the brand positioning is followed by the operation, Meituan's business model is almost not innovated by himself, but after the emergence of the new business model, Meituan imitates, improves and grows up again. For example, ele.me was the first to do takeout. Comments are acquired from mergers and acquisitions, not to mention, there was handle glutinous rice before the cat's eye movie, and the taxis, bicycles, catering supply chains and so on behind are not original.Meituan develops these businesses through meticulous operation, which reflects his strong operation ability and learning ability, and is also in line with the company's self-proclaimed "willing to fight is the core of Meituan's tactics."But at the same time, it also exposed a major defect of Meituan-the serious lack of innovation ability, which may also be one of the most obvious places where Meituan is away from Tencent and BABA.

In terms of financial performanceMeituan is from the stage of large-scale investment in the pursuit of business expansion / revenue growth to the strategic transformation of fine operation to strive to do each business well / improve the profit level, which embodies the efficiency + quality-oriented thinking.

In the second-quarter financial results, the year-on-year growth rate of Meituan's overall transaction size has been less than 30% for two consecutive quarters, but Meituan has shown to the market that throughWith the combination of increasing the profitability of the old business, moderately exploring new business and improving the overall management level, the company will gradually enter a healthy development stage of abundant operating cash flow, rising profit margins and expanding business boundaries. Maintaining this state is very important for the company's capital chain management and market value management.

Meituan's core competitiveness

1. Excellent management and execution skills:The Internet industry pays special attention to the ability of the person at the helm, and many VC and PE regard "team" as the first key point when investing in Internet enterprises. Meituan can become a company of this magnitude, the management ability of the management is naturally very strong, through the previous analysis, we can see that Meituan management is excellent in strategy formulation, tactical implementation, brand positioning, product operation, customer orientation, learning ability, crisis awareness, rapid response, tenacity and patience, etc.

2. Human resources and merchant resources that are difficult to copy:We know that many of Meituan's businesses, including group buying, dianping, takeout, wine travel, etc., rely on the ground to push the iron army, and the merchant resources of one family are stubbornly taken down; the role of the iron army is not only to seize the merchant resources in the early stage, but also includes the business ability training in the later stage, discipline and integrity supervision and control, responsible for the docking and follow-up management of the whole business resources, with high requirements for the ability of the team. And the iron army of tens of thousands of people who broke away from the group-buying war, as well as the countless offline merchant resources they put together, is one of the most distinctive core competencies in Meituan's business map, and it is difficult to recreate such an iron army in the same industry.

3. Extremely high barriers to entry based on the combination of online and offline:For the Internet business composed of offline modules, due to the investment of more resources, the competition barrier is stronger than that of pure online business (for example, direct e-commerce is stronger than platform e-commerce, there are very few domestic direct e-commerce, platform e-commerce emerge in endlessly) Meituan's two core businesses, takeout and arrival, have extremely high barriers to entry, including online technology (map, search, etc.) and capital (hundreds of billions); offline huge manpower (ground push team), city logistics, opportunity cost and time cost are very high, which are extremely difficult to copy. Meituan's core business (takeout and arrival) is easy to defend and difficult to attack.

4. Excellent brand strength and high user stickiness:In the Internet industry, especially in the platform Internet industry, it is very difficult to establish brand strength and user stickiness, and users pay more attention to factors such as efficiency, price, SKU and so on, which is also a big problem faced by Internet industries such as video, live broadcast, e-commerce, ride-hailing and so on. However, thanks to the particularity of Meituan's business, that is, the components of the offline module, as well as the long-standing values of "customer-centered" and "long-term patience", Meituan's business has a good reputation both at the merchant end and at the user end. Dianping and the hotel, in particular, the two ends are cross-influenced, strengthening the brand strength; and the scope of service is mostly local, and local users are very sticky.

5. Cost advantage:Relying on the continuous construction of human, logistics, technology and other infrastructure, as well as the low customer acquisition cost brought by word-of-mouth communication and network effect, each time the company enters a new field, the marginal promotion cost is very low and the input resources are relatively low. the customer acquisition costs of other Internet companies are rising rigidly. Mobile Internet accelerates the spread of network effect, which magnifies the cost advantage, which is a kind of core competitiveness that will continue to grow. Tencent / BABA / Amazon.Com Inc and other top Internet enterprises all have this core competitiveness.

Meituan's main disadvantages

1. At present, the profit space of the business is limited and the cash flow is under great pressure.At present, Meituan's several major businesses generally do not have much profit space. Catering itself is a small profit industry, the bargaining power of takeout business is weak, the cost of riders needs to be continuously subsidized, and the level of commission at the merchant end is gradually becoming a bottleneck, so it is not easy to maintain the general balance between profit and loss. The advertising and marketing business has natural radiation limits and little space; at present, the hotel business is still in a fierce battle with the industry leader, and it is far from the time to harvest results. New business requires continuous investment, and offline business, heavy investment in resources, short-term profit may not be seen, but will continue to lose blood.

Taken together, Meituan can not find a high-quality cash cow similar to Tencent's game or BABA's financial / cloud computing in the short term, resulting in poor cash flow, Q1 is-3.3 billion, Q2 is 3.1 billion, less than 1/5 of Q2 revenue of 22.7 billion.

2. The ability of innovation is insufficient.As analyzed above, Meituan has almost no original products, which is not very qualified for an Internet giant company specializing in science and technology. it may become the main reason that restricts Meituan's growth to the same level as Tencent Ali in the future.

Conclusion

Meituan is very much like Tencent in 12 years, with a forward-looking leader and strong executive team, holding a huge, high-barrier but unprofitable traffic disk (takeout vs Wechat), a potential cash cow business (vs games), is rapidly expanding into his ecosystem (life service circle vs pan-entertainment circle), network effects and scale effects are becoming more and more powerful. Advertising business has bottlenecks and it is difficult to support performance as effectively as traditional Internet companies.

However, in the process of Meituan's growth, there is also a lot of uncertainty. The characteristics of the local life service O2O business determine that this is a protracted tug-of-war and war of attrition. Although it has a good basic market, each time it enters a new field, it will face the tenacious resistance of its inherent overlords or the strong challenges of its followers.

In the future, Meituan has a good opportunity to expand himself, expand a wider ecological business, and explore more cash cow business. Life service is an unimaginable huge market, and its development potential is no less than Tencent's entertainment circle and BABA's e-commerce retail circle. At present, Tencent's market capitalization is 3.1 trillion Hong Kong dollars, BABA is about 3.7 trillion, and Meituan is 560 billion. Meituan already has a strong industry position and competitive advantage in his field, not to mention whether he can surpass Tencent and BABA, but it is still possible to grow into a company with a market capitalization of one trillion yuan.

Edit / Grace