① Youchao Innovation submitted a listing application. What are the highlights of the company's Smart Driving business? ② How high is Ali CEO Wu Yongming's shareholding ratio?

Finance Association, May 28 (Editor Feng Yi) On May 27, Shenzhen Youjia Innovation Technology Co., Ltd. (MINIEYE)) submitted a listing application to the Hong Kong Stock Exchange. CITIC Securities and CICC are its co-sponsors.

According to the prospectus, Youjiao Innovation was founded in 2014 and is a supplier of intelligent driving and intelligent cockpit solutions. It mainly provides customized L0 to L2++ intelligent driving solutions, including piloting, parking, and in-cabin functions. As of the last practical date, the company has carried out mass production for a total of 29 automakers.

It is worth noting that at present, it has gradually become a trend for domestic smart driving companies to go to Hong Kong for IPOs.

It is worth noting that at present, it has gradually become a trend for domestic smart driving companies to go to Hong Kong for IPOs.

On December 20, 2023, Zhixing Auto Technology (01274.HK) was officially listed on the Hong Kong Stock Exchange, becoming the “first autonomous driving stock” of the Hong Kong stock market.

Since its listing for more than six months, the stock price of Zhixing Auto Technology has risen to a high of HK$29.65 per share at the time of the sale, reflecting to a certain extent the Hong Kong stock market's acceptance of the concept of intelligent driving.

Since then, well-known companies in the industry chain, including Horizon, Zongmu Technology, and Black Sesame Intelligence, have joined the Hong Kong stock IPO team one after another.

According to Youjia Innovation, the financing will mainly be used to: enhance R&D capabilities in the field of artificial intelligence and products, including recruiting relevant R&D personnel; improving R&D infrastructure; improving production efficiency and solutions; and strengthening sales capabilities.

According to data, since its establishment in 2014, Youjia Innovation has received multiple rounds of financing. In November 2023, Youjiao Innovation completed the E-round with hundreds of millions of yuan. Among them, there was no shortage of state-owned institutions such as Guangzhou investment capital and the Ultra HD Video Industry Investment Fund.

Interestingly, at the beginning of its establishment, Youjiao Innovation received an angel round of investment from Alibaba's current CEO Wu Yongming. Currently, Wu Yongming still holds about 2.31% of the shares in Youjia Innovation.

At the industry level, currently L0 to L2 solutions have become mainstream intelligent driving solutions around the world. As automakers expand their presence in the field of intelligent driving, the global market for intelligent driving solutions has also ushered in significant growth.

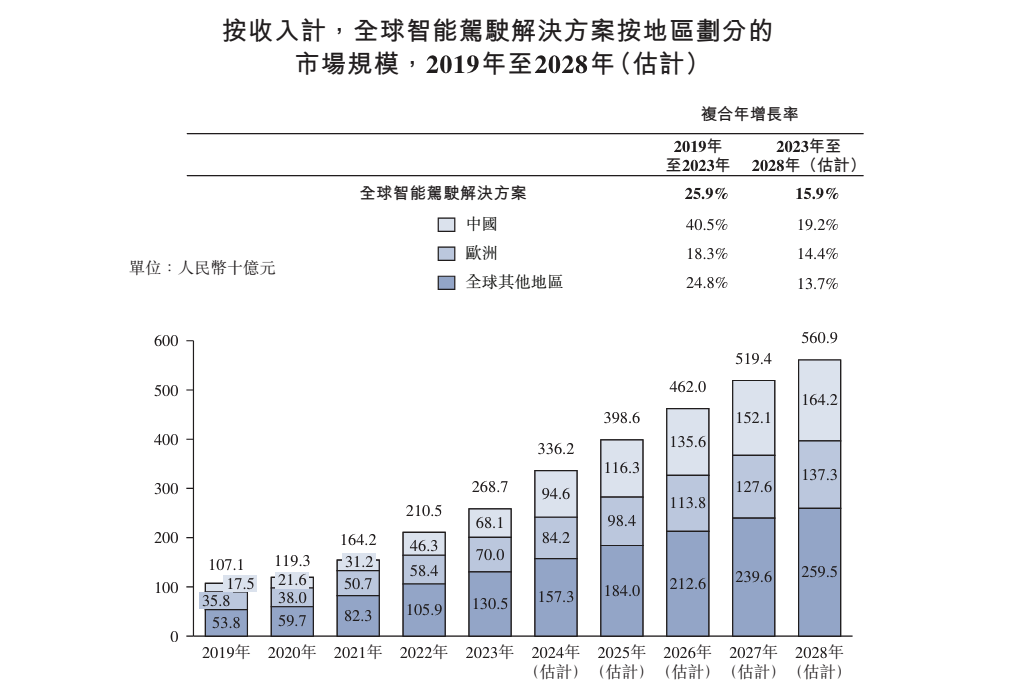

According to Insight Consulting, in terms of revenue, the global smart driving solutions market increased from RMB 107.1 billion in 2019 to RMB 268.7 billion in 2023, with a compound annual growth rate of 25.9%. It is expected to increase to 560.9 billion yuan in 2028, with a CAGR of 15.9%.

