Abstract: on Tuesday, Semiconductor Manufacturing International Corporation announced Q3 results: revenue was US $816 million, down 4% from the same period last year, up 3.2% from the previous month; net profit was US $85 million, up 1014.8% from the same period last year, reversing losses from the previous month; gross profit margin was 20.8%, up 1.7 pct from the previous month. In addition to the gratifying performance of Q3, Semiconductor Manufacturing International Corporation also gave strong Q4 guidelines, which are expected to increase Q4 revenue by 2 per cent month-on-month and gross profit margin to 25 per cent. Goldman Sachs Group thought SMIC's performance was better than expected and gave SMIC a "buy" rating target price of HK $11.50.

1. Q3 production capacity is close to full load

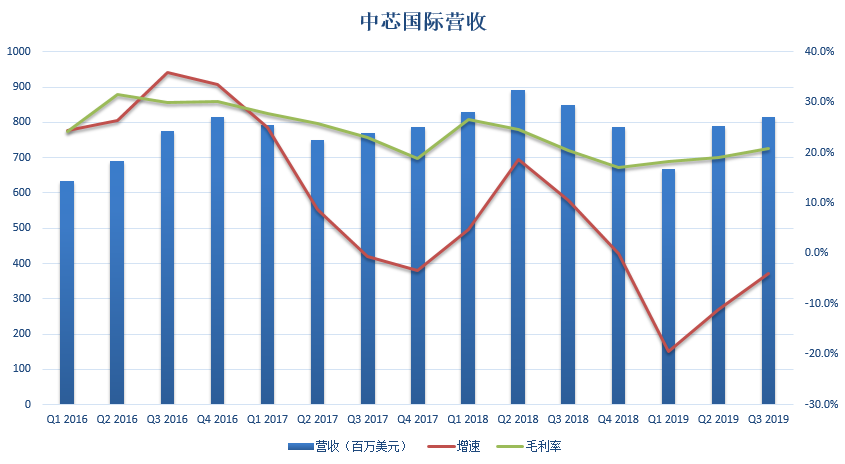

Affected by the overall slowdown in the global semiconductor industry, SMIC 2019Q1 revenue fell nearly 20% year-on-year, but revenue in Q2 and Q3 began to bottom out.

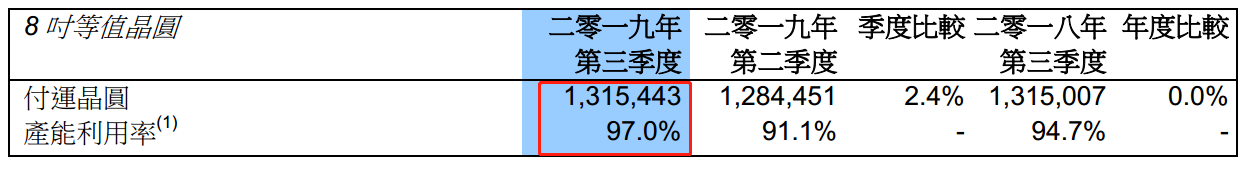

From the point of view of revenue = volume * price, the rebound in Q3 SMIC revenue is mainly due to the increase in capacity utilization.According to the financial report, SMIC's Q3 capacity utilization rate reached 97%, an increase of nearly 6 percentage points compared with the second quarter.

Among SMIC's current seven factories, Beijing 300mm wafer factory has produced 112500 equivalent 8-inch wafers with 25.35% production capacity, while Shanghai 200mm fab has produced 112000 equivalent 8-inch wafer with 25.23% production capacity, which is the two major production capacity.

It is worth mentioning that SMIC sold the slow-moving Vesino 200mm fab in Italy, and Q3 grew by 6.1 per cent month-on-month, up from the current 3.2 per cent.

From the perspective of regional revenue, revenue from China continues to increase, with Q3 exceeding 60%, an increase of 3.6 pct compared with the previous month, while the share of revenue in the United States has dropped significantly.After being restricted by the United States, most semiconductor enterprises are shifting their contract manufacturing to China, and Semiconductor Manufacturing International Corporation has obviously benefited from being the leading contract manufacturer in the mainland.

Q4 advanced process 14nm begins to contribute revenue

If SMIC Q3 performance is mainly due to the increase in mature process capacity, "volume" driven revenue growth, then Q4 SMIC will usher in a "volume and price rise", and the commissioning of 14nm advanced process will enhance SMIC's pricing power.

Semiconductor Manufacturing International Corporation revealed in the financial report that the research and development of FinFET technology is constantly moving forward: the first generation FinFET has been successfully mass produced and will contribute meaningful revenue in the fourth quarter.The research and development of the second generation FinFET is progressing steadily, and the introduction of customers is progressing smoothly. In the future, the process will be used in the fields of processors, automotive electronics and artificial intelligence.

In September this year, at the 2019 Semiconductor Manufacturing International Corporation technical seminar, Kelvin Low, vice president of marketing and overseas sales of Semiconductor Manufacturing International Corporation, said that Semiconductor Manufacturing International Corporation's 14nm FinFET process yield was climbing and its production capacity was growing exponentially. At that time, he mentioned that some customers are considering adopting FinFET technology, so there will be a big market for FinFET technology in the future.

14/12nmThe craft is Semiconductor Manufacturing International Corporation's first generation FinFET.CraftsmanshipThe Niss1 FinFET node will be the second phase of Semiconductor Manufacturing International Corporation, and it is expected that there will be a test capacity by the end of 2020, not only Numb1, but also a more advanced generation of Nissan 2 nodes.

Third, comprehensively launch and accelerate growth

SMIC Q3's financial report title is: start up growth in an all-round way.Investors familiar with SMIC know that SMIC has experienced too many twists and turns and ups and downs in its growth, but since February 2015, when the National Foundation invested HK $3.1 billion in Semiconductor Manufacturing International Corporation in the form of shares, Semiconductor Manufacturing International Corporation began to sort out his own path of development.With the success of 14nm research and development, SMIC has to get out of the trough and return to growth.

Semiconductor Manufacturing International Corporation co-CEO, Dr. Zhao Haijun and Dr. Liang Mengsong commented:"after two years of accumulation, we not only further shorten the gap between advanced technologies, but also comprehensively expand new mature process and technology platforms, and are confident that we will enter a new stage of development with the development of 5G terminal applications.

Customer inventory digestion, the company's capacity utilization rate increased, advanced mask sales increased, the company's third-quarter operating performance is better than the guidance. Customer demand in China is strong, accounting for 60.5% of revenue, up 10% from the previous month. Demand was driven by the Internet of things and smart homes, and revenue in the consumer electronics sector increased by 16% month-on-month. We expect the company's revenue to maintain growth in the fourth quarter.

The research and development of FinFET technology continues to move forward: the first-generation FinFET has been successfully mass-produced and will contribute meaningful revenue in the fourth quarter; the second-generation FinFET research and development is progressing steadily and customer introduction is progressing smoothly. We believe that Semiconductor Manufacturing International Corporation will fully benefit from the extensive business opportunities brought about by the migration of the market to 5G standards, go out of the adjustment and restart growth.

Goldman Sachs Group said in a report that Semiconductor Manufacturing International Corporation's announcement of third-quarter results and stronger-than-expected management guidance for the fourth quarter confirmed the bank's optimistic outlook for the company and gave SMIC a "buy" rating target price of HK $11.50.

Edit / jasonzeng