The production and operation activities of enterprises have maintained the trend of resuming development

This article is from: National Bureau of Statistics

On May 31, the National Bureau of Statistics released the performance of China's purchasing managers' index for May 2024.

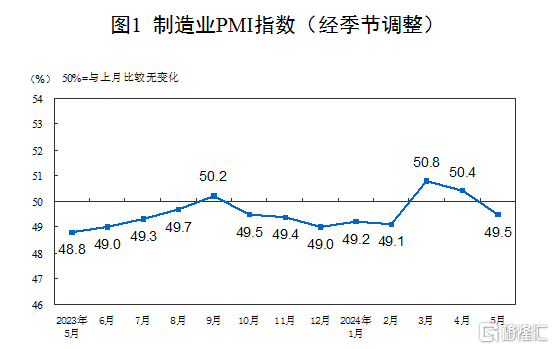

In May, the manufacturing purchasing managers' index, the non-manufacturing business activity index, and the composite PMI output index were 49.5%, 51.1%, and 51.0% respectively, down 0.9, 0.1 and 0.7 percentage points from the previous month. The overall output of the Chinese economy continued to expand, and the production and operation activities of enterprises continued to resume development.

Let's take a look specifically:

The manufacturing purchasing managers' index declined

In May, the manufacturing purchasing managers' index (PMI) was 49.5%, down 0.9 percentage points from the previous month, and the manufacturing sentiment level declined somewhat.

In terms of enterprise size, the PMI for large enterprises was 50.7%, up 0.4 percentage points from the previous month; the PMI for small and medium-sized enterprises was 49.4% and 46.7%, down 1.3 and 3.6 percentage points from the previous month.

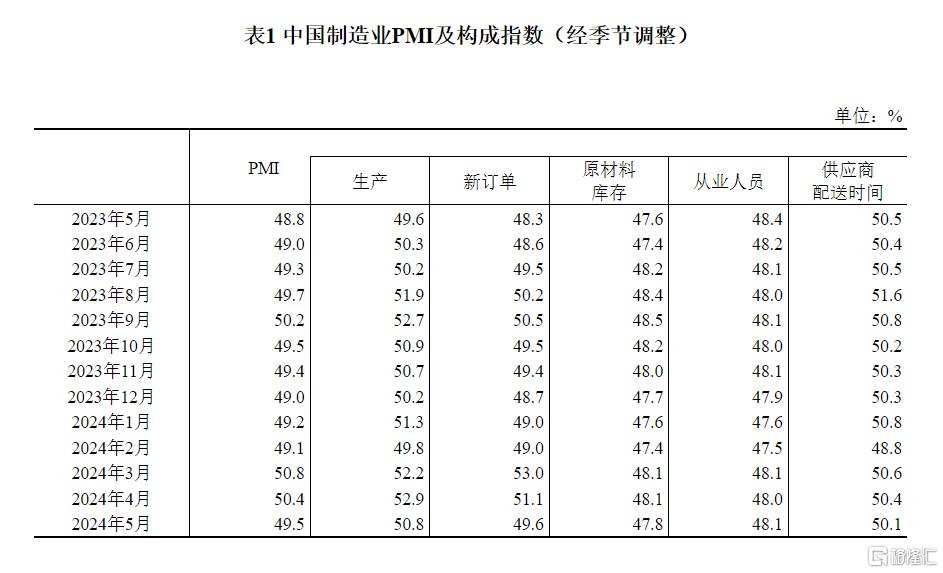

Looking at the classification index, among the five classification indices that make up the manufacturing PMI, the production index and the supplier delivery time index are above the critical point, while the new orders index, raw material inventory index, and employee index are below the critical point.

The production index was 50.8%, down 2.1 percentage points from the previous month, and still above the critical point, indicating that manufacturing companies' production continues to expand.

The new orders index was 49.6%, down 1.5 percentage points from the previous month, indicating a slowdown in demand in the manufacturing market.

The raw material inventory index was 47.8%, down 0.3 percentage points from the previous month, indicating a decrease in stocks of major raw materials in the manufacturing industry.

The employee index was 48.1%, up 0.1 percentage points from the previous month, indicating a slight recovery in employment sentiment in manufacturing enterprises.

The supplier delivery time index was 50.1%, down 0.3 percentage points from the previous month, and still above the critical point, indicating a slight acceleration in the delivery time of raw material suppliers in the manufacturing industry.

Zhao Qinghe, a senior statistician at the Service Industry Survey Center of the National Bureau of Statistics, explained that in May, due to factors such as the rapid growth of the manufacturing industry in the early stages, the formation of a high base and insufficient effective demand, the level of manufacturing sentiment declined somewhat.

(1) The enterprise's production continues to expand. The production index was 50.8%, down 2.1 percentage points from the previous month. It is still above the critical point, and production of manufacturing enterprises continues to expand. From an industry perspective, production indices for industries such as general equipment, railway ships, aerospace equipment, computer communication and electronic equipment have been in the expansion range for three consecutive months, with enterprises releasing production capacity relatively quickly; production indices for industries such as textiles, chemical fibers, rubber and plastic products have fallen to a contraction range, and enterprise production has slowed down.

