Bull of the Day: Nexstar Media Group (NXST)

The Zacks Broadcast Radio and Television Industry is currently in the top 20% of over 250 Zacks industries and Nexstar Media Group NXST is one of the dominant companies to invest in.

As the largest television station owner in the United States, Nexstar’s network affiliates include the four major networks of NBC, CBS, ABC, and FOX FOXA along with owning The CW which is America’s fifth major broadcast network.

Landing Nexstar’s stock a Zacks Rank #1 (Strong Buy) and the Bull of the Day is that earnings estimate revisions have ticked up after the media giant crushed its first quarter earnings expectations last Thursday.

Q1 Earnings Beat: Nexstar’s massive earnings potential should be catching investors' attention after posting Q1 EPS of $5.16 which beat the Zacks Consensus of $4.28 a share by 20%.

Furthermore, Q1 earnings soared 73% from $2.97 per share in the comparative quarter. Notably, Nexstar delivered record sales for the first quarter at $1.28 billion which increased 2% year over year and was roughly on par with estimates.

Image Source: Zacks Investment Research

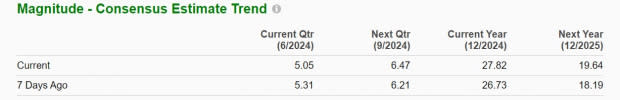

Soaring EPS Estimates: Indicative of now being a good time to buy Nexstar’s stock is that EPS estimates for fiscal 2024 have spiked 4% in the last week from projections of $26.73 a share to $27.82 per share.

This would be an 188% increase from EPS of $9.64 in 2023 and while FY25 earnings are expected to dip to $19.64 per share estimates have climbed 8% from projections of $18.19 a share seven days ago.

Image Source: Zacks Investment Research

Value to Shareholders

Dividend: Magnifying Nexstar’s immense profitability and separating its stock from other companies that primarily focus on growth and don’t offer or have a significant payout to shareholders is that NXST has a 3.76% annual dividend yield.

Better still, Nexstar has increased its payout in each of the last five years for an annualized dividend growth rate of 31.49% during this period. Nexstar’s 57% payout ratio also suggests there may be room for more dividend hikes in the future.

Image Source: Zacks Investment Research

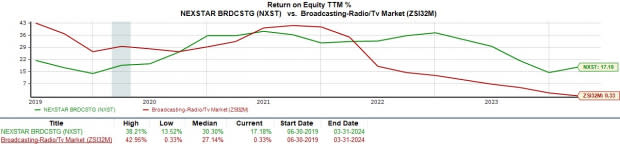

Return on Equity: Further illustrating Nexstar’s value to shareholders is a 17% trailing twelve-month ROE which has impressively topped its industry’s 0.33% and is closer to the S&P 500’s 25% average.

Image Source: Zacks Investment Research

P/E Valuation: With rising EPS estimates offering further support, it’s also noteworthy that NXST trades at just 6.7X forward earnings which is a significant discount to the industry average of 26.8X and Fox at 10.1X.

Image Source: Zacks Investment Research

Tracking Nexstar’s Total Return Performance

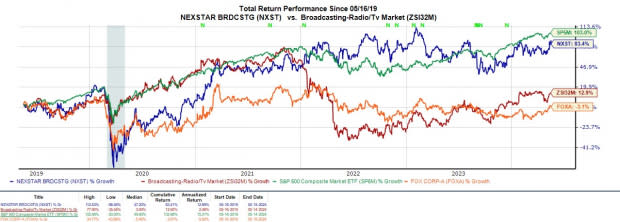

Proving to be a viable investment, Nexstar’s total return (including dividends) over the last five years is +83% which has largely outperformed the Zacks Broadcasting-Radio and TV Market’s +13% and is near the S&P 500’s +103%.

Image Source: Zacks Investment Research

Bottom Line

After exceeding lofty earnings expectations for the first quarter, Nexstar’s stock looks very promising in terms of growth and offers sound value to investors at its current levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nexstar Media Group, Inc (NXST) : Free Stock Analysis Report

Fox Corporation (FOXA) : Free Stock Analysis Report