The fact that multiple Evercore Inc. (NYSE:EVR) insiders offloaded a considerable amount of shares over the past year could have raised some eyebrows amongst investors. When analyzing insider transactions, it is usually more valuable to know whether insiders are buying versus knowing if they are selling, as the latter sends an ambiguous message. However, if numerous insiders are selling, shareholders should investigate more.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

Evercore Insider Transactions Over The Last Year

The Senior MD, Jason Klurfeld, made the biggest insider sale in the last 12 months. That single transaction was for US$1.0m worth of shares at a price of US$173 each. That means that even when the share price was below the current price of US$202, an insider wanted to cash in some shares. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. We note that the biggest single sale was 61% of Jason Klurfeld's holding.

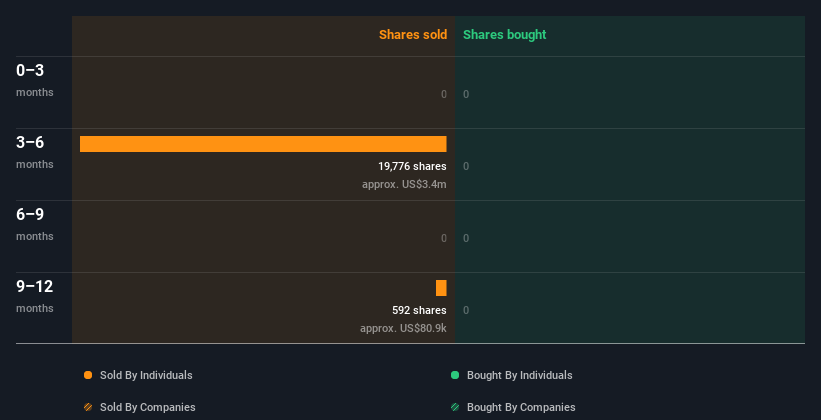

Evercore insiders didn't buy any shares over the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders but also have attractive valuations.

Does Evercore Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. It's great to see that Evercore insiders own 6.1% of the company, worth about US$547m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The Evercore Insider Transactions Indicate?

It doesn't really mean much that no insider has traded Evercore shares in the last quarter. It's great to see high levels of insider ownership, but looking back over the last year, we don't gain confidence from the Evercore insiders selling. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. In terms of investment risks, we've identified 2 warning signs with Evercore and understanding these should be part of your investment process.

But note: Evercore may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.