(2) The index of new orders has declined somewhat. The new orders index was 49.6%, down 1.5 percentage points from the previous month, and demand in the manufacturing market has slowed. From an industry perspective, the new order index for food, alcohol, beverages, refined tea, metal products, railway ships, aerospace equipment, electrical machinery and equipment continues to expand, and market demand continues to be released; the index of new orders in industries such as paper, printing, cultural, sports and entertainment products, petroleum, coal, and other fuel processing is low, and market demand in related industries has weakened.

(3) PMI expansion of large enterprises is accelerating. The PMI for large enterprises was 50.7%, up 0.4 percentage points from the previous month, and has remained in the expansion range since this year, effectively supporting the recovery and development of the manufacturing industry; the PMI for small and medium-sized enterprises was 49.4% and 46.7% respectively, down 1.3 and 3.6 percentage points from the previous month, and the boom level of small and medium-sized enterprises declined somewhat.

(4) The price index has rebounded somewhat. With the recent rise in the prices of some commodities, the overall level of prices in the manufacturing market has rebounded. The purchase price index for major raw materials was 56.9%, up 2.9 percentage points from the previous month. The ex-factory price index was 50.4%, up 1.3 percentage points from the previous month. It rose to the expansion range for the first time in 8 months, which is beneficial for enterprises to improve production and operation levels.

(5) Business confidence is relatively stable. The expected index of production and operation activity is 54.3%. Since this year, it has remained at a high operating level of 54.0% and above, indicating that manufacturing companies' expectations for market development are generally stable. From an industry perspective, the expected index of production and operation activities in agricultural and sideline food processing, food, alcohol, beverage, refined tea, special equipment, electrical machinery and equipment has always been in a high boom range of 55.0% since this year, and enterprises have strong confidence in the development of the industry.

Non-manufacturing business activity index continues to expand

In May, the non-manufacturing business activity index was 51.1%, basically the same as last month, and the non-manufacturing industry continued to expand.

By industry, the index of business activity in the construction industry was 54.4%, down 1.9 percentage points from the previous month; the index of business activity in the service sector was 50.5%, up 0.2 percentage points from the previous month. From an industry perspective, the index of business activity in industries such as postal services, telecommunications, radio, television and satellite transmission services, Internet software and information technology services, culture, sports and entertainment is in a high boom range above 55.0%; the index of business activity in capital market services, real estate and other industries is below the critical point.

The new orders index was 46.9%, up 0.6 percentage points from the previous month, indicating a recovery in demand in the non-manufacturing market. By industry, the index of new orders in the construction industry was 44.1%, down 1.2 percentage points from the previous month; the index of new orders in the service sector was 47.4%, up 0.9 percentage points from the previous month.

The input price index was 49.7%, down 1.4 percentage points from the previous month, indicating that the overall level of input prices used by non-manufacturing enterprises for business activities has declined. By industry, the construction industry input price index was 53.6%, up 1.4 percentage points from the previous month; the service industry input price index was 49.0%, down 1.9 percentage points from the previous month.

The sales price index was 47.8%, down 1.6 percentage points from the previous month, indicating a decline in the overall level of non-manufacturing sales prices. By industry, the sales price index for the construction industry was 49.7%, up 1.0 percentage point from the previous month; the sales price index for the service industry was 47.5%, down 2.0 percentage points from the previous month.

The employee index was 46.2%, down 1.0 percentage point from the previous month, indicating a decrease in the employment sentiment of non-manufacturing enterprises. By industry, the index of workers in the construction industry was 43.3%, down 2.8 percentage points from the previous month; the index of workers in the service sector was 46.7%, down 0.7 percentage points from the previous month.

The expected business activity index was 56.9%, down 0.3 percentage points from the previous month. It continues to be in a high boom range, indicating that non-manufacturing companies remain optimistic about market development prospects. By industry, the expected index of business activity in the construction industry was 56.3%, up 0.2 percentage points from the previous month; the expected index of business activity in the service sector was 57.0%, down 0.4 percentage points from the previous month.

Zhao Qinghe said that in May, the non-manufacturing business activity index was 51.1%, which is basically the same as last month, and the non-manufacturing industry continues to expand.

(1) The service sector is booming. The index of business activity in the service sector was 50.5%, up 0.2 percentage points from the previous month, and the service sector continued to resume its development trend. From an industry perspective, the index of business activity in industries such as postal services, telecommunications, radio, television and satellite transmission services, Internet software and information technology services, culture, sports and entertainment is in a high boom range above 55.0%, and the total business volume is growing rapidly. At the same time, the index of business activity in capital market services, real estate and other industries continues to operate at a low level, and market activity is weak. Judging from market expectations, the expected business activity index is 57.0%, which continues to be in a high boom range, and service companies remain optimistic about the market development prospects.

(2) The construction industry continues to expand. The index of business activity in the construction industry was 54.4%, down 1.9 percentage points from the previous month, and the expansion of the construction industry has slowed. Looking at market expectations, the expected business activity index was 56.3%, up 0.2 percentage points from the previous month, indicating that most construction companies have stable confidence in the development of the industry.

The composite PMI output index continues to expand

In May, the composite PMI output index was 51.0%, down 0.7 percentage points from the previous month. It is still in the expansion range, indicating that the production and operation activities of Chinese enterprises have continued to resume development. The manufacturing production index and the non-manufacturing business activity index, which make up the composite PMI output index, are 50.8% and 51.1%, respectively.