High-rolling investors have positioned themselves bearish on Canopy Gwth (NASDAQ:CGC), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CGC often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 15 options trades for Canopy Gwth. This is not a typical pattern.

The sentiment among these major traders is split, with 33% bullish and 60% bearish. Among all the options we identified, there was one put, amounting to $31,800, and 14 calls, totaling $802,572.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $8.5 to $12.0 for Canopy Gwth during the past quarter.

Analyzing Volume & Open Interest

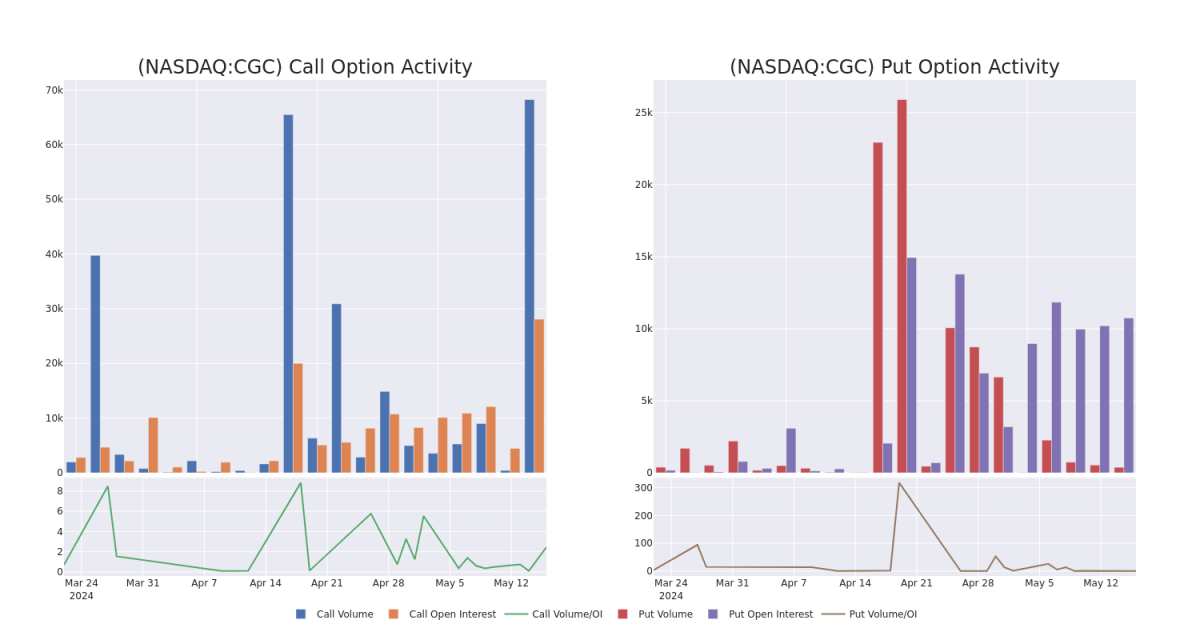

In terms of liquidity and interest, the mean open interest for Canopy Gwth options trades today is 4314.56 with a total volume of 68,596.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Canopy Gwth's big money trades within a strike price range of $8.5 to $12.0 over the last 30 days.

Canopy Gwth Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CGC | CALL | SWEEP | BULLISH | 05/24/24 | $1.03 | $1.03 | $1.03 | $10.50 | $203.5K | 319 | 3.2K |

| CGC | CALL | SWEEP | BEARISH | 05/17/24 | $1.85 | $1.7 | $1.7 | $10.00 | $94.3K | 8.9K | 10.7K |

| CGC | CALL | TRADE | BULLISH | 07/19/24 | $2.39 | $2.29 | $2.39 | $9.00 | $81.2K | 4.2K | 1.6K |

| CGC | CALL | SWEEP | NEUTRAL | 05/31/24 | $2.13 | $1.59 | $1.84 | $8.50 | $58.5K | 214 | 1.7K |

| CGC | CALL | SWEEP | BULLISH | 06/21/24 | $1.03 | $1.03 | $1.03 | $11.00 | $48.5K | 3.2K | 796 |

About Canopy Gwth

Canopy Growth, headquartered in Smiths Falls, Canada, cultivates and sells medicinal and recreational cannabis, and hemp, through a portfolio of brands that include Doja, 7ACRES, Tweed, and Deep Space. Its non-THC products include skincare products under Martha Stewart CBD and Storz & Bickel vaporizers. Canopy growth is attempting to merge its U.S. assets into a separately operated holding company, Canopy USA, which will not be consolidated into the Canadian company's financials.

Present Market Standing of Canopy Gwth

- Currently trading with a volume of 22,253,498, the CGC's price is up by 15.49%, now at $11.45.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 14 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.