Financial giants have made a conspicuous bullish move on GigaCloud Tech. Our analysis of options history for GigaCloud Tech (NASDAQ:GCT) revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $75,845, and 6 were calls, valued at $237,935.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $40.0 for GigaCloud Tech during the past quarter.

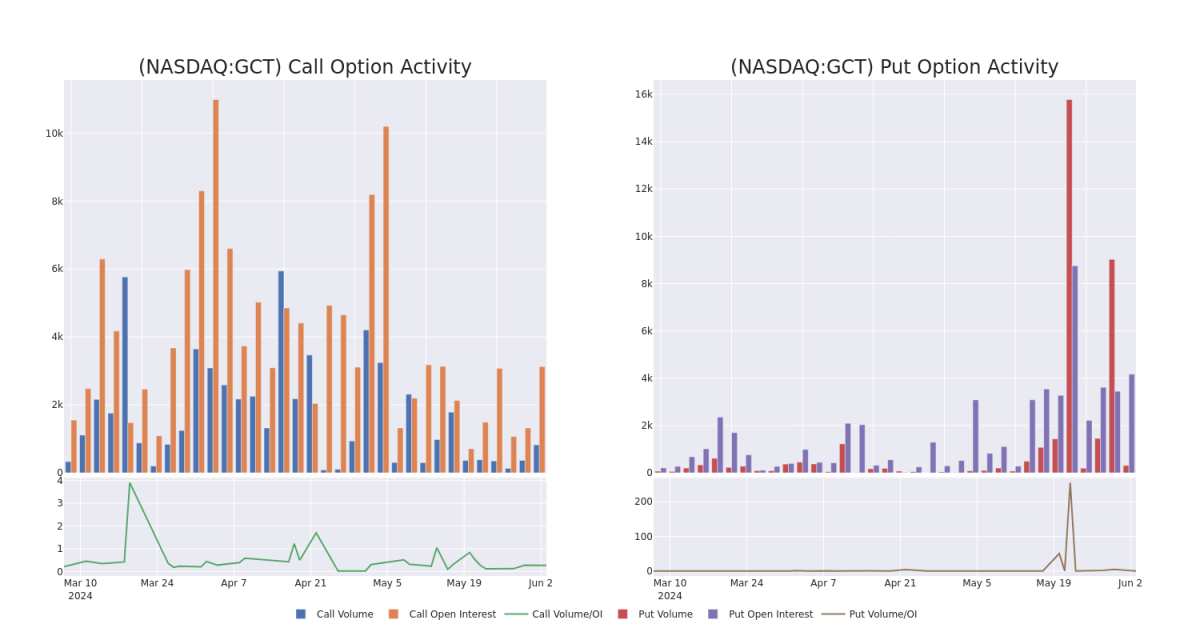

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for GigaCloud Tech's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GigaCloud Tech's whale trades within a strike price range from $20.0 to $40.0 in the last 30 days.

GigaCloud Tech Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GCT | CALL | TRADE | BEARISH | 06/21/24 | $4.5 | $4.0 | $4.0 | $30.00 | $80.4K | 1.5K | 224 |

| GCT | PUT | TRADE | BEARISH | 06/21/24 | $3.9 | $3.7 | $3.85 | $35.00 | $38.1K | 4.1K | 207 |

| GCT | PUT | TRADE | BEARISH | 06/21/24 | $3.9 | $3.5 | $3.85 | $35.00 | $37.7K | 4.1K | 102 |

| GCT | CALL | TRADE | BEARISH | 07/19/24 | $13.0 | $12.5 | $12.5 | $20.00 | $37.5K | 592 | 0 |

| GCT | CALL | TRADE | BULLISH | 07/19/24 | $1.7 | $1.25 | $1.65 | $40.00 | $32.8K | 1.0K | 421 |

About GigaCloud Tech

GigaCloud Technology Inc end-to-end B2B e-commerce solutions for large parcel merchandise. Its B2B e-commerce platform, which is referred to as the GigaCloud Marketplace, integrates everything from discovery, payments, and logistics tools into one easy-to-use platform. It offers online and offline integrated cross-border transaction and delivery services for furniture and large merchandise. Its marketplace seamlessly connects manufacturers in Asia, with resellers in the U.S., Asia, and Europe, to execute cross-border transactions with confidence, speed, and efficiency. It offers a truly comprehensive solution that transports products from the manufacturer's warehouse to end customers, all at one fixed price.

After a thorough review of the options trading surrounding GigaCloud Tech, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is GigaCloud Tech Standing Right Now?

- With a trading volume of 848,536, the price of GCT is up by 5.87%, reaching $32.97.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 71 days from now.

Expert Opinions on GigaCloud Tech

In the last month, 1 experts released ratings on this stock with an average target price of $69.0.

- Reflecting concerns, an analyst from Maxim Group lowers its rating to Buy with a new price target of $69.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.