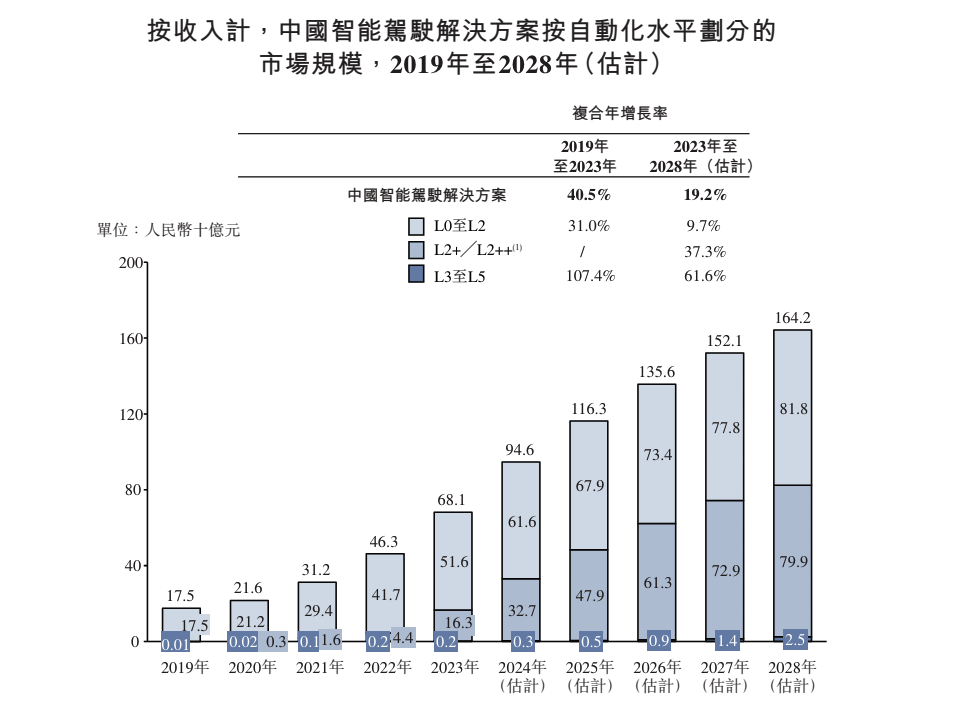

Among them, with advanced technology and broad consumer acceptance, China's domestic smart driving market is growing faster than the world. China's corresponding market size increased from 17.5 billion yuan in 2019 to 68.1 billion yuan in 2023, with a compound annual growth rate of 40.5%, accounting for 25.4% of the global market size in 2023.

It is expected that as technology advances and costs are reduced, the introduction of supportive policies will facilitate application to more models. It is estimated that by 2028, the market size of intelligent driving solutions in China will increase to 164.2 billion yuan in terms of revenue, and the compound annual growth rate from 2023 to 2028 will reach 19.2%.

At the business level, in 2021-2023, Youjiao Innovation's revenue was 175 million, 279 million and 476 million yuan, respectively, with a three-year compound annual growth rate of 64.9%; losses attributable to shareholders during the same period were 132 million yuan, 215 million yuan, and 197 million yuan, respectively.

As we all know, the intelligent driving industry is a technology-intensive industry. It requires a large number of technical talents and R&D investment, and the industry generally faces loss problems.

However, in this context, the gross margin of Youjia Innovation is quite interesting. From 2021 to 2023, the company's gross margins were 9.7%, 12%, and 14.3%, respectively, increasing for three consecutive years.

Compared to competitors, Zomu Technology, which is also a provider of autonomous driving solutions, had gross margins of -8.9%, -3.5%, and 3.5%, respectively, during the same period. Zhixing Auto Technology, which is already listed on Hong Kong stocks, had gross margins of 20.6%, 8.3%, and 9.9% respectively in 2021-2023.

Youjiao Innovation also suggested that competition in the industry is fierce, which will have a significant adverse impact on the company's business performance. Large R&D investments may also continue to affect the company's cash flow and profitability. In addition, the company also faces potential risks in various areas such as inventory, supply chain bargaining power, and industrial policies.

According to the prospectus, in terms of revenue in 2023, Youjiao Innovation accounts for about 0.6% of the market share. There is still a gap of several times with the top three in the industry. At the same time, it also has quite a few competitors that are catching up closely behind it.

值得注意的是,目前国内智驾企业赴港IPO已渐成趋势。

值得注意的是,目前国内智驾企业赴港IPO已渐成趋势。